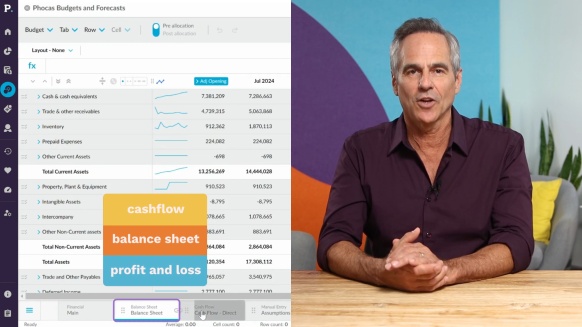

The 3-statement model software that effortlessly reveals the full cashflow picture

We all know cash is king in keeping your business alive. As distribution and manufacturing organisations continue to face supply chain constraints, the rising cost of raw materials and late paying customers — cashflow is an ongoing concern.

While many business people are busy addressing these immediate cashflow issues, others are also turning to the 3-statement financial models to ensure the cash measure is accurate now, in a year, and how working capital might hold up as you plan into the future.

Financial reporting helps us understand an organization’s historical financial performance, while financial forecasting based on these financial statements allow you to evaluate how your company might perform under different assumptions. A three-statement financial model enables you to conduct this type of analysis effectively.

The 3-statement model has always been invaluable but is complicated to execute using spreadsheets even when following a step-by-step process. If you want to have the 3 statements linked, you can now use software to build a companywide financial model for your business and get a more accurate picture of your company’s financial position.

What is a 3 statement financial model?

A three-statement financial model consolidates various outputs and schedules, focusing on three core elements that link multiple line items across the three main financial statements.

1. Income statement

The income statement outlines a business's profitability over a specified period. Typically presented with at least three years of historical results, it provides historical ratios and growth rates that inform future forecasts.

Building a three-statement model begins with inputting historical income statement data.

Financial planning and forecasting often start with a revenue forecast, followed by expense projections. The net outcome reveals earnings per share and overall income.

2. Balance Sheet

While the income statement captures operating results over time, the balance sheet provides a snapshot of a company’s financial position at the end of a reporting period. It shows assets, liabilities, and shareholders’ equity, highlighting how the company funds its resources.

Inputting historical data for the balance sheet follows the same process as the income statement.

The relationship between the income statement and the balance sheet is key. Operating assumptions derived from revenue forecasts influence items such as capital expenditures, working capital, and other balance sheet elements.

The income statement influences the balance sheet so in a financial model, revenue projections shape the assumptions that ultimately structure the balance sheet.

3. Cash Flow Statement

The cash flow statement is the final core element of a three-statement model. Unlike the income statement and balance sheet, historical cash flow statement data isn’t directly entered during the initial setup. Instead, the cash flow statement reconciles changes in balance sheet accounts.

Each line item of the cash flow statement is referenced from elsewhere in the financial model. When constructed correctly, the cash flow statement ensures the balance sheet remains balanced.

To forecast cash flow you need to reconciles changes between current and forecasted balance sheet accounts. The ending cash balance on the cash flow statement should always match the forecasted cash balance on the balance sheet.

By aligning income statements, balance sheets, and cash flow statements, three-statement financial models enable accurate scenario analysis, budgeting, and financial decision-making. For businesses seeking to streamline their FP&A processes, integrating a robust system beyond Excel helps with accuracy and fast decision-making.

When the income statement (profit and loss), balance sheet, and cash flow statement are linked into one dynamically connected financial model, you can cross-check growth, profitability and cashflow against all drivers – delivering the gold standardin financial planning & analysis (FP&A).

Off the rack vs custom made 3-statement model tutorial

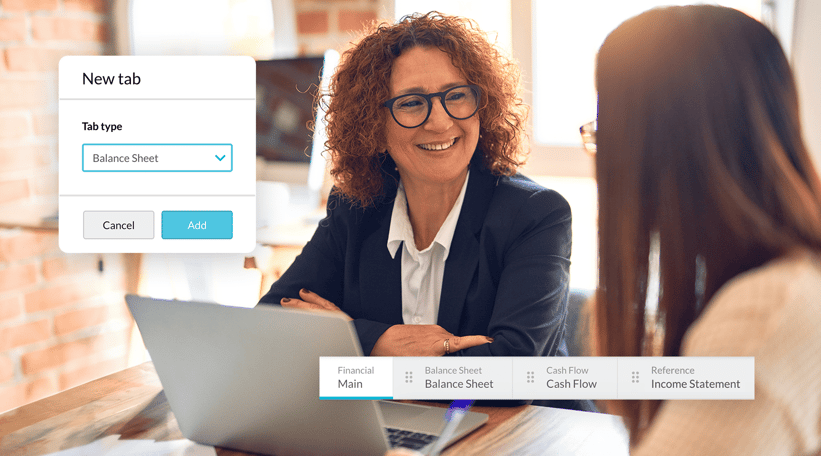

Let’s explain the difference in developing the 3-statement financial model in an excel template compared to custom-made software like Phocas - a business intelligence and financial planning and analysis platform that specialises in these types of financial models.

The income statement outlines all revenues and expenses, gains and losses finishing with net income. The balance sheet reports the assets, liabilities and shareholder equity. While the cashflow statement show changes in cash balance consisting of inflows and outflows over the set period.

Any ‘old school’ finance manager will tell you there’s a valuable lesson in building the 3-statement model. The beauty of using a software template to achieve this is that you still maintain the learning exposure, but without all the broken formulas and drawbacks.

Accountants certainly know their way around a spreadsheet but building a 3-statement financial model takes sophisticated skills where spreadsheets need to be joined, creative logic applied, and formulas are corkscrewed or chunked up for ease of management. Imagine all formulas, written in plain English, unbreakable and ready for you to select.

If you opt for a custom model, choose one that can be built on a data platform so that your three statements represent your consolidated data. Get the benefit of daily or hourly sales updates, operational and financial data drawn in from your ERP, CRM, ecommerce and inventory systems into the 3-statement financial model.

A cashflow forecast is more accurate and has financial integrity when it is driven by real-time accounts receivable and accounts payable data across financial statements.

How does a 3-statement financial model help with planning?

Another benefit of implementing a 3-statement model using custom made software is you test financial scenarios effectively. The model gives an accurate picture of how changing your business strategy will affect the income statement (profit and loss) and balance sheet but most importantly your cashflow.

Businesses are being hit with multiple challenges at the same time so knowing how these issues affect cashflow today as well as in 6 months and 12 months takes a lot more focus and effort for finance leaders.

When making complex economic decisions, a three-statement financial model provides a solid foundation of certainty by mapping out key financial outputs and ratios.

Consider this case study, imagine an Australian manufacturing business specializing in natural medicines. The company is grappling with market challenges more intense than it has faced before—demand remains strong, yet persistent global supply chain delays, rising operating expenses , and labor shortages create obstacles.

While daily operations are challenging, the business owner recognizes that to remain viable in the long term, addressing broader financial and strategic concerns is essential.

A top priority is replacing outdated systems to enhance the go-to-market strategy and align with shifting customer preferences. Yet, with so many moving parts, deciding where to focus efforts such as financing activity can feel overwhelming. By leveraging an automated, three-statement financial model, the manufacturer gains insight into how these operational and financial changes impact the big picture, offering essential direction.

This model enables the business leader to conduct sensitivity analysis and scenario analysis, facilitating a range of financial projections that clarify potential outcomes for liquidity. For example, the owner can explore:

- How adding sales personnel and upgrading the CRM system will affect revenue growth over the next 6 and 12 months.

- What profitability ratios and cash flows might look like if throughput remains sluggish over the upcoming year.

- Whether projected cash flows will be sufficient to cover new staff costs and service the business’s long-term debt, particularly with increases in financial activity due to new system investments.

- How varying accounts payable and receivable terms will influence cash flow over time.

Additionally, the model’s shortcuts simplify budgeting for capital expenditures (CapEx) and help forecast future decreases in operating costs associated with productivity improvements. By using this financial model, the business can confidently evaluate investment decisions, manage financial activity more effectively, and stay adaptable.

Strong economic decision-making is enhanced with the full picture. Software that enables you to build a well-structured financial model with an integration of three financial statements (3-statement model) makes this much easier. If there is a change in one financial statement, the other financial statements adjust accordingly.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

5 key FP&A trends for 2025

The role of the CFO is evolving rapidly, extending beyond traditional financial stewardship to encompass business partnering, operational oversight and technological innovation. A 2024 Sage study of over 1,200 global finance leaders reinforces this transformation:

Read more

Strategic budget allocation

Does your annual budget feel like more of a ‘shot in the dark’ than a strategic plan?

Read more

Departmental budgeting: how it works and how it helps you reach departmental goals

If you’re in business, here’s something you probably already know: at the core of any robust, well-managed company is a robust, well-managed budgeting process. Effective financial planning is more than spreadsheets—it establishes a strong framework with accurate data that helps guide all levels of the business and keeps you on track with your strategic goals.

Read more

Why reforecasting is crucial in financial planning

Budgets and forecasts need to work together. When finance teams and business leaders can track actuals versus budgets, reforecasting can become timely and accurate. This helps your strategic planning stay on track and allows you to deal with major changes in your business environment.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today