The advantages of activity-based costing (ABC) to improve pricing, budgeting and profitability

While businesses might have many purposes, maximizing profits is typically one of their primary goals. Understandably, companies expend endless effort toward this objective.

However, it’s hard to do so unless they can factor their total overhead costs into their final service product costs. If a business owner doesn’t know exactly how much they spend on a particular product or service, it’s hard for them to determine if they’re profitable or if they should adjust their methods or pricing.

Although traditional costing methods might provide a ballpark figure of the total cost to produce your products, activity-based costing will bring you closer to an accurate number by allocating all overhead costs to specific products and services. Knowing exactly how much each unit costs will open many options and strategies that will help increase your profits.

Here’s an explanation of the activity-based costing method, how you can implement the ABC system in your business, and how it can help you maximize your business’s profitability.

What Is Activity-Based Costing?

Activity-based costing is a method businesses use to determine the exact cost of their products or services. To use the ABC method, you would have to assign a portion of all your overhead costs, including every indirect expense and activity involved in your operation, to each product or service you offer based on how much of those expenses it uses.

To get started, you need to identify all of your costs, which vary by business type. Here are some of the indirect costs you would include depending on your industry. For instance in a manufacturing business you would include:

- Rent or financing costs and other expenses related to your facilities

- The cost of buying, setting up, and maintaining machinery

- Labor/salaries

- Utility bills

- Vehicles

- Depreciation

- Shipping costs

- Warehousing costs

- Marketing

Of course, you also have to know direct costs, such as materials and product design.

Once you have these figures, calculate how much of each expense is consumed by each of your products or services. You can then break down the true cost of providing each of your services or manufacturing each of your products. Knowing this lets you calculate your profits in many ways, including per unit and per customer.

Because activity-based costing breaks down costs for analysis, it is also sometimes referred to as segmentation analysis or segmentation reporting.

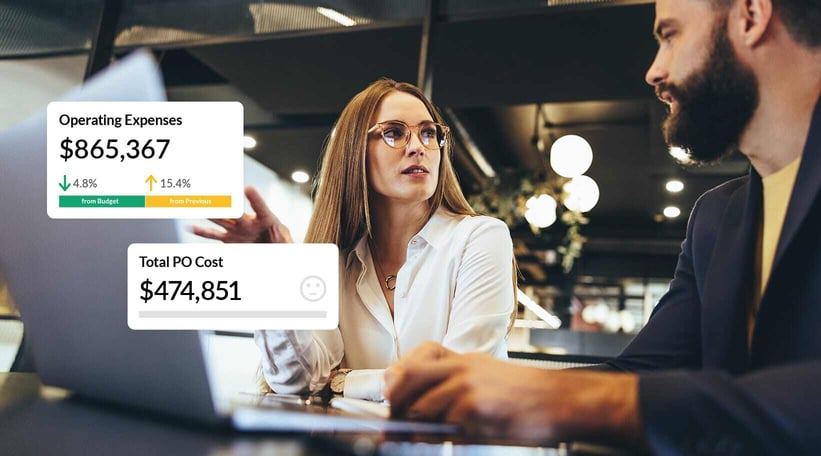

BI and FP&A platforms have made ABC systems much easier to implement

In the past, the ABC method was time-consuming and tedious. Now, you can use BI + FP&A software like Phocas to calculate cost drivers and activities, and the results are all factored in instantly. For instance, you can input rules, logic, or mapping that links different cost drivers to specific activities used to create your products or services, such as establishing a connection that automatically allocates the cost of machine setups and maintenance to any manufactured product.

The software automatically consolidates data from finance and operations software and systems to speed up the ABC process. In a manufacturing plant, finance costs and expenses include:

- Cost of goods

- Payroll

- Facilities

- Utilities

- Marketing

- The number of units produced

- How much inventory is on hand

- Defect rates

- The number of machine hours used

- The number of direct labor hours spent per unit

In terms of reporting, these two sets of data are seemingly worlds apart. But the right system can link them for a variety of analysis points, such as profitability — by product, salesperson, customer, etc., — pricing strategies and budgeting.

How ABC can benefit your company’s profitability, pricing strategies and budgeting

Here is a breakdown of the benefits for a company that implements ABC.

Profitability

The amount of profit your company makes is often tied to efficiency in production, sales, and how you service your customers.

You could have a high sales volume to a particular customer, but that doesn’t mean your margins are high. To measure customer profitability, you would have to calculate the cost to serve.

Say you own a company that delivers products for wholesalers. One wholesaler gives you hundreds of thousands of dollars in business a year but insists on having you pick up small shipments for delivery to their retailers. You need to send a driver out to their location every day for a small payload.

Another wholesaler only does tens of thousands of dollars of business with you per year. However, they agree to only call for a pick-up when they have a full truckload that’s ready for delivery.

The smaller customer may produce more profit because your cost to serve is significantly lower for them than for the larger customer. Without the ABC method, you might think that this is the case, but using the activity-based costing method, you can do a quick analysis to determine profitability.

Then, armed with this information, you can decide if you want to alter some of your policies. For example, you can inform your customer that you can only pick up a minimum of half a truckload. You can also discuss charging a fee for smaller loads.

The same applies to salespeople working for a manufacturer. One salesperson could be selling many times the volume of their colleague, but perhaps each order is of low quantity, or they could be selling low-profit items. Meanwhile, the other salesperson has very few sales but for high-profit items in high quantity.

With activity-based costing, you can clearly see how profitable each salesperson is and take action based on the data. At the next sales team meeting, you could encourage going after higher volume sales and convince them to push items with higher margins.

Knowing the exact profit margin for each product also helps you make decisions such as renegotiating prices with your suppliers for raw materials or discontinuing certain lines or products altogether.

Pricing strategies

Companies use various strategies to determine how much they charge for their products and services, including:

- Cost plus pricing, which typically simply adds a percentage to the production costs of products to establish a profit margin. A company might use different percentages depending on whether they’re low-volume or high-volume products.

- Competitor-based pricing, which determines prices for individual products on what the competition charges its customers.

- Value-based pricing, which establishes prices based on how customers perceive the value of different products.

When you estimate product costs with these costing methods, it’s hard to maneuver much. The assumption is that you’re making money on each of your products, but you don’t know how much, so varying from your strategy could mean you’ll end up losing money on some of your prices.

However, with the activity-based costing system, you can use a data analytics pricing model, which is much more dynamic and driven by insights. Since you know your actual costs, you can adjust pricing as necessary and maximize profits. For example, if you see that a product has a high profit margin, you can:

- Offer steeper discounts for bulk

- Justify spending more money on advertising for that product

- Create sales during holiday seasons or to get buyers in the door

Using the activity-based cost accounting method allows you to be strategic in how you charge your customers.

Budgeting

To plan for the upcoming fiscal year, businesses often use traditional methods of budgeting, especially incremental budgeting, which is based on the previous year’s budget, with increases based on expected changes, such as increased production or costs.

The incremental approach has worked in the past and continues to get the job done for companies, but it relies on historical data. They simplify costs without accounting for the connection between cost drivers and activities.

If you use activity-based costing, there are two additional types of budgeting you can tap into easily: activity-based budgeting and driver-based budgeting. These methods focus on cost drivers and activities, allowing you to zero in on precisely which factors are affecting your profits the most, both positively and negatively.

When budget time comes around, this knowledge leads to more educated and detailed decision-making, such as:

- Raising or lowering marketing budgets based on the profitability of specific items or product lines. Those with high manufacturing overhead costs that are not very profitable might not be worth the spend, and those with a high margin might be worth promoting more.

- Spending more money on automation if labor hours are affecting the cost of the production process for products too heavily.

- Increasing training budgets if salespeople who have undergone training produce significantly more profits than those who haven’t.

The direct link between overhead costs and your different products and services makes budgeting less about estimation and more fact-based.

Take advantage of the benefits of activity-based costing

Even activity-based costing won’t give you 100% accurate costs of production because it’s difficult to allocate exact overhead rates to activities. But this methodology will get you closer to actual unit costs than the traditional costing systems. And you can use Phocas Business Planning and Analytics to simplify the process of implementing ABC costing in your business to increase your bottom line.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

How technology is fixing the finance talent shortage and bringing a renaissance

Accounting is one of the oldest professions, with double-entry bookkeeping tracing back to Roman merchants in the 14th century. And the genius of a system in which every transaction is recorded with an opposite entry in a different account continues to be standard practice. Just as accounting emerged during the shift from the Middle Ages to the Renaissance, today’s finance teams must also adapt to new challenges and opportunities.

Read more

Using data to plan for the impact of tariffs and further change

Tariffs are here. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from affected countries such as Canada, Mexico or China or chosing local production, can affect your bottom line. We want to encourage you to scenario plan now not retrospectively.

Read more

An accurate view of your business’ finances: it’s not too hard to get

Finance teams are increasingly under pressure to provide CEOs and other executives with information related to their business’ current financial scenario — but it’s not always easy for them to do so.

Read more

Demand planning and forecasting

For finance teams in manufacturing, distribution or retail, effective demand planning is critical to meeting customer expectations without tying up cash in excess inventory. When done right, it ensures the right products are available at the right time and in the right quantities.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today