Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Many business owners, particularly distributors, have expressed concerns about tariffs and economic uncertainty. A recent study by MBM with 450 National Association of American Wholesale Distributors’ members revealed that the most frequently mentioned worry for 2025 is the impact of tariffs. So, the best way to allay your concerns is to have all the data you need to make the most viable decisions.

What is a tariff?

Import tariffs, like those introduced by the current American government are taxes placed on goods imported from various countries. In simple terms, a tariff is a tax on imported goods. There are various types of tariffs, and the kind implemented is known as an ‘ad valorem tariff’. This means the tax on imported goods is calculated as a percentage of the product’s value.

The purpose of a tariff is to increase the cost of imports, which theoretically makes locally made goods more competitive. For instance, if an HVAC part costs $200 to produce in China but $210 to produce in America, a 10% tariff raises the price of the imported good to $220, making the domestic option less expensive. However, local producers must still be able to produce the product and at the right price. According to Felix Tintelnot, Associate Professor of Economics at Duke University, it is also possible that the exporter could lower its price to maintain competitiveness to not lose market share.

It is understood that several factors influence the decision-making process regarding product mix and supplier selection, beyond just cost. These factors include quality, reliability and availability and need to be taken into consideration.

Who pays for tariffs?

Tariffs are paid by domestic importers (shipping goods in from Canada, Mexico, China and other countries) and are collected by the government that has imposed the tax. Historically, it is common for parts of the cost of tariffs to be passed on to consumers. Distributors face higher costs for imported goods due to tariffs and may transfer these costs to customers, if they can’t source cheaper local products. Manufacturers also face increased material costs, prompting them to seek alternative suppliers or pass the costs onto customers. Retailers experience price volatility, which can impact demand and overall profitability.

What data is needed for a tariff scenario plan?

Comprehensive and up-to-date data is essential for businesses to manage tariff challenges effectively. Many companies lack the detail about all the components and costs of a product, nor is this information validated from its source and structured in a single database for analysis at the transaction level, as a whole or in various parts. This data is often dispersed across spreadsheets, ERP systems and different supply chain functions, making it difficult to evaluate the impact of tariffs on a product-by-product basis.

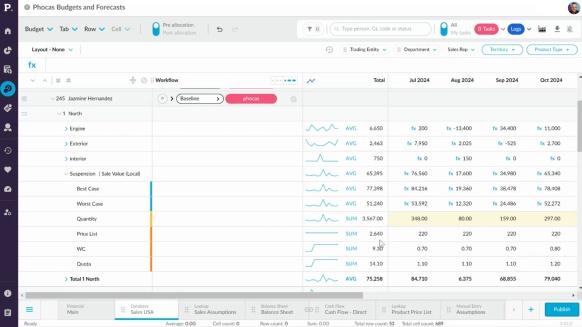

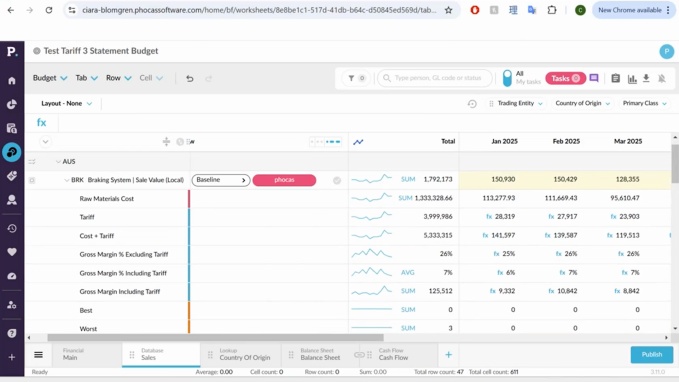

For effective analysis, consolidate data from all relevant sources into a BI platform like Phocas, then use FP&A software for Budgets and Forecasts to conduct scenario planning and analysis of all your products and their related costs, lead times and profit margins.

In Phocas Budgets and Forecasts you can build a tariff scenario planning tab into a financial budget, allowing for "what-if" analysis on the impact of tariffs on gross margins. The budget includes a "Country of Origin" lookup tab to reference tariff rates, which are then incorporated into the sales and gross margin calculations. The model allows updating tariff rates mid-year, e.g. increasing Australia's tariff from 25% to 35%, to see the impact on gross margins over time. The scenario planning can be switched between best, worst, and most likely tariff rate assumptions to understand the range of potential outcomes.

Why be across tariffs?

These new tariffs are likely to impact supply and demand, manufacturers might already be increasing production to meet rising demand or potentially you’re not sure yet if distributors are going to make the switch to you. As a distributor, you’ll have been talking to your overseas suppliers and started renegotiating raw material costs. If you use products like steel, aluminium or lumber and source from outside of America, these will need to be managed effectively because there is uncertainty about whether there is enough local supply domestically which could lead to higher prices and shortages.

Using data for scenario planning

Identifying where and how tariffs affect your business is pivotal. Scenario planning ensures businesses can move fast and in an informed way when the policies take effect. The data can reveal risks across products and regions.

A good place to start is to review your current budget and run various scenario plans based on different assumptions:

Manufacturer – Best case: Assume a 40% increase in demand for a specific part that is heavily imported during the months of April through December, as several distributors have already inquired about increased production. This analysis can be conducted for all affected products using the lookup tabs in Phocas Budget and Forecasts.

Manufacturer – Worst case: Assume a 20% decrease in demand for a particular part due to other local producers manufacturing on a larger scale

Distributor – Analyze the potential increase in costs if continuing with the existing overseas supplier or switching to a local supplier who cannot match the previous prices but may reduce delivery costs and carbon emissions. Set different assumptions and assess both best-case and worst-case price increases using the look-up tabs and purchasing data.

Distributor – Evaluate the potential decrease in product costs if a local supplier can produce at a lower cost than the increased tariff costs, considering both best-case and worst-case scenarios.

Running this type of analysis will help you prepare for all possible situations in advance. You then understand the price implications for all the different scenarios, which will help you decide which option will be optimal for your business. You can also do various scenario models based on other drivers like lead-time (it may take a while for the u.s manufacturers to get set-up), delivery costs, carbon emissions or you might be locked into a contract for another year – you can model all of these scenarios in your budget. These models can help in adapting your budget for the remainder of the year and lead discussions with local and overseas trading partners.

Do you need to diversify your supply chain?

Broad-based tariffs will make it necessary to spread your sourcing strategies risk – just as many manufacturers and distributors discovered during the pandemic. Moving some production to the US can reduce geopolitical threats but requires careful planning for labor and capital costs. Many companies are adopting a “China Plus One” model – keeping capacity in China for local demand and shifting exports to Southeast Asia.

To further mitigate risks, businesses should consider diversifying their supplier base globally, incorporating suppliers from regions less likely to be affected by tariffs. Establishing partnerships with multiple suppliers can create a buffer against sudden policy changes.

When the pandemic hit the global supply chain, many distributors experienced the bullwhip effect. One example that comes to mind was households bulk buying toilet paper so this change of demand at the retail level caused larger fluctuations at the wholesale and distributor level. The situation then was many businesses did not predict Covid was going to happen, so they had to react in real time. Tariffs on the other hand can be managed. We know what prices are changing within a range and what products will be affected.

Use the tariff disruption to spark further change

A trading environment where 25% tariffs on all goods requires proactive measures from manufacturing, distribution and retail businesses. The global trade landscape is becoming increasingly complex, involving not only tariffs but also new regulatory challenges, retaliatory tariffs and sustainability initiatives to also address.

Tariffs represent just one element within the broader context of trade disruption. The real opportunity is to use your data and BI and FP&A technology to rethink operations continually for greater efficiency and to holistically improve supply chain networks, preparing for all future challenges.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

The best financial KPIs for the distribution industry

Finance professionals in distribution businesses face a persistent challenge. That is to effectively blend operational and financial data to gain a complete picture of company performance. Traditional financial ratios often exist in isolation, making it difficult to assess the broader impact of operational decisions on financial outcomes.

Read more

Key sales KPIs for distribution companies

Managing sales in a distribution business without measuring key performance indicators (KPIs) is like maintaining your home without tools or a schedule. You don’t notice a leak until the damage is severe. Instead of making progress, you waste time searching for the right tools or calling an expert for simple fixes. Without the right KPIs, inefficiencies can go unnoticed, leading to cashflow issues and lost sales.

Read more

Essential KPIs every distribution company executive should measure

For mid-market leaders running a wholesale distribution business, data and business intelligence technology are crucial for monitoring financial and operational performance. However, the real value lies in how your team uses the data insights to influence decision-making.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today