Essential KPIs every distribution company executive should measure

For mid-market leaders running a wholesale distribution business, data and business intelligence technology are crucial for monitoring financial and operational performance. However, the real value lies in how your team uses the data insights to influence decision-making.

Given another tough year for the distribution industry, marked by pressure on profits, product margins, demand uncertainty and the constant need to manage rising costs - you need to know what’s happening in real-time.

Being able to consolidate your ERP data and other sources then track key performance indicators (KPIs) goes a long way in managing uncertainty and making data-driven decisions.

A recent Modern Distribution Management (MDM) survey of 250 American members of the National Association of Wholesale Distributors identified these main concerns for 2025:

-

Uncertainty in planning due to unclear government policies – Distributors are concerned about tariffs, environmental regulations and supply chain disruptions affecting long-term planning.

-

Global economic trends – The slowdown in the construction and automotive industries in Europe is impacting demand for materials, leading to concerns about inventory management and revenue stability.

-

The need to modernize technology – Many distributors recognize the importance of new technology and AI to eradicate inefficiencies but struggle with workforce training and adoption.

Tracking relevant KPIs will help wholesale distribution executives monitor these new industry challenges as well as deal with ongoing profitability and delivery issues to stay competitive.

Identifying the right KPIs and having access to the right data

As a wholesale distribution executive, you need visibility into key aspects of your business. Understanding financial performance as well as the effect of new and lost customers, efficiency moves and how your people are contributing will sufficiently inform you about the big picture but you need to ensure they reflect your business goals. Achieving a holistic understanding can be difficult if your data is siloed within an ERP like NetSuite or Infor without a centralized analytics system to push it out. Blended metrics of data from finance and purchasing or human resources provide deeper insights but can be time-consuming to track manually without automation. Therefore, how your data is managed and in which system can significantly affect whether you can measure the appropriate KPIs.

Accurate KPIs provide clarity. They reveal inefficiencies, identify areas for improvement, and can measure new initiatives like the introduction of e-commerce.

As the owner or president, you will work with your management teams in finance, sales and operations to develop accurate KPIs.

It is essential that KPIs are revised regularly, ideally updated monthly, to reflect changes in market conditions and business needs.

Below are the 17 most valuable KPIs to monitor, categorized into financial, customer, inventory and efficiency and people categories. We take into consideration our experience helping distributors consolidate their data from multiple sources, validate and automate ready to measure accurate KPIs.

Financial distribution KPIs

1. Gross profit margin (by product category, supplier, branch, sales rep, adjusted for extra costs like freight, warehousing and handling fees)

To measure you need sales revenue, cost of goods sold (COGS), additional costs (freight, warehousing, handling fees)

Gross profit margin helps owners understand profitability at multiple levels and pinpoint where margins can be improved. It can help inform when your team need to negotiate better supplier deals, change pricing or cost structures. Automating gross margin calculations in Phocas means they can be added to financial statements, and they are drillable so you can analyze performance right through to the transaction level.

Strong margins are critical for covering operating expenses and reinvesting in business growth. In distribution industries often material costs fluctuate so closely tracking margin trends can help optimize pricing and procurement strategies.

Gross profit margin formulas

Gross margin(%) = (revenue - COGS )/revenue ×100

Adjusted gross profit margin= revenue - (COGS +freight + warehousing +handling fees)/revenue ×100

2. Cashflow forecast

Data is required from accounts receivable, accounts payable, expected expenses and sales projections. Predicts future cash availability, ensuring liquidity to cover expenses and investments. Help you meet financial obligations and invest in growth without risk.

Net cash flow formula

Net cash flow = cash inflows−cash outflows

Customer KPIs

3. New customer numbers and value

New customer numbers and value requires customer acquisition reports and first-time customer orders to measure. This KPI tracks business growth and the effectiveness of your sales and marketing work.

New customer value formula

new customer value = sum of (first time customer purchases)

4. Lost customer numbers and value

This KPI looks into historical customer purchase records and customer churn reports to identify revenue loss risks and highlights areas where customer engagement strategies may need adjustment to meet customer expectations.

Lost customer value formula

Lost customer value = sum of (revenue from lost customers in previous timeframe).

5. Customer retention

You will need ongoing sales data, and update knowledge of active and inactive customers. A strong retention rate indicates strong customer satisfaction and relationships and stable recurring revenue.

Customer retention rate formula

Customer retention rate (%) = (Customers at end of period−new customers)/customers at start of period )×100

6. Customer life time value

You will need average order value, purchase frequency, customer lifespan information. CLV helps prioritize high-value customers, refine sales strategies and improve long-term profitability.

Customer life time value formula

Customer life time value = average purchase value x purchase frequency x customer lifespan

Inventory and efficiency KPIs

7. Current stock value

You will need inventory records and purchase costs for each product for detailed analysis. This KPI provides a snapshot of inventory investment and helps ensure the right level of stock is maintained to balance availability and cash flow efficiency.

Current stock value formula

Current stock value = stock quantity x unit cost

8. Dead stock lines and dead stock value

Let the system retrieve aging inventory reports, sales trends and warehouse data to identify obsolete stock that ties up cash and warehouse space.

Dead stock formulas

Dead stock lines = Count of skus with zero sales over a set period

Dead stock value = the sum of (stock quantity x unit cost for unsold skus)

9. Gross margin return on investment (GMROI)

This KPI measures how efficiently inventory investment generates profit. You will need sales data and purchasing data for every product line so you can calculate for every SKU. Very easy to automate in Phocas for inventory accuracy.

GMROI formula

GMROI = gross margin/average inventory cost

10. On time in full (OTIF) as well as fill rate, order rate, back order rate, number of orders, number of units

To measure these on-time delivery rate KPIs you need order fulfilment information, supply chain tracking and shipping so you can determine your service reliability and efficiency, helping improve supplier performance, customer satisfaction and lead time optimization.

OTIF Formulas:

OTIF (%) = order delivered on time in full/total orders x 100

Fill rate 9%) = units shipped / units ordered x 100

Backorder rate (%) = backorder item/total order items x 100

11. Aged debt per region

To measure you’d click into your finance database for accounts receivable, aging reports and overdue invoices so you can identifies cash flow risks and regions with higher credit issues. This will help your collection team focus its time.

The formula is simply the sum of accounts receivable by region which can be produced as a report in Phocas and compared side by side.

12. Cash conversion cycle (CCC)

You would use your purchasing and finance database to access inventory numbers, days sales outstanding and days payable outstanding. It shows how long it takes to turn inventory into cash, helping optimize working capital.

CCC formula

(days inventory outstanding + days sales outstanding) - days payable outstanding

13. Asset turnover ratio

This is calculated using total revenue and total assets and measures how efficiently a company’s assets are used to generate sales. A higher asset turnover ratio indicates that a company is using its assets more efficiently to generate revenue and making more sales for each dollar of assets it owns.

Asset turnover ratio = total revenue/total assets

14. Sell through rate (inventory turnover)

This KPI helps identify fast-moving vs. slow-moving products for better stock decisions.

Sell through rate formula

Sell through rate = sales units / (inventory units from last period + new inventory units received in current period) x 100

People KPIs

15. Revenue per employee

This is a basic calculation that require total revenue divided by the number of employees and measures workforce efficiency.

16. Total cost of workforce

The sum of (salaries + benefits + payroll tax + superannuation + training costs). This KPIs helps ensure labor costs align with business performance.

Can you track these KPIs in real time?

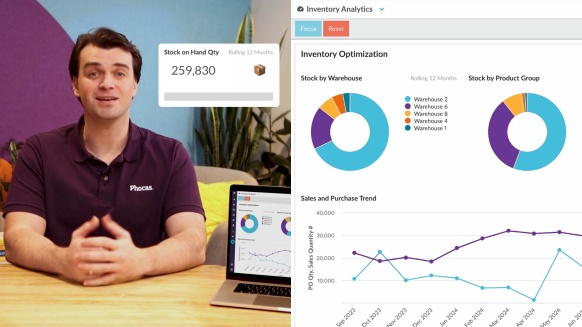

Consider whether you have all these calculations on a KPI dashboard and if you can access the report in real-time to monitor progress. This information can be useful for meetings, morning reviews or displaying on large screens throughout your business. Once your KPIs are established, business intelligence software like Phocas can consolidate all your data from various sources and automatically calculate the KPIs. These can also be integrated into custom financial statements and be benchmarks for ongoing progress and comparison across divisions.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Read more

The best financial KPIs for the distribution industry

Finance professionals in distribution businesses face a persistent challenge. That is to effectively blend operational and financial data to gain a complete picture of company performance. Traditional financial ratios often exist in isolation, making it difficult to assess the broader impact of operational decisions on financial outcomes.

Read more

Key sales KPIs for distribution companies

Managing sales in a distribution business without measuring key performance indicators (KPIs) is like maintaining your home without tools or a schedule. You don’t notice a leak until the damage is severe. Instead of making progress, you waste time searching for the right tools or calling an expert for simple fixes. Without the right KPIs, inefficiencies can go unnoticed, leading to cashflow issues and lost sales.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today