Boost MYOB reporting and analytics

Built for MYOB

The seamless integration with your MYOB ERP means you’re always up-to-date with the financial health and performance of your business. Phocas and MYOB work together for quick installation and set-up. Every new transaction is validated so data flows freely between the two systems, making it easy to drill into the detail and compare actual vs budget figures.

Phocas is compatible with

- MYOB Advanced

- MYOB EXO

- MYOB AccountRight

- MYOB Greentree

- MYOB Premier

- MYOB Acumatica

Put your essential data in one place

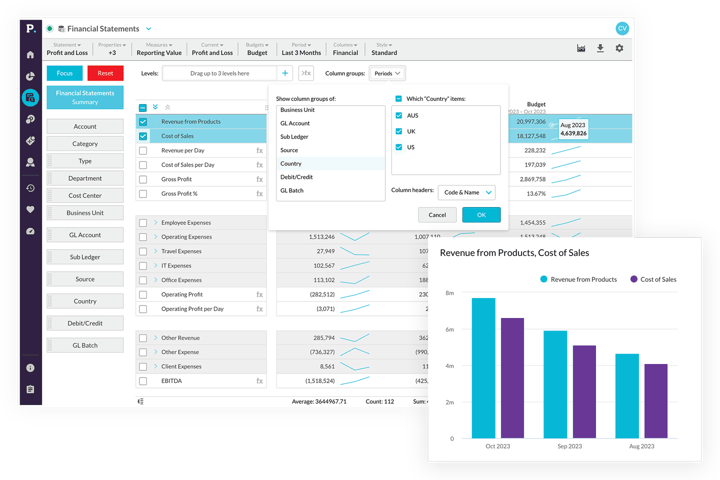

Whether you report across one head office or 50 branches, Phocas helps you customize all profit & loss, balance sheet and cashflow statements for each entity.

- Automate: Set them up once and then whenever you MYOB ERP data updates so do these dynamic reports

- Tailor: Review results in consolidated view, multi-location or individually in real time dashboards or custom reports

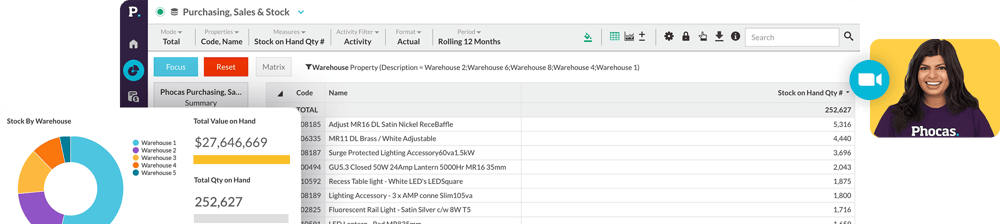

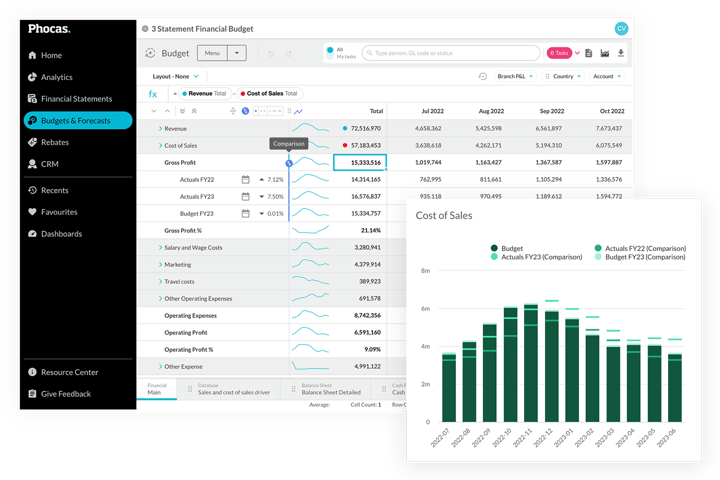

Powerful analysis for fast decision-making

No need to download or export MYOB data into Excel to analyze inventory, customers or late receivables. Phocas handles large data volumes and endless queries specific to your business.

- See: Visualize findings in charts and dashboards and share specific views with management or sales

- Live: Drill into transactions to learn more about insights at any time during the month by product, sales rep or customer

- Phocas AI: Fast-track data analysis for new users

Customer quote

MYOB + Phocas customer

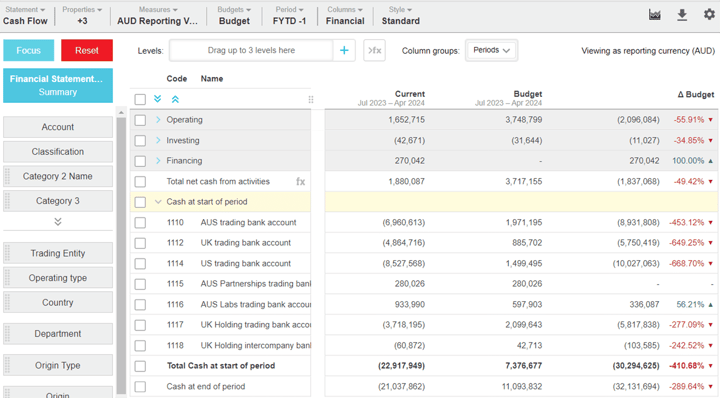

Self-serve MYOB financial reports

- DIY: Management or flash reports and dashboards can be built from scratch or using pre-built templates

- KPIs: Report on metrics relevant to your business or department, save as favourites and set up ongoing alerts

- Time & cost: Phocas prevents a backlog of requests to IT and Finance, and avoids escalating consultant costs.

Big ROI gains for giftware company, Splosh Australia

— Laura Kendall, General Manager at Splosh.

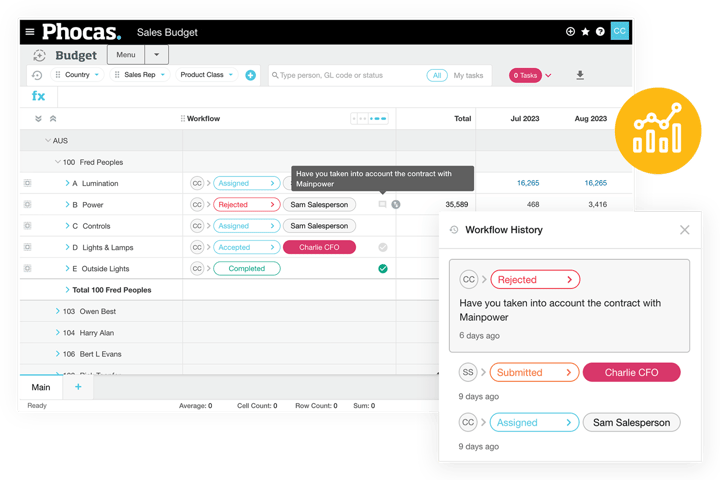

MYOB financial planning

-

Collaborative: Assignment, submission and approval processes make cross-functional input quick and painless

- Easy tracking: Live actuals allow you to track progress, compare to planned performance and visualize results

- Cashflow forecast: Use the budget model to create a three-way forecast that automatically syncs with your MYOB ERP

- Reforecasting: overlay actual performance onto the budget and update forecasted figures back to the respective databases

Customer quote

MYOB + Phocas customer

#1 Reporting/Analysis & Predictive Planning

In The BARC Planning Survey 24 Phocas scored a perfect 10 in reporting/analysis and ranked #1 in predictive planning in the “integrated products for planning and business intelligence and analytics category”.

Phocas

Anaplan

Board

Prophix

Vena

Phocas powers thousands of data-driven companies worldwide

Henry Schein

Henry Schein Bunzl Industrial Safety

Bunzl Industrial Safety Thermo Fisher Scientific Australia

Thermo Fisher Scientific Australia Husqvarna Construction Products

Husqvarna Construction Products Johnstone Supply

Johnstone Supply Stark Group

Stark Group Gazman

Gazman WD-40

WD-40 Hoyts

Hoyts- Monument Tools

- Becker Electric Supply

Steiner Electric

Steiner Electric Guest Supply Sysco

Guest Supply Sysco Seasol

Seasol Sistema

Sistema KYB

KYB Triton

Triton TJM Australia

TJM Australia Nassco

Nassco Baylis & Harding

Baylis & Harding Morelli Group

Morelli Group DMK

DMK Flournoy

Flournoy

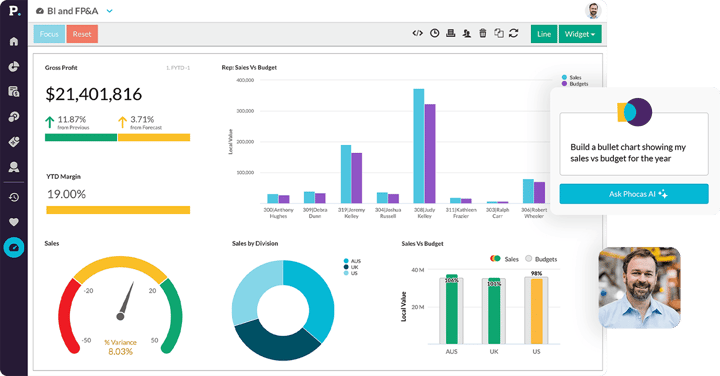

BI and FP&A together

- As your business grows, MYOB + Phocas covers everything: BI Analytics, Financial Statements, Budgets and Forecasts, Rebates

- No need to purchase all platform products together, simply choose what you need now and add more when you need them

Frequently asked questions

Phocas offers BI and FP&A together, while MYOB ERP systems are designed to manage various aspects of business operations. When integrated, Phocas enables companies to manage their operations more effectively in a various ways, such as:

- Robust BI analytics - Phocas collects and consolidates huge amounts of data from multiple business sources, empowering MYOB ERP users with fast, easy access to up-to-date data within one centralized platform.

- Self-serve reporting - Reports and dashboards are customizable to meet specific business needs and can be created by all users. Insights and metrics that may not be readily available in standard MYOB ERP reporting tools can be extracted with ease. Design your own reports in minutes and give cross-functional teams a deeper understanding of business performance.

- In-depth analytics - a unique ad hoc analysis layer, The Grid, enables all users to perform in-depth analysis. Drill down to transactional level and pivot the data in multiple ways such as by customer, branch, product or region.

- High performance - By integrating your MYOB ERP with Phocas, you'll achieve lightening fast loading times, regardless of the volume of transactional data stored. Phocas ingests and comprehends big data volumes.

- Companywide adoption - a user-friendly interface enables users across all departments to access and analyze their own data, not just IT experts or data analysts. Enhancing collaboration and fast decision-making.

- All-in-one platform - Along with a BI Analytics foundation, Phocas offers comprehensive FP&A products that work together smoothly, including Financial Statements, Budgets and Forecasts, and Rebates.

Yes - Phocas specializes in combining business data, most often ERP and financial data, with other operational data sources. Providing one trusted platform to measure, track and plan your ongoing business operations quickly and easily.

Phocas started as a BI solution, so we understand the ins and outs of data manipulation. Our customers loved the enhanced capabilities that Phocas brought to their ERP that they started asking for financial analysis and budgeting and forecasting capabilities too.

Our focus is creating software and tools that anyone in your organization can use to understand sales, operations and logistics, making sure that your team can plan and forecast based on a solid foundation of trustworthy data.

Data analytics, or business intelligence (BI), is the process of interpreting key business data to understand how an organization is performing, both financially and operationally.

Data analytics software is designed to retrieve, analyze, transform, and report on business data and metrics. This software provides organizations with an integrated view of their overall business by combining multiple data sets, such as enterprise resource planning (ERP) systems, CRM, HR, Payroll and e-commerce. BI can also be used to identify trends, uncover insights, and make informed business decisions.

Financial statement software is a program designed to automate the process of creating reports such as profit and loss (income statement), balance sheet and cashflow statements. It achieves this through the extraction of real-time data from ERP, CRM and multiple other data sources, and helps to ensure accuracy, consistency, and compliance with accounting standards.

Statements are fully customizable to suit your business needs with an intuitive interface that enables free-form data analysis. Visualizations such as dashboards, graphs, charts and Sparklines also help to connect the wider business to performance as it's easy to provide an at-a-glance view of your finances.

There are several benefits of using a Bssiness Intelligence and Financial Planning and Analysis platform over Excel or other manual reporting methods:

-

Time-saving: It frees up the finance team from time-consuming reporting tasks by automating entire processes, allowing for faster reporting, consolidation, and customization.

-

Accuracy: Data is pulled directly into the platform which ensures accuracy and reduces the risk of errors that can occur when maintaining and reworking static spreadsheets for financial reporting or budgets and forecasts.

-

Standardization: It enforces standardization across financial statements, budgets and reports to ensure consistency and enables comparisons across different periods.

-

Collaboration: It enables teams to collaborate and work simultaneously in a secure and auditable environment. This can improve communication and reduce the risk of data discrepancies.

-

Reporting: It provides advanced reporting capabilities, such as customizable templates and interactive dashboards. This makes it easier to visualize data and identify patterns and trends.

-

Security: It provides better security features than Excel, including data encryption, user access controls, and audit trails. This can help protect sensitive financial data from unauthorized access or modification.

- Customizable: You can add calculations to the statements such as EBIT, margins and ratios

While Excel can be a useful financial reporting tool, a complete platform of analysis, financial statements, budgets and forecasts, and rebates tools can help businesses streamline their financial reporting processes, improve accuracy, and make better, faster decisions based on real-time data.

Understand the past, operate better today, and plan well for the future