Different types of budgets for financial planning

As your business grows or becomes more complex it becomes crucial to have a budget plan. An essential tool in your Swiss army knife of financial planning is budgeting. A budget is a financial plan that outlines projected income and expenses over a specific period, typically a fiscal year. This not only provides a clearer view of your costs but also serves as a guide for managing and allocating financial resources to achieve organizational goals and objectives. Before we delve into the different types of budgets let’s explore the advantages of using a budget.

Benefits of budgeting for businesses

Achieve goals and monitor progress

Budgets allow you to set specific financial goals and track your progress toward achieving them. This helps in staying focused and motivated towards your business objectives. For example $20 million in sales revenue for a particular product line.

Manage resources

With a business budget in place, you can allocate resources such as funds, headcount, and materials efficiently. It helps in prioritizing expenditures based on their importance and impact on business objectives.

Continuous improvement

Budgets reveal areas of inefficiency or overspending. By analyzing budget variances, you can identify problem areas and take corrective actions to improve financial performance.

Manage cash flow

A budget helps in managing cash flow effectively by predicting inflows and outflows of cash. This ensures that there are enough funds available to meet your financial obligations and avoid cash shortages.

Guide decision-making

A financial budget provides valuable information for making informed business decisions. Whether it's launching a new product, expanding operations, or investing in new technology, budgets help in evaluating the financial feasibility and potential outcomes of various options.

Manage risk

By identifying potential financial risks and uncertainties, budgets allow you to develop contingency plans and mitigate risks effectively. This enhances the resilience of your business against unexpected events.

Evaluate performance

Budgets serve as benchmarks for evaluating the financial performance of your business. By comparing actual results with budgeted figures, you can assess performance, identify deviations, and take corrective actions.

Types of budgets

As business advisors, we see many budgeting methods being used across our customer base to cater for differing business cycles. In this blog, we will explore five budgeting strategies, discussing their purpose, advantages, and disadvantages so you can consider which type of budget is best for you and your business. We will also highlight that using a business planning and analytics platform also allows Finance to combine budget methods and create a hybrid budget model providing flexibility and detailed planning companywide.

Incremental or historical budgeting

This budgeting process relies on analyzing expenses from the previous year. By factoring in projected increases in costs and revenue, you can adjust the budget accordingly. For example, it may be that expenses are going to increase five percent on the previous fiscal year. So we add five percent to last year's expenses. In addition, we may expect a growth year ahead with a twenty percent increase in revenue projected so we apply a twenty percent increase to last financial year's expenses.

The incremental budgeting system offers several advantages for organizations. It provides stability and predictability since it builds upon previous budget allocations, making it easier to plan and manage finances. It is also less time-consuming than other budgeting methods, as it involves minimal changes from year to year, reducing administrative burden.

However, this historical method can lead to inefficiencies and resource misallocation. It can also discourage innovation and strategic thinking, as it prioritizes maintaining existing spending patterns over exploring new opportunities. Despite these drawbacks, incremental budgeting remains a popular choice for many organizations due to its simplicity and familiarity and when implemented as the base of a hybrid model using a business planning platform, finance teams can find the drivers of the revenue and expenses and isolate these key areas for collaboration and discussion. When the data can be interrogated and operational data can also be included, these drivers of revenue and expenses are detailed and granular, helping businesses plan more accurately.

Zero-based budgeting

This is a fresh start, devoid of any expenses from the previous financial year or quarter. Managers are requested to present their projected expenses for the upcoming year. Optimizing this process may require time and expert assistance, perhaps even involving a designated group of subject matter experts who need to be consulted about the intangible benefits of entertainment and travel that contribute to the bottom line. However, the result will be a detailed budget, without any unnecessary or wasteful expenses.

Zero-based budgeting promotes cost efficiency by requiring every item from each expense category to be justified, which can uncover areas of unnecessary spending. Also, it encourages a thorough review of operations, leading to improved resource allocation and strategic decision-making. Many customers using a hybrid budget model have been using zero-based budgeting for one line of their expenses such as travel and are benefiting from the more detailed analysis.

According to the Wall Street Journal, companies are using zero-based budgeting more since the pandemic to reduce costs especially across the use of external consultants and to consolidate real estate investments.

Activity-based budget

Activity-based budgeting facilitates efficient resource allocation by ensuring resources are directed towards the most productive activities, resulting in reduced variable costs and increased sales, ultimately leading to higher profits. It helps identify bottleneck-related activities, enabling their elimination and ensuring smoother business operations. It provides valuable insights into operational inefficiencies, empowering management to make informed decisions.

The implementation of activity-based budgeting is costly due to the resources required for research, analysis, and tracking however with the help of a busines planning and analytics platform these features are built-in and with the extensive access to consolidated data, the platform can help process the data and help you assess these cost centres.

Rolling forecast

A rolling forecast leverages actual data to anticipate future outcomes, offering a dynamic alternative to a static budget set at the beginning of the year. By continuously updating budgeting assumptions throughout the fiscal year, this budgeting process ensures greater accuracy and adaptability in financial planning.

This dynamic budget approach allows businesses to adapt plans and resource allocations based on changes in the economy, the industry, or how the business and your people are performing. This method is made achievable with a business planning and analytics platform that can be linked to your month-end reports. Finance is rewarded for the time spent building a budget model in year 1 which enables easy roll forward and continual monthly reforecasting. When the budget period ends, the coming 12 months of data is already there.

Cash flow budget

A cash flow budget is often the projection of a company's anticipated cash inflows and outflows for a specific budget period. This type of budget serves to evaluate whether a business possesses adequate cash reserves for operations or if additional borrowings/funding is necessary. By outlining the expected cash flow, businesses can effectively gauge their financial stability and make informed decisions to ensure smooth operations.

Benefits of a cash budget include helping to prevent cash shortages and debt by providing insight into inflows, outflows, and surplus funds, maintaining liquidity by identifying wasteful outflows and optimizing cash-saving opportunities, and bolstering financial stability.

Often a cashflow budget relies on estimates, but using a dedicated platform like Phocas allows for the addition of a Balance Sheet tab and Cash Flow tab to a budget workbook enables 3-statement budgeting and forecasting.

The Cash Flow budget help explains how you get from the start of your cash position to your ending cash position. You get to the end position by earning income (such as cash receipts from customers) and spending that income (such as paying for expenses) throughout the year. The Cash Flow shows where your money is coming from and what you are spending that money on. In the Phocas budgeting model, your Cash Flow is calculated automatically, based on how the Profit & Loss (Income Statement) and Balance Sheet move. This budget becomes available when you add the Balance Sheet budget and it is an extremely accurate forecast of you cashflow for the fiscal year.

Driver-based budget

Driver-based budgeting focuses on the business elements that influence financial performance.

Business drivers encompass various factors, such as economic and market conditions, headcount, assets and inventory, and strategic priorities. Additional examples can include sales volume, production capacity, maintenance and downtime, acquisition and churn, employee productivity, and supply chain management.

By aligning budgeting decisions with the underlying operational factors driving business success, organizations can create more accurate and flexible budgets that adapt to changing business conditions and priorities.

Driver-based budgeting is flexible by nature and can be implemented in nearly every industry.

Driver-based budgeting aligns operations with strategic goals, ensuring resources are allocated effectively. It fosters agility by monitoring key drivers, allowing timely adjustments to the budget. Additionally, it enhances transparency by focusing on crucial performance factors, facilitating better decision-making in your financial planning.

Driver-based budgeting relies on accurate driver identification and so by using accurate data including access to financial and operational information makes this possible. Again, a business planning and analytics platform like Phocas helps you determine a comprehensive set of drivers from across your business operations.

In the five budgeting strategies we have examined, there are advantages and downsides to each different model. No matter what budgeting system you currently use or choose to adopt, it is vitally important to efficiently and seamlessly manage the data. Whether you're a mid-market business or a larger enterprise, having access to real-time and accurate data is paramount when it comes to making informed decisions. At Phocas, we meet many clients and business owners grappling with various data challenges. These include managing multiple versions of static excel based spreadsheets, budgeting with incomplete data, as well as encountering difficulties in extracting data from ERP systems.

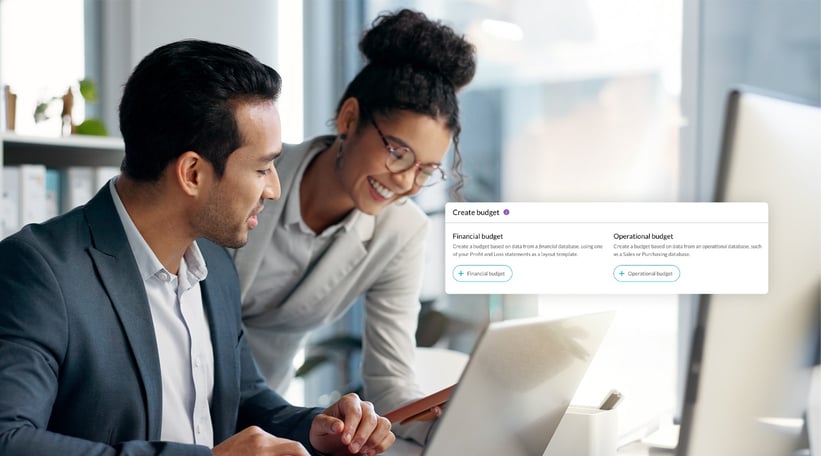

Phocas budgeting software streamlines this task by allowing you to build hybrid budget models and connecting up-to-date and comprehensive financial and operational data into the model. By seamlessly extracting data from your ERP system and various other sources, Phocas enables Finance to swiftly construct your master budget model. Moving away from a top-down approach is possible. Facilitating input from other business partners such as operations, sales, and inventory also becomes easier as all stakeholders collaborate on one data source with built-in security mechanisms to manage assigned permissions.

Phocas supports all the above-mentioned budgeting methods with its budgeting software within the business planning and analytics platform and facilitates the creation of a hybrid budget model that seamlessly blends different budget types. A widely favored combination is the incremental approach, coupled with driver-based analysis and rolling forecasts.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

5 key FP&A trends for 2025

The role of the CFO is evolving rapidly, extending beyond traditional financial stewardship to encompass business partnering, operational oversight and technological innovation. A 2024 Sage study of over 1,200 global finance leaders reinforces this transformation:

Read more

Demand planning and forecasting

For finance teams in manufacturing, distribution or retail, effective demand planning is critical to meeting customer expectations without tying up cash in excess inventory. When done right, it ensures the right products are available at the right time and in the right quantities.

Read more

Strategic budget allocation

Does your annual budget feel like more of a ‘shot in the dark’ than a strategic plan?

Read more

Cost allocation: why precision matters

It’s a common scenario: you’re out for dinner with friends, and you've enjoyed a nice meal. Now it’s time to split the bill.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today