How to measure stock on hand, over stock, under stock and dead stock quickly and simply

Many businesses need to frequently update demand forecasting due to unexpected supply chain disruptions. Companies are experiencing continued delays in shipping and higher transportation costs for products sourced internationally.

Customer behaviour also shifts and some products increase in demand while others less so. For companies that manage lots of products, it's important to evaluate how the impact of disruptions affect the balance sheet and cashflow. By measuring stock on hand, over stock, under stock and dead stock and collating all these metrics on a dashboard will help you control your inventory in real time.

In traditional stock management, ratios such as inventory turnover and gross margin return on inventory investment (GMROII) were used to measure inventory performance. Both of these metrics require a series of calculations.

While some businesses now rely on exports between ERP systems and spreadsheets or make requests to different departments for stock management reports, this process can be prone to delays and errors.

Although understanding stock management is critical to success, inventory and operation managers no longer have to rely on complicated calculations. Sounds too good to be true? It’s not. Below we have listed some key metrics relating to inventory management and we discuss how to measure them in the simplest, most accurate way possible.

Find out more in the ebook here: Data driven inventory management

Stock on hand

The stock on hand metric may not come as a surprise to anyone who has dealt with stock management before. In order to understand and manage inventory in an effective manner, you must first understand what you have in your warehouse. This includes inventory items already committed to purchase orders and customer consignments.

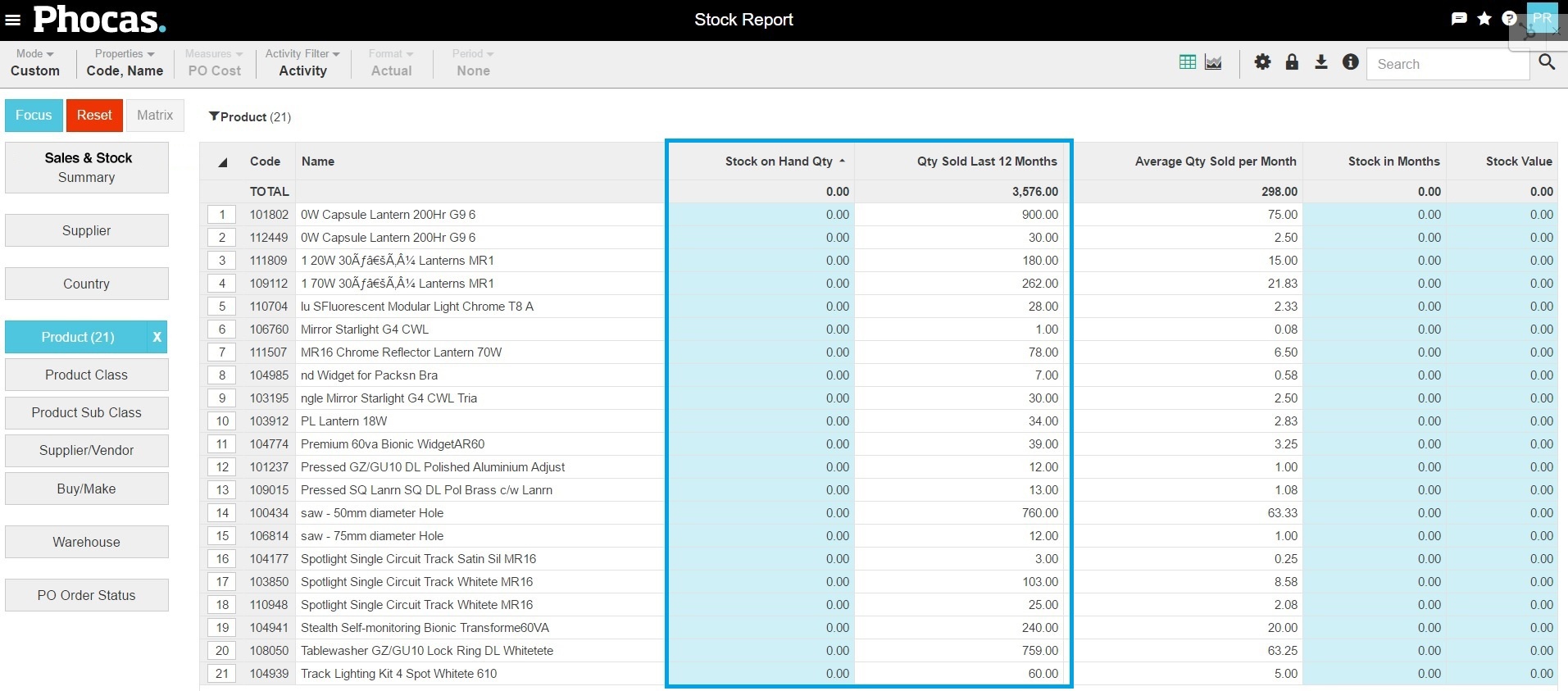

Instead of using a spreadsheet with many different calculations, you can quickly and easily generate a stock on hand report for any particular product using inventory analytics software like Phocas.. You can sort from highest to lowest in volume, drill down on a particular inventory item to find in-depth information and determine the average price paid per SKU.

Overstock

Overstock of a product occurs when a product is kept in storage in quantities much larger than what is being sold. Overstock can be determined by looking at historical sales trends, and comparing these to current stock in hand. This concept is closely related to that of inventory turns, or inventory turnover ratio,which is measured by how many times a company’s inventory is sold and replaced in a specific period.

In the image below, you can see how an inventory management system helps you quickly identify overstock with a metric called ‘stock in months’. If your historical data tells you that you typically sell little of a given product, but you see you have 60 months (or 5 years!) worth of a product in stock, this would typically mean you have overstock.

You can use this information to ensure you do not continue to purchase more of this product or it can alert you to run sales/marketing campaigns to move this product before it becomes dead.

Understock

Understanding when you have too much stock is essential but so is knowing when inventory levels are too low. If you know a specific product has an especially long lead time from your supplier, you will want to make sure you reorder soon enough to fulfil customer sales orders.

If you know it takes up to two months to source a product, and you see you have two months of stock left, it may be time to order more frequently. Likewise, items that are selling fast and there is a low supply of may need to be ordered. In terms of inventory turnover, understock represents a high inventory turnover ratio.

To identify such products in the Phocas business planning and analytics platform, beyond looking at the ‘months in stock’ column, you can with a single click sort your products from low to high to identify where you have less product compared to demand.

Dead stock

You may have read our blog on dead stock. Dead stock is stock that is no longer being sold and presents a loss to your business.

That stock sits in your warehouse gathering dust. And it’s costing you to store it too. Try a last ditch promotion to move the stock or send it to a branch in a different region where there is a market for it to avoid ongoing costs.

We showed how Phocas enables you to run quick stock on hand reports for any product you have. You can then see how much of the product sold over the past 12 months. See the first two columns below.

In addition, Phocas reveals how much the dead stock could be costing you.

In the image below, the column on the far right highlights this company is holding over $695,000 worth of stock for products that led to no sales over the past 12 months. This is an alarming statistic – And most business would prefer to have used the capital on products that are in demand.

The importance of good inventory management

It is important to understand stock on hand, understock, overstock and dead stock in order to run an efficient business and keep customers happy with a reliable supply of the products they want. Appropriate stock levels enable your sales team to ensure your valued customers get their consignments on time and allow you to make the most of your capital.

If overstock is not returned or sold at a discount, it may contribute to a dead stock graveyard over time. The business is then not only unable to sell the stock it purchased, but storage space that could have been used for profitable products is also taken up.

In addition, overstock or dead stock that is of a high value represents company assets that are not accessible and are not producing a profit. This may prevent the company from investing in opportunities for business growth, or may put the business in a difficult position when prices are pressed down through competition.

To learn more about effective inventory management, download the eBook Data-driven inventory optimization

Craig is an expert in data analytics helping customers determine specific data requirements so they can enhance performance, productivity and confidence.

Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Read more

Safety stock calculations for distributors

Effective inventory management is critical for distributors to meet customer demand, prevent stockouts, and optimize supply chain efficiency. At the heart of your inventory strategy is safety stock levels like a library stocking multiple copies of favorite titles, so if several people borrow the same book at once, there's still a copy available for the next reader. A distributor stocks extra product as well, to maintain product availability and customer satisfaction but striking the right balance is key to success.

Read more

Demand planning and forecasting

For finance teams in manufacturing, distribution or retail, effective demand planning is critical to meeting customer expectations without tying up cash in excess inventory. When done right, it ensures the right products are available at the right time and in the right quantities.

Read more

The wide appeal of self-service reporting

Your own data is a critical asset that can drive business growth, improve decision-making, and boost customer satisfaction. Among the various tools available, self-service reporting solves one of the most significant barriers to real-time data analysis—accessibility.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today