Financial Reporting

Find out how our platform gives you the visibility you need to get more done.

Get your demo todayFinancial reporting software compared to financial analysis software

To understand how a business is tracking you need financial software as it allows you to monitor performance and determine your profitability. Generally, financial software divides into three broad categories:

- Spreadsheets for basic transactions. Generally, only very simple businesses rely solely on spreadsheets to handle accounting; for most others, spreadsheets usually complement other accounting processes.

- Specific accounting software that is created to manage SME's accounting needs. Accounting software allows you to create customized functions to fit your specific company or industry

- Enterprise resource planning (ERP) software is used by much larger businesses to manage complex operations and often integrates accounting with other services offered in the software such as reporting and project management.

Each type of financial software has its pros and cons and as businesses grow often this financial software is augmented with other products such as business intelligence, customer relationship management and financial analysis software.

Financial planning and analysis software is connected to the ERP and enables the finance team to further analyze and review large volumes of data as well as automate processes. This software enables people to provide insights about the business that are hidden in standard reporting and do day-to-day tasks faster. These insights can be anything from what products have performed well in the last quarter based on set profit margins to which customers have the highest cost-to-serve.

Financial analysis software also typically enhances the reporting capability from the ERP in the form of financial statement creation and financial dashboards. Some ERP systems create financial reports but have limited customization. Most finance teams harness the financial data visualization tools to create a number of simple and visually appealing charts and graphs. These dashboards update automatically with new transactions and make sharing financial performance simple.

What other types of financial software are used in business?

Financial reporting and analysis is used to generate customized financial statements such as profit and loss (income) statements, balance sheets and cash flow statements. Often there is more functionality in this software than the ERP and statements are automated, so people can check financial performance at any time with up-to-date data and embed a range of financial metrics like profitability, liquidity, leverage efficiency ratios. Finance teams are being relied on to provide greater analysis of a company’s financial health, so analysis tools that are compatible with current general ledger systems are used to examine the nuances of performance and uncover issues much earlier than at month-end.

Financial dashboards are tools that show at a glance the top level performance of a business. The various widgets on a dashboard are often charts or gauges which help explain complex information. A dashboard allows the finance team to more readily share the financial performance of a business with the rest of the organization. Dashboards can be constructed any way desired but are often used as a simple way to see the big picture, incorporating all financial statements such as Profit and Loss (Income), Balance Sheet and Cashflow into one dynamic page.

Budgeting tools help the finance team and rest of the business to quantify the revenue expected for the year ahead. It is important to plan ahead for expected revenue and costs as well as create a baseline to compare against actual results. This helps to understand why certain areas varied from the plan. Many companies use spreadsheets for budgeting but in recent years, more sophisticated tools have been created to make budgeting easier and more useful. Business goals are also changing and budgets are a moving target and the resources are volatile and unpredictable.

Forecasting tools use historical and current data to make predictions like whether your business is moving in the right direction. Forecasting tools are used in conjunction with a budget workflow and worksheet and provide a simple way to re-forecast estimates during the budget period or prepare a rolling forecast which helps form the basis of the next year’s budget. Forecasting software and tailored FP&A allows change to happen faster, by bringing in current year actuals to-date and revising budget assumptions.

What combination of financial software tools do businesses use?

How does financial software work with an ERP?

The financial software helps consolidate all the sales, operational and general ledger data from the ERP into a single source of information so the finance team can carry out analysis efficiently. The ERP and financial analysis software connects via an API (an application programming interface) or by SQL (relationship database) or text file extracts from the ERP server.

The financial analysis and statement software sit as a presentation layer on top of the ERP data. Financial statements are created in the same tradition as the accounting team recognizes, but the process is automated for each statement. The finance team can build financial statements customized to users’ access, so branch managers or area managers can see information relevant for them, and management can see information across the whole business.

Financial software versus Excel

For many organizations, the monthly static financial reporting process is arduous, especially if it’s still performed manually. It’s a time-consuming process and relies mostly on transferring data from the ERP system (sometimes multiple) into spreadsheets, with lots of switching back and forth.

The process is slow because every new reconciliation affects the numbers, making the static spreadsheet-based reports instantly out-of-date, forcing the regular creation of new versions.

The modern approach to financial reporting and management involves an inclusive model where finance still controls the data within the ERP but automates statement generation with financial analysis software. The software allows users to access the output of that ERP in real-time and at a level customized to business need allowing everyone to have greater visibility of the numbers.

The data is automatically synced to the statements so users can see all financial transactions linked to them, so it is easy to interrogate the numbers further. Many of the questions about the finance information can be analyzed and answered on the spot - as the finance team don’t have to go back through all the spreadsheets to find the answers as is necessary when carrying out manual reporting.

What financial analysis software concentrates on is removing the limitations of Excel and instead uses the power of the data analytics software to carry out data consolidation, analysis and customization, so the preparation of the financial statements is straightforward to free-up time for analysis and value-add tasks.

One CFO from Wholesale Distributor says:

“We’re coming from an Excel spreadsheet base, we’re trying to make the financial information more readily available, and we’re trying to move our finance team from the transactional to the analytical, which is where it needs to be. Based on the time Financial Statment software has saved us, and even the simple sales analytical reviews it has enabled us to do, it has already paid for itself.”

Steven Aquilin, Chief Finance Officer, United Fasteners

What implementation and training is required?

Implementation of a financial data analytics solution takes about 6 weeks. Once the data is connected and flowing from your ERP into the data analytics software, then the different databases are built. You might have a database for sales, stock and finance. The financial analytics software sits over these databases so you can choose to analyse all data or specific portions of the data incorporating data models that can grow and flex with business challenges.

Most vendors provide initial training of the software and if the software is intuitive and built for the everyday user, then you should be able to build dashboards and add KPIs quickly. It’s a good idea to check what type of online support is included in the subscription and whether you have a customer success person assigned to your account.

What industries use financial software?

Every industry can benefit from using financial software, however, companies that have multiple locations, branches, warehouses and people working remotely benefit from having easy access to a single source of core financial information. this keeps productivity high and enables more people to make accurate decisions.

Whiting Holdings, a global steel distributor implemented financial data analytics to automate reporting which saves on administration tasks so they can dig into things that make a difference - like margins.

“Phocas has created a lot of efficiency in our finance team and we've actually reduced the number of days it's taken to roll out those reports from about ten days to about five.”

Ingrid Vanlangenberg, Finance Project Manager

IMMY, an American manufacturer of fungal diagnostic tests, integrated Phocas Financial Statements and Budgets and Forecasts with their Infor CloudSuite Industrial (SyteLine) ERP, to improve management reporting and significantly revamp the manufacturer’s complex budget process.

"Our annual budget process is totally revamped. It is so much faster and the software has the functionality to securely delegate it to other people.”

Devin Moxley, Financial Controller

How does financial software help to understand financial performance?

Financial performance is the way a company measures financial results across an organization. The main reason companies review financial performance is to compare actual results to budgets and forecasts and make adjustments accordingly.

Financial software helps refine business processes, automate the preparation of financial statements and makes budgeting and forecasting more straightforward and dynamic. Financial statements software provides an instant view of how a business strategy is working and whether the whole business or different parts of it are profitable or not.

Budgeting software takes historical data in a company’s systems. It extrapolates that data based on changes and assumptions added in workflow tools which allow the coordination of budgets across divisions and departments.

Financial software enables CFOs to bring all company data together into one source of information and complete all these tasks in one software system. The software makes reviewing financial performance easier and improves interdepartmental communication, so businesspeople are better equipped to meet their business goals and track key performance indicators.

How can financial software improve financial decision-making?

How does financial software benefit an organization?

The use of financial software allows the finance team to share and analyze data securely and therefore make financial performance the core focus of the business. When everyone has access to the same numbers, a team often collaborates more and understands the impact of their decisions on financial performance, in real time.

- Financial reporting and analysis - Dynamic reporting makes information accessible rather than locked away in spreadsheets or deep within legacy systems. A finance reporting and analysis solution that supports dynamic reporting will automatically pull the relevant information from the ERP and present it in a universally accessible format for business users to review, analyze and reference for performance management throughout the month. When financial reports are dynamic, the CFO can bypass the traditional month-end presentation because the stakeholders can access the information they need at any time. Rather than build custom visualizations for a month-end presentation, dynamic reports can incorporate responsive design elements that easily demonstrate whether, for example, a division is on target or whether there are any unusual variances in expenses.

Stakeholders across all divisions will have a better understanding of the numbers, as a dynamic report can present timely data in a responsive, more understandable format.

Like all others, finance professionals only have so many hours in a day. The more transactional work that can be automated, the more time financial professionals will have available for analysis. Business owners want the finance team to solve problems, find new efficiencies and determine what percentage of products are selling at the right margin. A financial solution backed by data analytics will help them achieve these strategic objectives by automating the lengthy process static reporting demands. The software will also enable you to attract top young talent to your business. - Financial dashboards + examples - By using a dashboard to showcase the month-end financial reports will help more people in an organization to visualize financial data in the form of charts or graphs.This way is more natural to uncover patterns, communicate insights, and make data-driven decisions. The benefit of a dashboard is that all the statements (Profit & Loss, Balance Sheet and Cashflow) can be included on one page so you can quickly see an overall snapshot of the business. The statements each serve a different purpose but seeing them all together is what tells the real story of financial health. More visibility of financial performance through dashboards leads to better conversations between teams by simply having an easier way to visualize the financial statements.

- A budgeting tool allows the finance team to easily create a budget and seek feedback from the parts of the business that are impacted through workflows.This means when changes are needed — it’s simple — as the financial data analytics software has turned your budgets and forecasts into living, value-add tools

- Forecasting tools often work alongside a budgeting tool, and the inbuilt workflow and worksheet provide a simple way to either re-forecast estimates during the budget period or prepare a rolling forecast which will form the basis of the next year’s budget. You can prepare your forecasts easily, by bringing in current year actuals to-date and revising budget assumptions.

Pitfalls of not using financial software and budgeting tools

A recent study of CFOs posed the question: What are the most common financial mistakes organisations make and the overwhelming response was to keep data siloed in departments. Nearly 40% of respondents said they work with five different data sources which wastes time and leads to human error.

In today’s business world, executive decision-makers are asking CFOs for a forward-looking view of the organization to help make the most well-informed and strategic decisions. As a result, the CFOs who are not looking for ways to break down these data silos and create a single source of truth are falling behind. The software enables businesspeople to analyze the growing amounts of business data and provide a view of cross-functional performance.

Companies that don’t have financial software spend a lot of time on ‘busy’ admin work and therefore don’t have the time to create customized reports for different parts of the business nor the time to invest in strategic analytic work to help better manage the business.

Without easy-to-use financial software, that can automate reporting, the burden of reporting falls to either the finance or IT department. This creates reporting bottlenecks and slows down decision making.

We all know that accountants love spreadsheets, but we also know the ubiquitous tool is not always fit-for-purpose, especially when preparing month-end statements or bringing together multiple data sources. Many will be aware of the common pitfalls of Excel around data integrity, formula errors, user errors and data becoming corrupted.

Key features of financial software

Real-time insights - A financial software tool takes the heavy-lifting out of financial reporting because it populates and automates the report at any given time. To get the latest figures, you click a button, and the software collates the new data from the ERP and other sources for anyone to view. People from across the business can carry out financial reporting without needing specialized training or financial expertise. It’s the difference between getting an insight every month compared to having them available in real-time.

Scalable cloud infrastructure - Scalability in cloud financial software refers to the ability to increase or decrease IT resources as needed to meet the changing demand of a business. This means you can start small and then increase for example data storage and data sources as the tools gain traction within a business.

Data consolidation and single source of truth - A single source of truth is an accurate and consistently updated source of data from all data sources across a business. An organization has a lot of moving parts, so keeping track of inventory and sales, maintaining customer data and monitoring the health of the business is critical to the growth of the organization. Financial software creates a single source or truth allowing business people the ability to manipulate and report on the data far more easily.

Financial data open to all - Financial numbers are often the domain of the accounting team. By using financial software that enables sharing profit, loss and budgets with other departments, means more people can engage and invest in the development of a team's performance. By having access to the business’s financial data shows leaders the outcomes of their strategies, which both makes them more accountable for the execution of a strategy and demonstrates what works and what doesn’t. By offering the whole organization governed access to financial data through a data analytics financial solution allows more people in a business to make decisions around value centres such as branches.

By letting more people run the numbers, that are relevant to them, will reduce the requests for other reports and enable people to answer their questions and carry-out data-driven decision-making. The finance team will continue to control the general ledger but will find it much simpler to provide branches, teams and regions with customized financial reporting. And discrepancies between groups resolve faster with a single source of truth.

What to look for in financial software

There is a lot choice when it comes to financial software so businesspeople need to look for tools that suit their industry, their needs and are intuitive and easy-to-use.

The first step is to understand your requirements and then make a checklist of the prerequisites for your company. Top of many lists is the cost and compatibility with existing systems. This is understandable as all IT teams are being asked to do more with less so finding a robust plug and play option is worthwhile.

Another key factor is that the software doesn’t require a team of people to manage it and once it is implemented and some basic training has been carried out, everyone should be able to use it and start to run their own reports and answer their own questions.

Flexibility is also important. For instance, does the software allow you to customize financial statements to suit the needs and nuances of your business structure. Then how scalable is the software, for instance can you add new licences gradually as you build adoption across your company?

Financial dashboards or the visualization features in financial software are proving to be very valuable across businesses as they allow the finance team to quickly share information and build knowledge, companywide of financial performance. Look out for these as well.

What is the finance team's role in supporting the software?

The finance team should continue to have ownership of the numbers in the General Ledger but by using financial software they can grant permissions for others across the business to access up-to-date reports, carrying out their queries and be more familiar with financial performance.

Like all software, the finance team is responsible for have clean data in the ERP and would work with different parts of the business to add different datasets.

Financial software is designed to be an assistant to the team and through automation and customization, the software frees up time for the finance team to provide more valuable analysis and advice to the business.

Choosing the right financial software

Best Financial Software

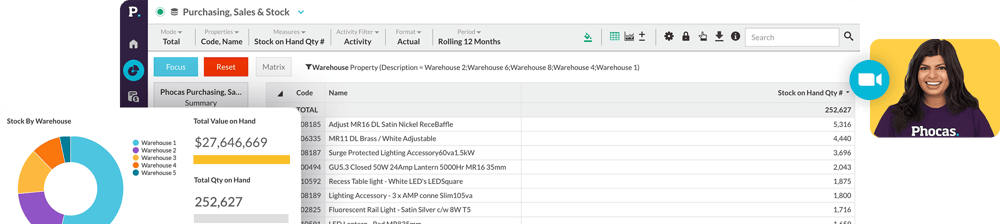

Phocas Financial Statements allows finance leaders to carry out cloud-based financial reporting, analysis and visualization. This product delivers efficiencies to the finance team and the business more broadly.

Data from the ERP is fed directly into Financial Statements, leaving the ERP data intact to ensure ledger data integrity. In the product, finance can access a data interface designed for faster reporting, consolidation, customization, drill down and seamless export to Excel for any extended modelling.

The finance leader can configure the statements to specific areas so that users only see what they need in order to manage their area’s expenses and financial KPIs proactively and effectively answer their own questions.

The software integrates with multiple data sources to reveal what’s really going on across a business so people can make better and faster decisions. People can also achieve immediate drill through to transactions for quick ad hoc analysis without touching the ledger.

Phocas Financial Statements is also designed to work with Excel and have an extension into it, as required. When exporting to Excel, all Phocas hierarchy’s are maintained, and formulas remain intact for seamless integration enabling additional modelling such as cash flow forecasting.

Best Budgeting Software

Phocas Budgeting and Forecasting builds on the Phocas Financial Statements product and together they elevate a business’ budgeting, reporting and analytics to be more inclusive and powerful.

Budgeting becomes easier as the tool has built in workflows so the co-ordination of a budget is less of a burden so it can be updated easily and revisited many times throughout a year. For guidance, comments can be attached, and a detailed history of each workflow can be viewed. With built in permissions set by Finance, GL codes are only visible to certain people on a needs-to-know basis. Notifications let contributors easily track the items assigned to them and alert them to new tasks.

Forecasting uses the budget workflow and worksheet and provides a simple way to either re-forecast estimates during the budget period or prepare a rolling forecast which will form the basis of the next year’s budget. You can prepare your forecasts easily, by bringing in current year actuals to-date and revising budget assumptions.

Phocas budgeting and forecasting software allows companies to collate several data sources into a single source of data so they can understand the full financial position.

The spreadsheet nightmare or the ‘budget hell’ is over as people no longer need to worry about version control, validation issues or permission access. Budgets become integral to an organization and more widely trusted and used. There is a companywide razor focus on the numbers and people can see the impact of their decisions on financial performance in real time and more accurately predict future issues and cashflow.

Case studies - financial software

“When we were a smaller organization with 50 employees, spreadsheets were fine,” said Soulby Jackson, CIO of Resolute.

But circumstances have changed. “As we have grown 3 times our size, the need for a single source of truth and the ability to manipulate and dig into the data has grown. We are on an aggressive growth path through acquisition, so seamlessly integrating data from a growing number of data sources to see the big picture is critical.”

After evaluating a couple of solutions, including Microsoft Power BI, Resolute opted to deploy Phocas BI because of the quickness of the database, the interface and user-friendly dashboards, and the customer service.

Soulby Jackson, CIO, Resolute HVAC&R provider

"The biggest challenge of American Metals faced prior to Phocas Financial Statements was the time it took to look at data. So for instance we would have to data dump into Excel then manipulate it before we could really see the results which would be a huge time for us. And it would take a lot away from analyzing."

Justin Capar, Controller, American Metals Supply Company

"We have set-up a portal using the Phocas software so everyone can access their financial statements and have them immediately —when they need them— and use these at any time."

Andy Williams, Chief Financial Officer, Capitol Group

Understand the past, operate better today, and plan well for the future