5 key FP&A trends for 2025

The role of the CFO is evolving rapidly, extending beyond traditional financial stewardship to encompass business partnering, operational oversight and technological innovation. A 2024 Sage study of over 1,200 global finance leaders reinforces this transformation:

-

85% of CFOs expect to play a more significant role in shaping business strategy over the next three years.

-

CFOs currently spend over four hours a week on tasks outside their standard remit.

-

Over 80% anticipate spending more time on new technology—either acquiring it or upskilling in it.

Finance teams are now at the center of business operations, leveraging their analytical skills to assess opportunities and support company-wide data-driven decisions. However, this expanded business partnering role comes with added responsibilities, stretching already busy teams. This shift is driving five key financial planning & analysis trends, aimed at enhancing efficiency and data management.

1. Business planning within BI platforms

Integrating budgeting and planning within Business Intelligence (BI) platforms is revolutionizing financial management and the planning process. Historically, budgeting has been confined to ERP systems or spreadsheets, but BI platforms now offer a more dynamic and consolidated approach.

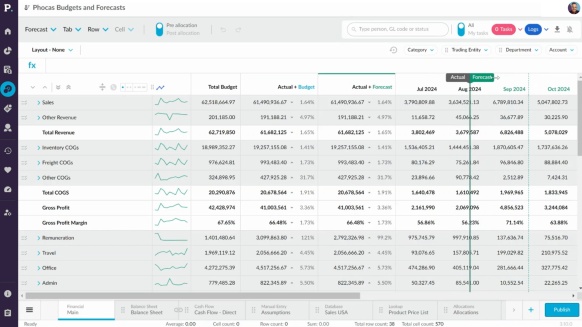

BI-integrated Financial Planning and Analysis tools enable businesses to leverage real-time financial and operational data, create detailed and flexible budget models, and automate updates as new financial data becomes available. For example, in Phocas, the budgeting module integrates directly with financial statements and analytics. If new costs emerge, they can be mapped within financial statements, automatically reflecting in the budget workbook. Finance teams can also drill down into sales data, budgeting by region, sales rep, or product category—ensuring alignment across departments and extra detail in the budget model for accurate scenario planning or driver-based planning.

2. Advanced analytics and real-time data accuracy

Static reports with outdated data are becoming obsolete. Advanced analytics in FP&A platforms allow deeper insights, providing finance professionals with the tools to drill down from high-level financials to transaction-level details. Consolidated data in one platform reduces reliance on ad hoc reporting and manual data pulls and empower non-finance teams with self-service analytics.

This shift promotes agility, ensuring that teams can access the latest metrics in dashboards to make informed decisions. More importantly, it increases stakeholder trust in your data by establishing a single source of truth, eliminating discrepancies between various data silos.

3. Reforecasting as a strategic imperative

In an unpredictable business environment, an up-to-date understanding of financial performance and dynamic budgets are necessary. Frequent reforecasting has become essential for companies to adapt swiftly to changing market conditions. Traditional financial forecasting methods—often reliant on disconnected spreadsheets—are cumbersome and error-prone.

BI and FP&A platforms streamline this process by automating actuals-to-forecast reconciliation, providing scenario modelling, and allowing collaboration across finance and operational teams. Rather than spending hours updating historical data, finance professionals can focus on forward-looking assumptions and strategic planning. This capability ensures businesses remain prepared for unforeseen disruptions or to be ready to cease new opportunities.

4. Automating tasks for greater strategic focus

Finance teams are increasingly turning to automation to free up time for high-value activities. Routine tasks such as reconciliations, expense management, and financial reporting in excel—can be streamlined through BI and FP&A platforms.

Automation reduces manual data entry and errors, accelerates financial close processes and allows finance teams to dedicate more time to strategic initiatives. While artifical intelligence plays a role, automation encompasses system integrations and pre-built financial models and visualizations that reduce the administrative burden on finance teams. Organizations that successfully implement automation can redirect their focus from transactional tasks to business growth and new partnerships.

Where do you think most finance teams sit in terms of automation maturity? It is likely to be somewhere between passive and proactive - though definitely leaning more toward proactive compared to five years ago. Many businesses are still transitioning from having siloed finance teams focused on churning out reports, to teams that act as true business partners who collaborate across departments on budgets and operational projects.

It often very much depends on the life stage of the business and how much investment in systems and process has happened to date as to where they sit.

Technology is really pushing automation forward. A lot of BI and modern FP&A platform providers already have built-in frameworks, making more time-consuming and complicated tasks like driver based planning straightforward.

5. Tech stack consolidation for efficiency and cost savings

Many mid-market businesses operate with a fragmented financial technology ecosystem using multiple tools for BI, reporting, banking, expenses and forecasting. However, consolidating these systems into a BI and FP&A platform delivers significant advantages.

By reducing the number of tools, businesses can lower licensing fees and IT maintenance costs, improve productivity by minimizing time spent switching between systems, and enhance data integration for more accurate reporting and decision-making. Additionally, consolidating financial technology strengthens security and simplifies compliance management.

Despite these benefits, a recent Chartered Accountants Australia and New Zealand (CA ANZ) study found that only 7% of organizations have an all-in-one financial tech stack. However, this number is expected to rise as companies recognize the operational and financial efficiencies of tech stack consolidation.

These trends reflect the growing strategic importance of finance and FP&A teams within organizations. As FP&A professionals take on more operational responsibilities, investing in BI-driven planning, automation and integrated analytics will be crucial for maintaining efficiency and agility.

By embracing these advancements, finance teams can move beyond operational tasks and play a pivotal role in sharing the benefits of FP&A business partnering to achieve companywide planning and growth.

To learn more about these trends and the future of FP&A for financial professionals, watch our on-demand webinar: Financial planning & analysis trends for 2025

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

How to make your NetSuite budgeting and forecasting agile

Agility is everything in manufacturing, distribution and retail businesses. Finance teams are under constant pressure to deliver accurate forecasts, accelerate the planning cycle and to have actuals at hand so everyone knows how they’re tracking. For businesses running NetSuite ERP, this means their budgeting and forecasting tools must be up to the task.

Read more

Master inventory forecasting for cost-effective stock management

Inventory management is a tight-rope balancing act. Ordering too much leaves you with excess stock tying up capital and warehouse space. Ordering too little puts you at risk of running out of stock, leading to stockouts, missed sales, and frustrated customers. Bad inventory forecasting means storage fees, excess inventory, waste from unsold goods, and operational inefficiencies that eat into profits.

Read more

Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today