Cost control strategies

In the ever-evolving landscape of business, one principle remains constant: the importance of cost control. While it may seem like an obvious and straightforward concept, its significance extends far beyond merely cutting business expenses and keeping a tighter grip on cash flow.

What is cost control?

Cost control in a business is the process of monitoring and managing expenses to ensure they align with the company’s budget and financial goals. It involves identifying areas where costs can be reduced without compromising quality or efficiency, such as streamlining operations, negotiating better supplier terms or minimizing waste.

By implementing cost control measures, business people (usually finance) can improve profitability, maintain financial stability and allocate resources more effectively. Successful cost control requires regular review of financial and operational performance across the whole business and proactive adjustments to address changing circumstances.

Types of costs in business

A business can incur fixed costs, variable costs, direct costs, and indirect costs. Here’s how they apply to a wholesale distributor:

Fixed Costs: These are expenses that remain constant regardless of the level of business activity.Take rent for the warehouse or distribution center. The cost remains the same each month, regardless of how much inventory is stored or shipped.

Variable Costs: These costs change based on the volume of goods or services produced or sold. Shipping costs for delivering goods to customers falls into this category. The more products sold and shipped, the higher the shipping expenses.

Direct Costs: These are expenses directly tied to the production or procurement of goods. Such as purchasing inventory from suppliers. These costs are directly linked to the items the distributor sells to customers.

Indirect Costs: These are expenses that support the business but are not directly attributable to a specific product or service. Salaries of administrative staff. These employees support overall operations but aren’t tied to specific items sold.

The importance of cost control

Before we share our recommended strategies for better cost control, let’s start by briefly touching on the benefits of cost control.

Maximizing profitability

Cost reduction directly impacts the bottom line by increasing profitability. By streamlining operations, eliminating waste, renegotiating supplier contracts, or optimizing supply chain logistics, companies can bolster their financial performance. This surplus capital can then be reinvested in the business, distributed to shareholders, or used to fund expansion initiatives, fostering sustainable growth and long-term success.

Enhancing competitiveness

Businesses face relentless pressure to stay ahead of the curve. Cost reduction plays a pivotal role in enhancing competitiveness by enabling companies to offer products and services at more attractive prices while maintaining profitability. When a company reduces its costs, it can either lower prices to attract more customers or invest the savings in research and development (R&D) or marketing for example, all of which contribute to gaining competitive advantage.

That’s because, contrary to popular belief, cost reduction doesn't have to stifle innovation; in fact, it can fuel it. By reallocating resources from low-impact areas to strategic initiatives, companies can stimulate innovation.

Flexibility and adaptability

In today's dynamic business environment, adaptability is key to survival. By reducing costs, companies become more agile and better equipped to navigate economic downturns, industry disruptions, or unexpected challenges. Cost-efficient operations provide a financial cushion, allowing organizations to weather storms without resorting to drastic measures like layoffs or downsizing. This flexibility empowers businesses to pivot quickly, seize opportunities and remain resilient.

Sustainable practices

In an era where sustainability is no longer an option but a necessity, cost reduction can align with environmental and social responsibility goals. By minimizing waste, optimizing energy usage, and adopting eco-friendly practices, companies can reduce their carbon footprint while simultaneously cutting costs. Sustainable initiatives not only appeal to environmentally conscious consumers but also contribute to long-term cost savings through efficiency gains and regulatory compliance.

To sum up, cost control is a hugely beneficial exercise for businesses. It shouldn’t be seen as a necessary evil to stay afloat, but rather a strategic lever which can be pulled to inspire change.

Barriers to implementing cost control measures

So, if cost reduction has so many advantages, why don’t businesses do it all the time?

Because cost accounting isn’t an easy task. In the short term, figuring out ways to lower costs ironically comes at a cost because it impacts moral, and takes time which finance teams don’t have.

For example, before a business can implement cost reduction initiatives, it needs to ask itself:

- Where are we underspending or overspending versus budget, and why?

- What will be the short-term impact on cash flow and the long-term impact on profitability of reducing business costs, such as operating costs, labor costs or overhead costs?

- For example, if 1 delivery truck is sent instead of 5 due to a drop in sales, there may be a saving on picking, packing and transport but this will be offset by a loss in revenue and profit, impacting the bottom line.

- How do we communicate and report on this cost reduction to affected stakeholders?

All of these questions require access to real-time financial data, which many stakeholders simply don’t have. That’s because much of the data they need is only available in the business’ Enterprise Resource Planning (ERP) management system which typically only finance and IT can log into. This means that by the time reports are run, the information within them is already outdated. Similarly, to gain a holistic picture, businesses may also need to combine ERP data with other system data, which can result in further delays.

Effective cost management is about playing the long game. It may feel like there’s some effort required up front but systematically focusing on cost control can really pay off over time.

5 effective cost control strategies

It can feel like there are an infinite number of cost control methods available to businesses.

Some are easier to implement than others, whilst some are more fruitful than others and, what tactics work in one business, might not be as effective in another. There are also macro-economic factors at play such as product shortages and price hikes that are hitting some industries harder than others and may be beyond a business’ control.

That said, even some attempt to manage costs is better than none at all.

Here are 5 common cost control strategies that we’ve seen Phocas customers have success with in recent years:

1. Conducting regular expense audits

Turning cost control into an every day task, rather than a knee-jerk reaction to a drop in profit margin, is key to fostering a company culture where cost savings are embraced and not dreaded.

By conducting regular audits of reoccurring business expenses such as raw materials, staff remuneration and equipment expenditure to identify areas where costs can be reduced or eliminated, cost reduction becomes the norm.

However, a word of warning. If these audits are too onerous for finance teams to pull together or too complicated for end users to comprehend, they become a wasted effort.

To be effective, cost management audits need to be:

- based on accurate and real-time data

- quick and easy to produce (ideally using automation and workflows)

- visually engaging, such as a dashboard or scorecard which shows the cost variance (actual cost versus forecast) represented as a traffic-light (i.e. red = cost is over budget, amber = cost is close to budget and green = cost is on budget or under budget)

- ideally, interactive. Importantly, this means that business owners and management teams can self-serve and drill down into transactional level detail if they spot any cost anomalies, without requiring finance or IT teams to run ad hoc reports for them.

In the audit, it’s also beneficial if businesses can hone in on an established set of company-wide metrics so that cost reduction efforts aren’t spread too thinly and, identify industry benchmarks if they’re available which they can measure its ongoing performance against.

2. Supplier negotiation and consolidation

The cost of raw materials, transport, utilities and office supplies can be a significant proportion of business expenses so negotiating better terms with suppliers and vendors to secure discounts or favorable payment terms is a must.

However, to be in the best position for negotiation, procurement teams need to go into supplier conversations armed with a complete picture of the business’ purchase history which can be time consuming to prepare manually.

Phocas Analytics enables everyone, including non-technical users, to build and customize dashboards based on historic ERP and other system data by supplier. They can be securely locked down and shared with third-parties to discuss trends, facilitate negotiations and support decision making. Additionally, businesses can use the insights within Phocas to consider consolidating purchases with preferred suppliers to leverage economies of scale and reduce procurement costs.

3. Streamlined rebate management

Rebate management plays a vital role in cost control for businesses by optimizing the utilization of available incentives and discounts. By effectively managing supplier rebates, businesses can maximize their savings on purchases, and reduce overall procurement and production costs. This involves tracking, monitoring, and validating rebate claims to ensure compliance with terms and conditions set by suppliers or manufacturers.

Additionally, implementing robust rebate management systems such as Phocas Rebates allows businesses to streamline processes, improve accuracy, and minimize errors, thereby enhancing operational efficiency. Moreover, by leveraging rebate management as part of their cost control strategy, businesses can strengthen supplier relationships, negotiate better terms, and ultimately improve their bottom line.

On the flip side, Phocas is also beneficial for managing costs associated with customer rebates as it can make it easier to track if, or when, a customer will hit a rebate threshold and therefore require a pay out; projections which are vital inputs for cash flow forecasting.

4. Implementing zero-based budgeting

In our experience, one of the best cost control methods for manufacturers, distributors and retailers is zero-based budgeting (ZBB); a budgeting approach where each expense must be justified for each new period, regardless of whether the expense was incurred in the previous period.

According to McKinsey, “when implemented effectively, Zero-Based Budgeting can lead to a significant reduction of 10 to 25 percent in Sales General & Administrative costs, often within just six months.”

Unlike traditional budgeting, which often starts with the previous period's budget as a baseline, ZBB requires every expense to be evaluated from scratch, hence the term "zero-based." This means that all expenses must be justified based on their necessity and potential contribution to the organization's objectives. By scrutinizing every expense and reallocating resources based on current needs and priorities, ZBB encourages cost efficiency and can lead to the elimination of unnecessary spending.

Deloitte explains how ZBB as a budgeting method “supports cost reduction by avoiding automatic budget increases, often resulting in savings” but also warns that it can be “costly, complex, and time consuming as the budget is rebuilt from scratch annually, whereas simpler and faster traditional budgeting requires justification only for incremental changes”.

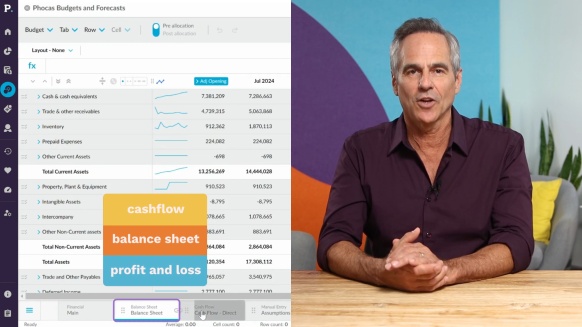

Dedicated software such as Phocas Budgets & Forecasts can help to accelerate the adoption of ZBB by providing comprehensive data accessibility and granular analysis, and allowing organizations to scrutinize expenses and justify budget allocations from the ground up. Its real-time reporting and scenario planning capabilities further enable agile decision-making, fostering transparency and accountability throughout the budgeting process.

5. Customer management

Last but not least, customers play a pivotal role in cost control strategies as businesses strive to balance the cost to serve with profitability. Understanding the cost to serve of each customer segment is essential for businesses to allocate resources efficiently and optimize profitability. By analyzing the expenses associated with acquiring, serving, and retaining customers, organizations can identify opportunities to reduce costs without compromising service quality. This may involve segmenting customers based on their profitability and adjusting pricing or service levels accordingly.

For example, using Phocas sales analysis, a business’ sales team can easily monitor the number of customers in sales and margin decline. If a customer is identified as declining, users can simply click on a customer to reveal their full purchasing history, including products, value, volume and more. With quick identification, a business’ sales team can intervene before a customer is completely lost.

Additionally, implementing customer-focused cost control measures such as self-service options, efficient order processing systems, and targeted marketing efforts can help minimize operational expenses while enhancing customer satisfaction. Ultimately, by aligning cost control initiatives with customer needs and preferences, businesses can achieve sustainable growth and profitability while delivering value to their customers.

How cost control management software can help

In a 2023 blog for FP&A Trends, Michael J. Huthwaite, Director of Product Management, Intelligent Reporting at Walmart rhetorically asks “How do you get your employees to spot waste and want to do their part to cut it out? How do you build a culture that embraces spend management as a new normal without feeling like they are going through austerity measures? Regardless of what approach you take, the key is to be consistent in your messaging and your management approach.” And we couldn’t agree more.

Cost reduction isn’t merely about tightening belts. It's about establishing a culture that values strategic optimization and long-term viability. Businesses who can master the art of cost control will not only survive but thrive, positioning themselves as leaders in their respective industries.

Adopting cloud-based financial management software like Phocas to streamline cost control provides the foundation for cultural consistency that Huthwaite so passionately recommends.

Phocas BI and FP&A allows businesses to:

- bring all their ERP and other system data together to establish a single source of truth

- reduce inefficiencies through the automation of cost control processes

- get a better handle on all types of costs across the business

- be always up-to-date with cashflow with 3-statement forecasting

- perform cost variance analysis and scenario planning such as headcount planning with ease

- empower staff with real-time cost reporting and analysis to make more informed decisions.

Phocas also provides sound return on investment; acting as the catalyst businesses need to establish and maintain a healthy cost control culture. By allowing financial and operational teams to easily identify cost savings or tap into new opportunities, it pays for itself - and then some.

For example, Replenex, an award-winning industrial distributor based in the US, has totally transformed its approach to financial reporting thanks to Phocas Financial Statements.

Replenex’ Vice President of Operations and Integrator, Tony D’Aquisto explains:

We certainly streamlined the AR and AP process and if I was to use this as a tagline, it was the biggest bang for the buck to date. The AP/AR was the biggest bang. Huge, huge payback.

Before joining Phocas as an in-house tech writer, Ali worked as a freelancer and brings a wealth of industry experience to her writing. She previously occupied a senior management position at a national distributor of plumbing and building supplies in the UK. Ali has a genuine passion for writing about ways to help businesses feel good about data.

How technology is fixing the finance talent shortage and bringing a renaissance

Accounting is one of the oldest professions, with double-entry bookkeeping tracing back to Roman merchants in the 14th century. And the genius of a system in which every transaction is recorded with an opposite entry in a different account continues to be standard practice. Just as accounting emerged during the shift from the Middle Ages to the Renaissance, today’s finance teams must also adapt to new challenges and opportunities.

Read more

Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Read more

Essential KPIs every distribution company executive should measure

For mid-market leaders running a wholesale distribution business, data and business intelligence technology are crucial for monitoring financial and operational performance. However, the real value lies in how your team uses the data insights to influence decision-making.

Read more

5 key FP&A trends for 2025

The role of the CFO is evolving rapidly, extending beyond traditional financial stewardship to encompass business partnering, operational oversight and technological innovation. A 2024 Sage study of over 1,200 global finance leaders reinforces this transformation:

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today