How to prepare financial reports that work for your business

Accurate and actionable financial statements are critical for any business. However, many organizations struggle with incomplete or outdated data, delays in data entry and processing and siloed access. These issues can make it hard to get a clear, up-to-date picture of your company's financial health, leading to poor decision-making, missed opportunities, and even compliance headaches.

Creating meaningful financial statements can feel like an endless slog without the right systems and processes. Compiling data from multiple sources, reconciling discrepancies, and translating complex numbers into digestible insights taxes the best accounting team. Most importantly, is the information accurate and current enough to rely on?

Here are tested and proven strategies and tools to streamline your financial reporting and deliver the clear, actionable insights you need to power intelligent business decisions. Discover how to automate many of the most tedious and error-prone aspects of report generation while enhancing visibility, collaboration, and control over your organization's finances.

The three key financial statements for your business

Access to data and automating the mapping of accounts transform the accuracy and ease of preparing the three financial statements: the profit and loss (P&L) or income statement, the balance sheet, and the cash flow statement.

Here’s a quick look at why they are essential.

Profit and Loss (P&L) Statement

Also known as an income statement, the P&L report shows your company's revenues, expenses, and net profit or net loss over a specified period, typically a month, quarter, or year. This is a critical document for understanding your overall financial position.

The P&L or income statement shows you at a glance if you are generating more revenue than you're spending, giving you a clear view of profitability. It allows you to identify areas for cost-cutting and pricing optimization to make strategic decisions about business operations.

Balance Sheet

The balance sheet gives a snapshot of your company's financial position at a given moment, including fixed assets and shareholders' equity. It lists your company’s assets, current liabilities, and equity. This report is essential for assessing your company's liquidity, solvency, and overall financial health. A strong balance sheet shows you have the current assets available to weather economic ups and downs and pursue strategic investing activities.

Cash Flow Statement

While the P&L and balance sheet focus on your financial picture, the cash flow statement tracks your business’ cash balance. This report details the sources and uses of your liquid funds, whether from operations, investments, or financing activities.

Understanding your statement of cash flows helps you manage day-to-day operating expenses, plan for large purchases, and ensure you have the liquidity required to meet your obligations. Strong positive cash flow is a crucial indicator of financial stability and success.

These three financial statements give you a complete view of your company's financial performance, position, and health. They help you make informed decisions and make the best decisions for your operating activities for long-term growth and profitability.

However, what happens when your accounting team doesn’t have accurate or up-to-date financial data or the statements days to run? Here’s a look at common issues with these critical financial reports.

Why your financial reports may be letting you down

While financial statements are essential for running a business, many companies struggle to produce them promptly and reliably. The finance team builds these reports in various ways, either pulling and consolidating data from their enterprise resource planning (ERP) system and other data sources or painstakingly preparing them using spreadsheets.

Both of these approaches come with challenges that can undermine the accuracy and timeliness of your statements.

One of the biggest challenges finance teams face is by pulling data from multiple disconnected systems. These may include your ERP, payroll software, HRIS and spreadsheets. Each source has its own data formats, definitions, and reporting capabilities.

Financial data siloed across disparate sources makes ensuring consistency and accuracy difficult. Minor discrepancies in how each system classifies or calculates specific figures can lead to significant reporting errors. The more manual steps, the higher the risk of human error.

Phocas Financial Statements addresses the challenge of disparate data sources by offering robust integration capabilities. It seamlessly connects with various ERP systems, databases, and other data sources, centralizing and harmonizing the financial data. This integration allows Phocas to provide a unified view of total assets, outflows, liabilities, and net income, enhancing accuracy and accessibility for further real-time financial analysis.

Even when financial data is centralized in a single system, there can still be significant lags in how quickly that information becomes your reports. This is a common issue when companies rely on manual data entry processes or have lengthy transaction approval workflows.

Suppose it takes several days or weeks for accounts payable invoices to be coded and posted to the general ledger. In that case, your balance sheet and cash flow statement will show an outdated picture of your financial position. Similarly, delays in recording sales, payroll, and other operational data can skew your net profit and cash flow statement, making it difficult to read your company's performance.

If you base strategic choices on outdated financial statements, you risk missing important trends, making poor resource allocation choices, and losing ground to more agile competitors.

Phocas Financial Statements tackles timeliness issues in financial reporting by enabling real-time data integration and analysis. Its cloud-based platform ensures that all financial data is constantly updated and accessible, allowing instant report generation. This real-time capability enables swift, informed decisions based on the most current financial position, reducing delays and increasing the responsiveness of financial operations.

Another major challenge with financial reporting is the inherent complexity involved, especially when relying on spreadsheets and other manual tools. The more complex your financial reporting needs become, the greater the time to produce and risk of manual errors mapping accounts across entities. Spreadsheets, while flexible, simply weren't designed to handle the scale and sophistication required for accurate financial planning and analysis (FP&A).

Phocas resolves broken formulas and manual errors by automating data entry and calculations. This ensures consistency and accuracy in the reports generated, reducing the risk of human errors associated with manual data handling. Additionally, Phocas provides built-in checks that alert users to inconsistencies, ensuring that all financial data is reliable and precise.

Financial reports are designed to track your company's performance against budgets and forecasts. This alignment between actuals and projections is critical for understanding financial health, identifying risks, and capitalizing on opportunities.

Acquiring this level of visibility on the business’s financial activities is challenging when relying on disconnected data sources and manual processes

Far too often, the finance team is the sole gatekeeper of the critical reports and models, leaving other departments and executives in the dark. This lack of visibility and collaboration can be problematic for several reasons, including:

- Decision-makers are flying blind without the full financial analysis

- Cross-functional alignment and accountability become much harder to achieve

- The finance team becomes a bottleneck, overwhelmed with ad-hoc reporting requests.

- Getting an accurate, big picture view of the company's performance is slow

The solution is to deploy a financial planning and analysis platform that prioritizes visibility, control, and standardization. Phocas allows you to grant secure, role-based access to financial reports and dashboards, empowering teams across your organization to self-serve the information they need. At the same time, you maintain central governance over critical models and metrics, ensuring consistency and integrity.

The competitive advantages of a cloud-based financial reporting system

Leveraging a modern, cloud-based platform designed specifically for financial planning and analysis is an effective way to overcome common financial reporting challenges. Phocas Software offers unique advantages that can transform your reporting capabilities and deliver a competitive edge.

Customizable financial statements

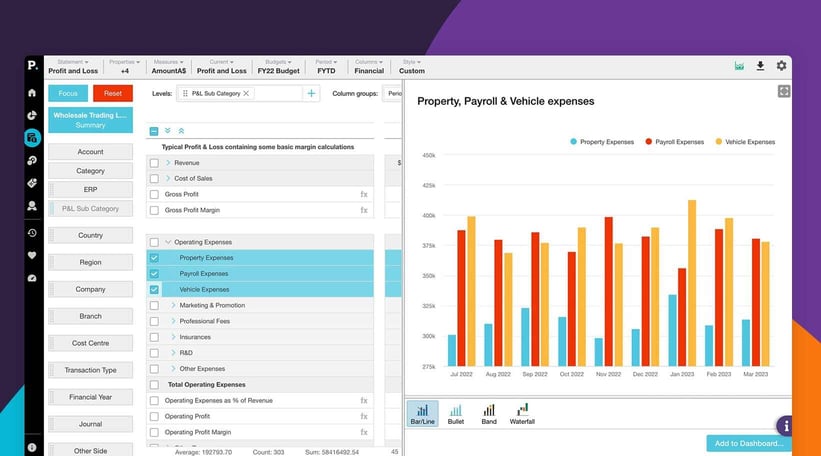

Phocas’ cloud-based system empowers you to build custom financial statements tailored to your business needs. Rather than being limited to generic income statements, balance sheets, and cash flow reports, you can create customized views and dashboards highlighting the most relevant metrics and KPIs. You might also automate daily "flash reports" tracking key performance indicators to divisional analysis that provides granular, actionable insights for specific aspects of your business like inventory or branch performance.

Integrated data and visualization

Beyond numbers on a general ledger, Phocas allows you to customize how you output financial data with visual analytics and business reporting tools. You can move fluidly from raw financial figures to visualizations that help you uncover trends, identify root causes, and generate impactful reports to share across your organization.

Our client, Viva Leisure, used the Phocas system’s flexibility and SAP integration to transition from monthly to daily financial insights. This dramatically improves the timeliness and quality of their decision-making, empowering people to easily generate and interpret meaningful reports.

Collaboration and visibility

Phocas’ integrated and easily accessible platform breaks down data silos, facilitating greater collaboration around financial performance. Rather than finance being the gatekeeper of critical reports, you can grant secure, role-based access to stakeholders across your organization to promote transparency, accountability, and the cross-pollination of ideas.

Our client Trade Supply Group set up their dashboards so each manager can quickly see their division's results, compare them to broader company performance, and uncover new opportunities for improvement. This ability to generate customized reports and freely share financial insights vastly improved strategic decision-making.

Phocas empowers your finance team to deliver the clear, reliable insights you need to drive intelligent, data-backed decision-making by automating many of the most complex and error-prone aspects of report generation.

From seamless ERP integrations that eliminate data silos to custom financial statements and visual analytics, Phocas puts you in control of your company's financial picture. With secure, role-based access, you can foster a culture of transparency and collaboration that aligns stakeholders across your organization around a single source of financial truth.

With Phocas, you'll know your reports are always timely, accurate, and actionable, providing a competitive advantage and a sound foundation for continued growth and success.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

How technology is fixing the finance talent shortage and bringing a renaissance

Accounting is one of the oldest professions, with double-entry bookkeeping tracing back to Roman merchants in the 14th century. And the genius of a system in which every transaction is recorded with an opposite entry in a different account continues to be standard practice. Just as accounting emerged during the shift from the Middle Ages to the Renaissance, today’s finance teams must also adapt to new challenges and opportunities.

Read more

An accurate view of your business’ finances: it’s not too hard to get

Finance teams are increasingly under pressure to provide CEOs and other executives with information related to their business’ current financial scenario — but it’s not always easy for them to do so.

Read more

The value of integrating financial and operational data

In today’s fast-paced business world, operational efficiency and confident decision-making are key to keeping your competitive edge. However, leveraging financial and operational data to do just that is a significant challenge for many organizations.

Read more

Why accounting is important in business

Apologies if you think we are stating the obvious and you know accounting is big business. But the main point we want to make is the changing nature of the accounting function. Financial management has always been necessary in a business to oversee the income, expenditures and cashflow but now the accounting function is the hero or the main influencer of a business.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today