The value of integrating financial and operational data

In today’s fast-paced business world, operational efficiency and confident decision-making are key to keeping your competitive edge. However, leveraging financial and operational data to do just that is a significant challenge for many organizations.

According to the Chartered Accountants ANZ 2024 Technology Research (supported by Phocas), over a third of organizations still input and integrate data manually. The sheer time and effort this takes—often days, even weeks—only leads to wasted resources and delayed insights. It also causes data analytics issues, with 69% of organizations reporting human error as their primary concern regarding data management.

So, what’s the solution? How do you integrate financial and operational data to make it easy for everyone across your business to access real-time information – and actually feel good about the data?

Challenge one: integration can be complex.

The modern business landscape is complex. Companies frequently undergo mergers, acquisitions, or expansions, resulting in a patchwork of systems that often fail to communicate with one another.

Based on the Chartered Accountants research, 60% of respondents said their organization uses a system other than their ERP to generate financial statements, but only 7% use an ‘all-in-one’ system. For many of those same organizations, using multiple data sources and software providers exacerbates data accuracy and consistency issues, with 45% concerned about incompatible systems and 43% troubled by data silos – and that’s on top of worries around human error.

When different departments use various software and tools, integrating financial and operational data can seem impossible. Consider a company that has recently merged with another organization. If both companies utilize different ERP systems, the financial data from one cannot seamlessly integrate with the operational metrics from the other. Similarly, in organizations that operate in silos, finance teams might have access to specific data sets disconnected from the operational teams’ insights. This lack of integration can hinder decision-making and create a fragmented view of performance.

Challenge two: the issues of disparate data

When financial and operational data cannot be easily integrated, time and resources are the most pressing issues. Your team may spend hours, if not days, gathering and collating data. This lag in real-time information leaves decision-makers like the CFO consistently on the back foot, making it difficult for your organization to respond quickly to market or operational changes.

The potential for errors increases when manually compiling data, too. Human mistakes can result in reporting incorrect figures or missing vital data, which can misguide strategic decisions. This is particularly problematic in fast-changing environments where data is constantly updated—new sales are coming in, products are shipped out, and staffing levels are fluctuating.

The solution: integrate data effectively with BI and FP&A software

To overcome the challenges of different systems and disparate data, you need a robust data integration platform that automatically connects your financial and operational data from your ERP and various other sources, providing a single source of truth. It should also continuously update that data as source information changes so you avoid the data accuracy and consistency issues that come from manual data entry.

Phocas software combines business intelligence (BI) and financial planning and analytics (FP&A) in one easy-to-use platform with visualization tools that enable people of all skill levels to become more data-driven. By consolidating financial and operational data into one accessible location, teams can access regular, deeper analysis and make holistic business decisions based on complete and accurate data.

Financial data: the fiscal backbone of your organization

Financial data comprises key indicators like revenue, profit margins, and expenses. You can transform those numbers into actionable insights by integrating this information with operational data with BI and FP&A software.

The pillars of financial reporting

- Balance sheet: A snapshot of your financial position at a specific time.

- Income statement: A reflection of your profitability.

- Cash flow statement: An essential indicator of liquidity, showing cash coming in and going out.

Operational data: the dynamics of daily operations

Operational data captures the essence of your daily business operations, including production metrics and employee efficiency. When integrated with financial data, you get a real-time view of the operational heartbeat of your company.

Operational reports for different industries

Manufacturing

- Production: Track output levels, production rates, and efficiency.

- Inventory: Monitor raw materials, work-in-progress, and finished goods inventory.

- Quality control: Analyze defect rates, inspection results, and compliance with standards.

- Equipment utilization: Assess machinery performance and downtime.

- Cost analysis: Evaluate production costs, labor expenses, and overhead.

- Supply chain: Monitor supplier performance, lead times, and procurement status.

- Logistics: Track shipping times, transportation costs, and delivery performance.

- Inventory turnover: Measure how quickly inventory is sold and replaced.

- Order fulfillment: Analyze order accuracy, processing times, and backorder levels.

- Warehouse performance: Assess storage capacity, picking efficiency, and labor utilization.

- Cost-to-serve: Evaluate the total cost associated with delivering products to customers.

- Demand forecasting: Predict future sales trends and inventory needs.

- Sales: Track revenue by product, category, and location.

- Customer traffic: Analyze foot traffic, conversion rates, and shopping patterns.

- Inventory management: Monitor stock levels, turnover rates, and shrinkage.

- Promotional effectiveness: Evaluate the success of marketing campaigns and discounts.

- Employee performance: Assess sales staff productivity and customer service metrics.

- Customer feedback: Collect and analyze customer satisfaction and feedback trends.

The multiple benefits of integration

The benefits of integrating financial and operational data using BI and FP&A software range from automating workflows and permission controls to deeper financial insights – all advantages that help your business as a whole make faster, more proactive decisions:

1. A more thorough understanding of financial performance

You can make more informed decisions when you have access to a complete picture of business performance. Integrating financial and operational data provides deeper insights into the drivers of profitability, efficiency, and growth. For example, by analyzing sales data alongside inventory levels, you can optimize stock levels and reduce costs, ultimately improving your bottom line.

2. Better budgeting and forecasting

Access to integrated data enables companies to create more accurate and detailed budgets and forecasts. Instead of relying on isolated metrics, you can utilize a comprehensive set of information reflecting your operations' interconnectedness. This leads to more realistic financial planning that aligns with strategic business initiatives.

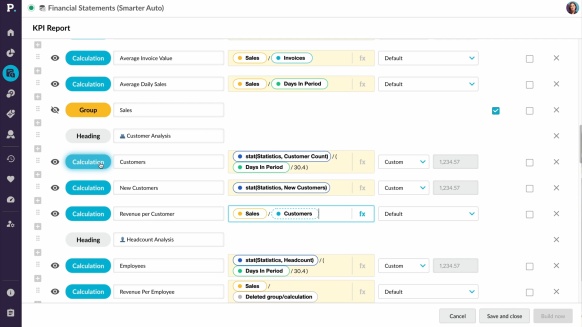

3. Customization of metrics

Every business has unique performance indicators that matter to its specific operations. With integrated BI and FP&A software, you can customize reporting dashboards to measure metrics relevant to your business needs and goals. For instance, a freight company can track the weight of its fleet, allowing for better decision-making regarding routes and capacity management. This level of customization is invaluable for optimizing operational efficiency.

4. Automation of reports and dashboards

Integrating financial and operational data is critical to automating reports and dashboards. With real-time updates from source data, you can be confident that the data and reports you’re looking at are always current. This automation reduces the administrative burden on teams and allows them to focus on analyzing the data rather than gathering it.

5. Improved internal and external conversations

Having a single source of truth facilitates better communication within your organization. When teams can access consistent, real-time data, discussions are grounded in facts rather than assumptions. This clarity can extend beyond your organization, allowing for more informed conversations with external stakeholders, such as customers, suppliers and partners.

6. Effective permission controls

Lastly, integrating financial and operational data through BI and FP&A software allows for robust permission controls. You can ensure that employees have access to information relevant to their roles without exposing confidential data. This balance of transparency and security is critical for fostering a data-driven culture – while protecting sensitive information.

Make proactive decisions based on facts, not assumptions.

Whether you’re battling operational silos or disparate ERP systems closing the gap between financial metrics and operational insights isn’t just a nice-to-have – it’s a necessity if you want to make data-driven decisions.

By integrating financial and operational data with BI and FP&A software, your organization can unlock a wealth of insights and streamline performance across all business processes. Investing in data integration will not just give you a competitive edge—it’ll position your organization for long-term success in a dynamic marketplace.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

How technology is fixing the finance talent shortage and bringing a renaissance

Accounting is one of the oldest professions, with double-entry bookkeeping tracing back to Roman merchants in the 14th century. And the genius of a system in which every transaction is recorded with an opposite entry in a different account continues to be standard practice. Just as accounting emerged during the shift from the Middle Ages to the Renaissance, today’s finance teams must also adapt to new challenges and opportunities.

Read more

Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Read more

An accurate view of your business’ finances: it’s not too hard to get

Finance teams are increasingly under pressure to provide CEOs and other executives with information related to their business’ current financial scenario — but it’s not always easy for them to do so.

Read more

Demand planning and forecasting

For finance teams in manufacturing, distribution or retail, effective demand planning is critical to meeting customer expectations without tying up cash in excess inventory. When done right, it ensures the right products are available at the right time and in the right quantities.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today