What are your company's most important financial ratios?

Companies that make data-driven decisions do better. While this is a common-sense opening line, you might be surprised at the number of businesses that only look at surface-level data like total sales. We’re not saying that in order to be successful you have to be data-obsessed, but sometimes you have to dig deeper into the data to make those bigger, more impactful decisions.

Financial ratio analysis is an effective way to use data from your company’s financial statements, such as balance sheet, income statement, and cash flow statement, to gain vital information about your company’s performance and financial health. Today, we’re going to dive into the important financial ratios that can help you make revenue-generating decisions that get results.

Profitability ratios

Profitability ratios are like fortune tellers in the data world; they can tell you how well your company is doing and where you’re falling short. Profitability ratios are customizable and can be compared to historical company data. They can also be used across departments to find gaps in performance. Typically, this falls into two different buckets:

- Margin ratios: Show how well your organization turns sales into profit at different levels of your statement. Think gross margin, operating profit margin, and net profit.

Gross margin ratio = Gross profit / Net sales

Operating margin ratio = Operating income / Net sales

Net profit margin ratio = Net Profit ⁄ Total revenue - Return ratios: Provide insights into your company’s ability to generate returns. Such as return on equity, return on assets, return on capital employed

Return on assets ratio = Net income / Total assets

Return on equity ratio = Net income / Shareholder’s equity

Return on capital employed ratio = EBIT / (Total assets - Current liabilities)

Profitability ratios uncover areas of your business that need special attention. For example, let’s say that you are the operator of a retail manufacturing company. Your Operating Expenses Ratio has been increasing over time and you need to figure out where the leak is. Using the right data, you’re able to determine that your organizational operating costs are growing relative to sales or revenue. Because of this, you catch the leak fast enough to avoid disaster and are able to implement cost control practices.

Efficiency ratios

Who wouldn’t want to track where their company’s money goes? Efficiency ratios measure your ability to use assets to generate income and help you get paid faster. Efficiency ratios typically fall into two categories:

- Turnover Ratios: Best known for calculating the number of times that certain areas turn over in a year such as inventory, receivables, or assets. The higher the number, the better; this means that you’re bringing in money from customers faster.

Inventory turnover ratio = Cost of goods sold / Average inventory

Receivables turnover ratio = Net credit sales / Average accounts receivable

Asset turnover ratio = Net sales / Average total assets

- Days Ratios: Includes Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Combined, these ratios incorporate the Cash Conversion Cycle.

Days inventory outstanding (DIO)= (Average inventory / Cost of sales) x Number of days in period

Days sales outstanding (DSO) = (Accounts receivables / Net credit sales) x Number of days in period

Days payables outstanding (DPO): (Average accounts payable / Cost of goods sold) x Number of days in period

Efficiency ratios work best when you track them over time. Let’s say that your DPO is rising. In order to avoid supply chain issues (which are abundant in this day and age), you can reach out to suppliers and let them know that you need a longer grace period to pay for goods. Or maybe the efficiency ratio shows that customers are taking longer to pay. You are able to reach out to them with an invoice reminder before they fall through the cracks of your busy operations.

Think of it this way: efficiency ratios help you get paid faster so you never have to wonder “where has my money gone?”

Liquidity ratios

Want to avoid a cash flow problem? Liquidity ratios are about to become your new best friend. This data helps you assess if there are sufficient assets available to cover current liabilities. If you’re doing well on this front then it means that your business can pay its expenses and debts via profits…instead of going further into debt. These ratios fall under the liquidity ratios umbrella, and it’s advisable to familiarize yourself with them to determine which one is right for your business:

-

Operating Cash Flow Ratio: A measure of how many times an organization can cover current liabilities from operating activities.

Operating cash flow ratio = Operating cash flow / Current liabilities -

Current Ratio: Measures your ability to pay short-term obligations over twelve months.

Current ratio = Current assets / Current liabilities -

Quick Ratio (Acid Test Ratio): Evaluates the number of liquid assets available to cover liabilities. A higher ratio means that you are able to meet current obligations using liquid assets.

Acid-test ratio = Current assets – Inventories / Current liabilities - Cash Ratio: Calculates ability to repay short-term debt with cash resources and cash equivalents (such as savings accounts and money market instruments).

Cash ratio = Cash and Cash equivalents / Current Liabilities

Liquidity ratios are your golden ticket. They help you determine financial instability and fix it before it becomes a problem. Diagnosing cash-flow issues or a trend in debt problems can be done quickly and efficiently, instead of playing guessing games that can hurt your business over time.

Leverage ratios

While determining financial risk sounds like something that only lenders would be interested in, understanding where your company falls on the chart can help you make adjustments in order to get the funding you need. Leverage ratios are an important metric for management and shareholders because it helps companies make critical decisions about the amount of debt the company is carrying and whether adjustments need to be made. Here are the most common leverage ratios:

-

Debt Ratio: Just as the name suggests, this measures the percentage of assets that are being financed with borrowings.

Debt ratio = Total liabilities / Total assets

-

Debt to Equity Ratio: Measures the weight of borrowings against shareholder equity.

Debt to equity ratio = Total liabilities / Shareholder’s equity

-

Interest Cover Ratio: Measures how many times the company can cover interest expenses out of earnings.

Interest coverage ratio = Operating income / Interest expenses

-

Debt to EBITDA Ratio: Measures the number of earnings that is available to pay back debt sans interest and tax.

Debt to EBITDA ratio = Net debt / EBITDA

If you operate a mid-sized business that wants to get more funding, then leverage ratios are absolutely essential. While you can certainly calculate this on your own, it’s best to track and study them over time to help you determine how much debt your company is carrying and how much more you can take on while still meeting the terms of your financial commitments.

Phocas on financial metrics, the easy way

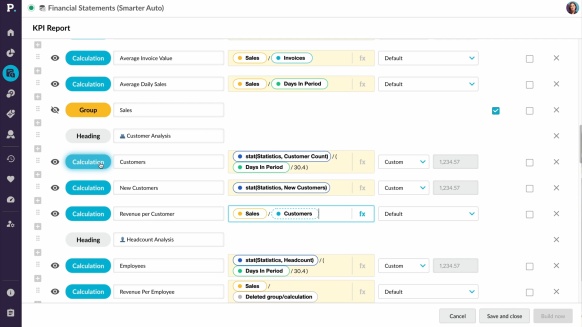

If the thought of tracking and pouring over mountains of data immediately gives you a headache, then Phocas Financial Statements is right for you. We democratize financial data by significantly reducing manual reporting and giving end-users easy access to the data they need. Our fully customizable solution enables your team to pull relevant data and automate the calculation of your chosen ratio.

Say goodbye to wearing a million hats, and hello to an easy financial data solution that saves you time and increases revenue.

Contact us to speak with a Phocas Financial Statements expert today!

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

How technology is fixing the finance talent shortage and bringing a renaissance

Accounting is one of the oldest professions, with double-entry bookkeeping tracing back to Roman merchants in the 14th century. And the genius of a system in which every transaction is recorded with an opposite entry in a different account continues to be standard practice. Just as accounting emerged during the shift from the Middle Ages to the Renaissance, today’s finance teams must also adapt to new challenges and opportunities.

Read more

An accurate view of your business’ finances: it’s not too hard to get

Finance teams are increasingly under pressure to provide CEOs and other executives with information related to their business’ current financial scenario — but it’s not always easy for them to do so.

Read more

The value of integrating financial and operational data

In today’s fast-paced business world, operational efficiency and confident decision-making are key to keeping your competitive edge. However, leveraging financial and operational data to do just that is a significant challenge for many organizations.

Read more

Why accounting is important in business

Apologies if you think we are stating the obvious and you know accounting is big business. But the main point we want to make is the changing nature of the accounting function. Financial management has always been necessary in a business to oversee the income, expenditures and cashflow but now the accounting function is the hero or the main influencer of a business.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today