Efficiency ratios focus on operational effectiveness

Efficiency ratios , often called activity ratios, are designed to ensure a business is getting good return on assets, collecting its debts, selling its stock, and settling accounts payable. If your company looks after inventory management in the manufacturing and distribution industries, efficiency ratios are critical financial ratios to track closely.

The importance of efficiency ratios

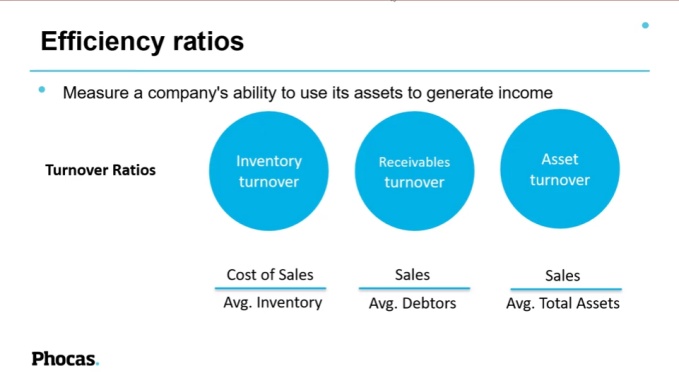

What makes efficiency ratios useful? Efficiency ratios measure a company’s ability to use its assets to generate income. This type of ratio analysis is an extremely helpful way to track where your company’s money goes and can help you get paid faster.

The efficiency ratios you use will depend on the area of the business you’re trying to measure. Generally, they fall into the following two types of efficiency ratios: turnover ratios and days ratios.

Turnover ratios

The turnover efficiency ratios calculate the number of times that certain areas turnover in a year, such as inventory, receivables, or assets.

- Inventory turnover ratio tracks how often stock replenishes in a year and is calculated by taking cost of goods sold divided by average inventory. The ratio indicates how quickly a company sells and replaces its inventory. A high inventory turnover ratio has several important implications for a company's operations and financial health. A high ratio often reflects efficient inventory management practices and strong sales from high demand. Companies are normally holding stock for shorter periods, which reduces costs and increases cash flow.

- Accounts receivable turnover ratio measures how quickly your company collects its average accounts receivables. The higher the number the better, since you want high sales and low debtor values to bring in money from customers more quickly.

- The asset turnover ratio is calculated by dividing net sales by average total assets and measures how efficiently a company’s assets are used to generate sales. A higher asset turnover ratio indicates that a company is using its assets more efficiently to generate revenue and making more sales for each dollar of assets it owns.

- Fixed asset turnover ratio is the efficiency ratio that includes fixed assets in its calculation. This ratio measures how efficiently a company uses its fixed assets (such as real estate, plant, and equipment) to generate sales.

Days ratios

These ratios measure the average number of days it takes for a company to perform certain activities, such as collecting receivables, selling inventory or paying suppliers. These ratios are often used to assess operational efficiency and liquidity.

Days sales outstanding (DSO) which indicates the average number of days it takes to collect payment after a sale. The formula is average accounts receivable divided by net credit sales × 365. A lower DSO implies quicker collection of receivables.

Days inventory outstanding (DIO), also known as inventory days, represents the average number of days inventory is held before being sold. The calculation is average Inventory divided by cost of goods sold multipled by 365 days. A lower efficiency ratio for DIO indicates the faster the inventory is sold.

Days payable outstanding (DPO) reviews the average number of days it takes for a company to pay its suppliers. The measure is average accounts payable divided by cost of goods sold multiple by 365 days and a higher DPO indicates efficient use of credit from suppliers.

The cash conversion cycle uses the three ‘days’ ratios: DIO, DSO and DPO to calculate the time it takes for a company to convert its investments in inventory and receivables into cash.

Some finance teams also like to measure the payable turnover ratio. The payable turnover ratio measures how efficiently a company pays its suppliers by comparing the total purchases or cost of goods sold (COGS) to its average accounts payable. It shows how many times, on average, a company pays its suppliers during a specific period.

Tracking the cash conversion cycle

A cash conversion cycle is a metric measuring the amount of time it takes to convert stock into cash through the process of purchasing or creating inventory, selling it, and receiving payment.

When it comes to a cash conversion cycle, the aim is to make this as short as possible in a sustainable way. For example, if the days inventory outstanding (DIO) is 50 days, the days sales outstanding (DSO) is 60 days, and the days payable outstanding (DPO) is 30 days, the cash conversion cycle would be 50+60-30 = 80 days.

When you want to improve your cash conversion cycle, you can focus on any of these individual metrics:

- Reduce days inventory outstanding (DIO) by improving planning and forecasting to ascertain how much inventory you'll need at different times, and carry out demand planning so you can better predict customer demand and reduce excess inventory. When a business reduces the time inventory stays in the warehouse you improve cash flow.

- Reduce days sales outstanding (DSO) by sending invoices sooner, offering customers several ways to pay, and setting up a system that sends out automatic payment reminders. With cash coming in faster, you can better manage working capital and meet short-term obligations. Having more cash on hand can increase your company’s ability to be flexible and participate in new opportunities.

- Increase days payable outstanding (DPO) by paying as close as possible to the due date or negotiating longer terms with suppliers. An increase means you are taking longer to pay your suppliers, which can improve cash flow in the short term but delaying payments too long can affect relationships with suppliers.

Efficiency ratios vs liquidity ratios

Higher efficiency ratios, the ability to turn current assets and inventory into cash flow have an important flow on effect to other financial metrics like liquidity ratios, the ability of a company to cover current liabilities like short term debt and operating expenses. This is an important financial performance benchmark that lenders and suppliers will look at when issuing new lines of credit.

How to use efficiency ratios for maximum value

Tracking efficiency ratios over time is a great way to catch a decline in a company’s efficiency early. If you notice, for example, that DSO is trending up and customers are taking longer to pay, you can reach out to them with an invoice reminder or find out when they can send a payment. On the other hand, if your DPO is rising, you can reach out to suppliers to communicate that your organization needs additional time to pay, which can help avoid any supply issues.

We know it can be difficult and time-consuming to track a cash conversion cycle in a spreadsheet. Automations in a financial reporting solution like Phocas enable you to track and compare efficiency ratios, such as DIO, DSO, and DPO, in a single view or add them to your financial statements. It’s much easier to notice trends in your financial analysis and quickly develop plans to deal with problems, like if your business is holding onto the stock for too long or customers are taking too long to pay for it.

In Phocas, you can also add efficiency and profitability ratios to your income statement. Adding these calculations is straightforward, and ensures your team can monitor the trends over time and make more informed, data-driven decisions.

In tough economic times, efficiency ratios can help your company gets paid faster, so you’re never left wondering where the money has gone.

Read more about how Phocas’s financial solutions help automate your financial performance monitoring in our financial process automation ebook.

Chartered accountant and expert adviser on streamlining budgeting and reporting for the mid-market.

Related blog posts

If you’re nodding along to this headline, you’re probably interested in finding out how this process can be made reliable and repeatable. Many finance teams need spreadsheets, email trails and offline files to make critical adjustments before reports are ready for the business. It works until it doesn’t. As complexity grows, the gap between your ERP and the final ‘true’ management view widens.

Read more

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Intercompany journals are like transferring stock between two warehouses in the same distribution group. One warehouse records inventory going out at as an internal transfer price, and the other records it coming in. The group hasn’t gained or lost anything — it’s just tracking the internal movement.

Read more

Communicating financial statements effectively is one of the most important responsibilities for finance professionals. Whether you're advising the sales team or preparing updates for board members, you need to meet them where they are. Financial reporting is about ensuring your stakeholders can understand the company’s financial position, profitability and overall financial performance.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today