How to achieve a seamless budgeting process

As a CFO or finance team member, you probably know all too well the labor-intensive task of budgeting and forecasting. While your team spends hours manually updating, revising, and cross-checking spreadsheets, you’re likely missing out on opportunities to connect with internal business partners, create more accurate forecasts and otherwise add value to the organization.

Unsurprisingly, financial managers admit to spending approximately 48% of their time manually updating, revising, modifying and correcting spreadsheets, according to research by Deloitte. Although they have their uses, as you know, spreadsheets can be error-prone and difficult to manage. This can make them highly unsuitable for the budgeting process which is notoriously complex as it requires multiple iterations and input from various stakeholders.

To solve this problem, many companies are turning to a modern and collaborative approach by adopting a business intelligence and financial planning and analysis platform like Phocas.

In this blog, we discuss what financial planning software is, how it can benefit your approach to budgeting and our 5 recommended steps to achieving a seamless budgeting process.

A quick intro to financial planning and analytics

Before we jump into what financial planning software is and its benefits, let’s start by understanding more about the importance of financial planning and analytics as a process.

FP&A, as it’s sometimes known, primarily focuses on the strategic allocation and management of resources, with a big emphasis on budgeting and forecasting. It involves the meticulous process of setting financial goals, developing budgets, and utilizing data-driven insights to optimize resource allocation. By integrating budgeting into the broader framework of strategic planning and analytics, business people can more effectively monitor their fixed costs and variable costs, forecast expenditures to maintain a healthy cash flow, allocate funds to various initiatives, and measure business performance metrics against predefined targets.

This approach enables organizations to make informed decisions about investments, expenses, and revenue generation, ensuring financial stability and sustainable growth in a constantly evolving fiscal year. If you’re a product-based business, it can be particularly beneficial as you’ll have lots of moving parts across multiple channels to budget for. As an example, if you have a branch network, sales team and e-commerce arm to your business, the traditional budgeting process can feel siloed and slow. FP&A helps you to take a more holistic view of planning, allowing you to be effective budgeting for wider strategic needs of your business.

How financial planning software can help

Combining budgeting software, with forecasting capabilities and real-time financial reporting and analytics, a financial planning and analysis platform can significantly streamline your planning process, speed up your decision-making and ultimately help your business achieve its KPIs and financial goals.

But, if you’ve been used to creating your budget manually using spreadsheets and historical data, you may be left wondering how the budgeting process differs using business planning software.

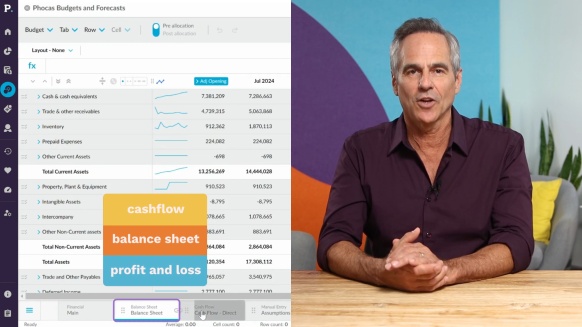

Well, perhaps unsurprisingly, it’s largely the same but faster; eliminating all the data wrangling associated with budgeting season. This frees up finance team members to focus on value-add activities such as cost savings, sharing results with the wider business and easily creating more accurate forecasts after the books are balanced. To give you an idea of how it works, watch this quick video from Jeff who talks you through building a budget model for the first time in Phocas taking into account various departments or business entities.

5 steps to a seamless budgeting process

Regardless of the types of budgets you produce, whether they’re top-down, bottom-up, zero-based or rolling forecasts, we believe there are 5 common steps that, when closely followed, can lead to a more seamless budgeting process.

These steps enable manufacturers, distributors and retailers to modernize their business budgets and forecasts, improve collaboration, feel confident in the numbers, drive efficiency and ultimately lift performance regardless of the market conditions.

1. Collaboration is key

Building a successful business budget relies on finance to effectively engage with business partners, comprehending their needs and plans, and integrating pertinent components into the overall budget. This ensures a shared and accountable planning outcome for everyone involved.

However, a traditional budgeting model using spreadsheets alone doesn’t easily allow for input from budget managers outside of the finance department and can stifle collaborative efforts.

In a typical budget project management scenario, you’d email files to business partners to solicit input. Of course, you want to be careful with the information you share with other departments and might worry about outdated versions circulating throughout the company as the budgeting process gains pace.

A budgeting software solution enables you to retain overall control of the master budget, whilst allowing you to share financial information securely with any departments you choose, thanks to built-in permissions set by finance teams. Budget workflows allow employees to view the task, submission and approval process for each account code line, with the opportunity to add comments and view a detailed history of each workflow. The importance of collaboration doesn’t end at the budget planning stage either. The added benefit of business planning and analytics software is that finance teams can more easily engage the wider business during the monitoring phase of the budgeting process by connecting the budget to financial reporting and dashboards. We’ll cover this in more depth in step 4.

2. Automate the budget process including your data inflow

Working with Excel can be a cumbersome, inflexible process that limits your team’s ability to gather insights during budget planning. Your finance team may spend the bulk of its time transferring data from the Enterprise Resource Plan (ERP) into spreadsheets. When corrections and modifications need to be made, they must create new versions resulting in the spreadsheet reports and data becoming outdated.

Automating the budgeting process can eliminate these time-consuming manual inputs. Using a budgeting software solution that automatically integrates with your ERP and other data sources can free up your accounting department. Users can easily make changes that become visible to other users in real-time, removing the worry about using an outdated or incorrect version.

By implementing a financial planning and analytics platform like Phocas, finance is rewarded for the time spent building a budget model in year 1 which enables easy roll forward and continual monthly reforecasting. When the budget period ends, the coming 12 months of data is already there in a ready-made budget template.

3. Scenario planning, stress testing and 3-way forecasting

In today's fast-paced world, thorough checks enable organizations to test their budget, prepare for different situations and make smarter business decisions.

Scenario planning helps by reviewing different future possibilities and what they could mean for the business. Stress testing checks how well financial plans can handle tough situations; finding weaknesses and improving risk management. 3-way forecasting looks at income, the balance sheet, and cash flow statements together, giving a full picture of financial health and helping manage cashflow more effectively.

Together, these planning processes allow businesses to adapt more quickly to changing needs. However, they are historically difficult to do well in spreadsheets which means they are often not done enough, or worse still, not done at all.

Business planning and analytics software like Phocas enables budget managers to play out different financial scenarios to understand their potential impact, all whilst keeping the master budget intact.

A great example is headcount planning as employee salaries are usually the largest expense and common to all businesses. This powerful functionality which, can be performed at a few clicks of a button in Phocas, saves finance teams from running numerous models for headcount, allowing them to account for every person including new starters and leavers in the budget period whilst not overspending. All this sensitive information is secure and confidential and finance can share it with non-financial managers in a restricted format.

4. Connect your budget to your financial statements

In traditional budgeting processes, management teams don’t often realise there is an issue for weeks because viewing the budgeted vs actual numbers can involve a lot of manual data consolidation. The finance team needs to pull the actual numbers from the ERP, manually add them to the budget figures in spreadsheets and then run formulas for comparison. It’s typically the same team who has spent two months bedding down a budget, who aren’t keen to poke the ‘budgeting’ bear so soon after it has been approved. The result? A ‘set and forget’ business budget that no-one has bought into delivering on.

Linking your budget to your financial statements is paramount for maintaining financial health and achieving strategic goals. By aligning your budget with your financial statements, you gain a comprehensive understanding of your financial position, performance, and trends. This synchronization enables you to make informed decisions about resource allocation and expenditure control by providing you with a real-time picture of your performance versus budget, and the subsequent effect on cash flow.

For ongoing measurement, Phocas Budgets & Forecasts has a smooth connection with Phocas Financial Statements, allowing for easy comparison with actuals and ongoing analysis. The budget figures and actuals can be visualized through graphs and charts, segmented into branches and divisions, so you can constantly connect all your people to financial performance.

5. Create more accurate forecasts

Creating accurate forecasts is paramount for businesses to effectively allocate resources and make better decisions. It provides a roadmap for strategic planning, enabling organizations to anticipate market trends, identify potential risks, and seize opportunities, ultimately enhancing their competitiveness and long-term sustainability.

However, as you know, budgeting can be an inexact science. Relying solely on spreadsheets for forecasting presents challenges such as mistakes in data entry and formula, along with difficulty managing large datasets. Collaboration becomes harder, and spreadsheets lack advanced features like automated data integration and scenario analysis. This makes it tougher to make informed business decisions because they contain static data and therefore don’t provide a real-time view of how much money you actually have at your disposal.

Using business planning and analytics software can significantly improve forecasting accuracy by enabling management and finance teams to analyze data and market trends more efficiently. It also streamlines decision-making by speeding the entire budgeting process up and eliminating the risk of human error. Shortfalls or overspending become much easier to spot and can be reforecast before they escalate.

Phocas provides you with the ability to use rolling forecasts throughout the year. You can either re-forecast estimates during the budget period or create a rolling forecast, which will come in handy for future budgets.

A positive impact on business operations

Regardless of the types of budgets you’re looking to build, adopting financial planning and analytics software like Phocas can truly transform the budgeting process, making it more efficient, collaborative, and insightful.

By automating tasks, enabling scenario planning, and connecting budgets to financial statements, organizations can streamline decision-making and achieve more accurate forecasts.

This not only enhances financial management but also empowers your business to navigate uncertainties, seize opportunities, and drive sustainable growth in today's dynamic market environment. With the right tools and strategies in place, your business can achieve a seamless budgeting process that adds significant value to the entire organization.

In Phocas, your data, financial goals, operating budgets and forecasts are integrated across the business so everyone can collaborate from the one, detailed model. Business budgets are also linked to financial reports to monitor results and make timely monthly adjustments after the books are closed - preventing any surprises to the bottom-line.

Before joining Phocas as an in-house tech writer, Ali worked as a freelancer and brings a wealth of industry experience to her writing. She previously occupied a senior management position at a national distributor of plumbing and building supplies in the UK. Ali has a genuine passion for writing about ways to help businesses feel good about data.

5 key FP&A trends for 2025

The role of the CFO is evolving rapidly, extending beyond traditional financial stewardship to encompass business partnering, operational oversight and technological innovation. A 2024 Sage study of over 1,200 global finance leaders reinforces this transformation:

Read more

Project cost management

Managing project costs can often feel like an uphill battle. Unexpected expenses, budget overruns and lack of financial visibility are common issues that can derail even the most well-planned projects. These challenges not only cause stress but also jeopardize the project's success and client satisfaction.

Read more

Year in review 2024 at Phocas, the feel-good data company

The highlight of 2024? Working closely with customers and helping them improve efficiencies and accelerate growth through the adoption of business planning and analytics solutions.

Read more

Strategic budget allocation

Does your annual budget feel like more of a ‘shot in the dark’ than a strategic plan?

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today