Financial statement analysis: what's changing?

Financial statements are scorecards for businesses, allowing the finance team to interpret and analyze financial performance.Understanding these numbers and taking action based on them can significantly impact managing cash flow effectively and addressing issues promptly. However, a common problem with traditional financial reporting is that the numbers are often outdated, meaning that by the time a low-margin situation is identified, it may have persisted for a while.

How financial statements are evolving

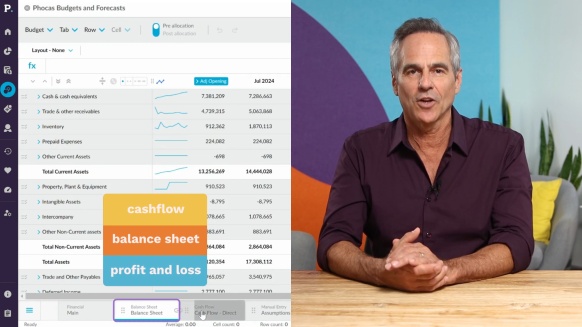

A lot of work goes into the creation and maintenance of the different types of financial statements which cover the income statement (profit and loss), balance sheet and cashflow statement. With the arrival of live data platforms, finance teams can use consolidated data (financial data and operational data) to build, customize and automate financial statements for many entities within a business and update them daily.

This shift in the way statements can be created and updated means they are taking on a more ubiquitous role within a business.

One accountant from a common size, mid-market business described the change as being more up-to-date and useful to everyday queries:

Because the Financial Statements are timely, accurate and data informed, they have become more than a retrospective financial report, but something I interact with regularly to answer real time questions.

Another perspective highlights the benefit of easy access to consolidated data, enabling more extensive analysis. A financial controller working in a business with 17 branches explained that the Phocas Financial Statements platform gives him the time to create multi-entity statements with more branch-specific details, making them more relevant to the people working in those areas. The inclusion of non-financial data also allows for measuring ratios like revenue per product, which used to be time-consuming to calculate.

Customizing the Financial Statements means I can better serve a greater range of stakeholders in the business... Combining non-financial data with my financial data means I can go deeper into understanding business performance.

Different types of financial analysis in statements

Vertical analysis

Vertical analysis presents each line item as a percentage of a base amount. In the income statement, each item is typically expressed as a percentage of total revenue, while in the balance sheet, items are presented as a percentage of total assets or total liabilities and equity. This approach standardizes financial data, making it easier to analyze relationships between different components and assess a company’s cost structure, profitability, and financial position.

By using vertical analysis, businesses can identify trends, compare performance across periods, and benchmark against industry standards or competitors. For instance, a rising percentage of cost of goods sold relative to revenue might signal efficiency issues or increased input costs. This method also helps stakeholders quickly gauge how resources are allocated within the business and evaluate areas requiring strategic adjustments.

Horizontal analysis

Horizontal analysis compares financial data over multiple periods to identify trends and growth patterns. It calculates the percentage change in each line item from one period to the next, highlighting areas of significant growth or decline. This approach helps businesses understand how their financial performance evolves over time and assess the effectiveness of their go to market strategies.

By using horizontal analysis, companies can track revenue growth, expense fluctuations, and changes in assets or liabilities. For example, a consistent increase in operating expenses without a corresponding rise in revenue might indicate inefficiencies. This analysis also allows stakeholders to evaluate progress toward financial goals and make data-driven decisions to address emerging challenges or capitalize on opportunities.

Ratio analysis

Ratio analysis is a financial analysis technique that evaluates the relationship between different financial statement items to assess a company’s performance, liquidity, profitability, and financial health. By calculating key ratios, such as profitability ratios (e.g., net profit margin), liquidity ratios (e.g., current ratio or quick ratio), and solvency/leverage ratios (e.g., debt-to-equity ratio), businesses can gain insights into their operational efficiency, financial stability, and overall performance.

This method is particularly useful for comparing a company’s performance across periods, against competitors, or against industry benchmarks. For example, a declining current ratio might signal potential liquidity challenges, while a high return on equity (ROE) indicates efficient use of shareholder capital. Ratio analysis provides a clearer picture of financial trends and helps stakeholders make informed decisions about investments, creditworthiness, and operational improvements.

Income statement analysis

Typically, when it comes to statement analysis, the go-to document is the income statement (profit and loss), as it contains information that most people are interested in, such as the business's profitability and margin status. Two common techniques used for analysis are vertical analysis, which compares each line item to revenue, and horizontal analysis, which examines the year-over-year or month-over-month changes in each item to measure growth or decline in revenue, cost of goods sold, and EBITDA.

The Phocas financial statement platform can include all this analysis in one income statement. The findings and ratios can also be presented visually using color and graphs. This allows you to graph a period of time, say five months of revenue and quickly do trend analysis to identify which periods are performing better than others. You can also incorporate profitability ratios, such as margin ratios, operating profit margin, and net profit, to assess how well your organization converts sales into profit at various levels of the statement.

By tracking profitability ratios, you can easily pinpoint areas of concern that need attention. For example, if your operating expenses ratio increases over time, it may indicate that your organizational operating costs are growing relative to sales or revenue, prompting the need for cost control measures.

The ability to add non-financial data to your income statement allows you to uncover valuable insights into your business's performance. For instance, you can include operational information such as revenue per unit sold and operating profit per unit sold. You can also apply the same metrics to customers and employees, enabling you to benchmark your company's performance and conduct ratio analysis on these more specific metrics.

Balance sheet analysis

When the finance team conducts balance sheet analysis, they often focus on working capital because liquidity ratios revolve around this figure. Working capital measures a business's ability to meet short-term obligations (liabilities) and is a valuable tool for assessing its financial health.

Customers' procurement teams can use these liquidity ratios to determine whether your company can supply stock before placing an order and evaluate whether your company is financially healthy enough to fulfill a contract.

For product/stock-driven businesses, liquidity ratios are powerful metrics to monitor in combination with debtor days and stock turnover.

As with any financial ratio, it's crucial to observe trends. Frequent changes in liquidity ratios could indicate financial instability. If your liquidity ratios consistently trend downward over time, it necessitates discussions across your company to address the underlying issues.

Effectively using liquidity ratios allows you to quickly diagnose cash flow issues or identify trends in debt problems, which is particularly relevant for stock-driven businesses. A liquidity ratio above 1.0 indicates that your company is financially healthy enough to cover its current bills.

Calculating liquidity ratios manually using Excel can be time-consuming. A financial statement platform like Phocas enables your team to swiftly retrieve the relevant data and automate the calculation of liquidity ratios. The platform's analytics feature also allows you to track this metric over time and drill down into transactional data to pinpoint issues without the need to navigate through all the journal entries.

Efficiency ratios are also measured on the balance sheet and provide valuable insights into the company's ability to utilize its assets for generating income. Depending on the type of business you are analyzing, you will measure turnover ratios like inventory turnover, receivables turnover, and asset turnover. Inventory turnover tracks how often stock replenishes in a year, while receivables turnover measures how quickly your company collects its receivables. A higher number is better in both cases, as it indicates higher sales and faster customer payments.

Cashflow statement analysis

The cash flow statement, or statement of cash flows, comprises three areas: cash from operations, cash used in investing, and cash from financing. Each of these sections provides crucial insights into the company's sources and uses of cash over a specific time period.

Many investors consider the cash flow statement the most important indicator of a company's performance. Understanding how different ratios can be used to assess an organization's operations from a cash management perspective is essential. The transactional data making up each statement is also straightforward to drill into so a cpa or CFO can easily spot errors or understand what is affecting anomalies in net income or gross profit.

Linking the three statements together or 3-statement modelling is often seen as the gold standard in cash flow management and can be achieved quickly in a platform like Phocas.

A company’s financial statements will continue to be a fundamental way of understanding financial performance. When technology can enhance these scorecards, making them more useful or insightful, then this is positive change. By incorporating ratios and non-financial data, financial statements become a reflection of your business, enabling a broader audience to understand the impact of their actions. The timeliness of the results also makes the management of cashflow and accounts receivable more immediate and the analysis of financial statements becomes a daily or weekly practice.

To find out more about Phocas financial statement and analysis platform, download the eBook below.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

Related blog posts

Communicating financial statements effectively is one of the most important responsibilities for finance professionals. Whether you're advising the sales team or preparing updates for board members, you need to meet them where they are. Financial reporting is about ensuring your stakeholders can understand the company’s financial position, profitability and overall financial performance.

Read more

Financial planning and analysis (FP&A) provides the insights that drive growth, protect profitability and guide new investments. Done well, FP&A transforms raw financial data into scenario models and forecasts, helping finance leaders and business units move ahead with confidence.

Read more

Artificial intelligence is changing the way finance teams can approach financial reporting. From automating repetitive tasks to analyzing financial statements, AI-powered tools promise faster and more efficient financial reporting processes. The use of AI in finance to create common reports like balance sheets, cash flow statements or for more specific tasks like performance analysis dashboards can offer significant benefits. Yet along with the benefits of AI come some known issues.

Read more

Picture a football coach preparing for the big game. He watches game‑tape, studying player metrics, analyzing every play and using real‑time stats to inform strategy. That’s exactly how sales managers and sales leaders should approach their coaching program—with a data‑driven approach.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today