Customer profitability analysis helps see the big picture

Not all customers are made equal. Customer profitability analysis (CPA) helps companies understand how reliant they are on profitable customers and the resources spent on less profitable ones. Low-profit customers can come at a high cost, so it’s critical to have a comprehensive and accurate understanding of your customers to minimize at-risk relationships and maximize profitability.

A customer profitability analysis is an evaluation of your customers' buying patterns looking into the profit generated per individual customer whereas activity based costing is associated with product profitability. Using your customer data, you can apply measurements to key metrics that drive profitability such as the annual revenue a customer generates, plus customer acquisition costs, customer retention costs and service costs as well as strategic factors like loyalty. Measuring customer profitability enables you to create a more sustainable and profitable business.

Behaviors at touchpoints that affect profitability

The Phocas sales analytics tool helps manufacturers, distributors and retailers pinpoint specific elements in common that affect profitability such as sales volume and cost-to-serve. Phocas has developed a means to weigh these variables so companies can fashion a customer profitability formula to help rank customers and determine profitable customer segments.

A high cost-to-serve can wipe out the gross margin if the customer drives your services through the roof, easily tipping the balance from profit to loss. Here are the different elements of cost to serve at various touchpoints.

- Order sizes and frequency of orders: This metric impacts your inventory and handling costs. Frequent small orders incur higher sales administration costs than less frequent and larger orders. Order behavior that varies greatly also impacts your ability to accurately forecast your inventory needs.

- Accounts receivable: we all like customers to pay within the set-terms. Phocas enables you to analyze your AR and monitor in-depth your potential trouble area and pinpoint ageing receivables. The cost to extend credit to a customer is determined by your own capital sources. A customer’s payment history is key to extending credit and payment history.

- The rate of returns and exchanges: Customers who frequently return or exchange items cost more due to additional handling and restocking expenses increasing your operational costs.

- Sales administration: This is the cost of sales and service calls. Customers who require multiple sales visits or place multiple orders cost more than customers who place orders in one batch.

- Shipping or delivery: Customers who place multiple orders or require same-day delivery increase your delivery costs. If you run an ecommerce arm, review your package-return figures and analyze which customers are raising your customer service costs.

- Customer loyalty: Loyalty is important because the cost of replacing customers is expensive. Loyalty is subjective and more difficult to measure but customer lifetime value (CLV) is often a useful measure. Other objective indicators of loyalty can also be considered, such as the number of years in the relationship and the willingness to recommend your products and services to other businesses.

Categorize customers based on purchasing decisions

Types of customers can be categorized into four groups based on their purchasing behaviors: Core, Opportunistic, Marginal, and Service Drain. This classification enables you to better understand your customers and serve their needs.

- Core customers: Core customers purchase at a higher volume on a regular basis. Their hallmarks are a sustained relationship, low cost-to-serve, and buying a full range of high and low-profit products. They are high-value customers.

- Opportunistic customers: These customers are also a profitable customer group. However, they buy infrequently when their regular supplier runs out of stock. They can be classified as high margin, low volume, low cost to serve.

- Service-drain customers: These customers are high volume customers but require consistently high levels of service while demanding low prices. They typically have a sustained relationship but have low profitability due to their high cost-to-serve. In some cases, they may have a negative adjusted gross margin.

- Marginal customers: The hallmark of the marginal customer is an abnormal risk of non-payment. They typically purchase infrequently and at a low volume. They tend to require higher levels of service or low prices. These are high risk, low profitability customers.

How to measure customer profitability with SaaS

The practical measures embedded in sales analytics software help map customers according to these categories and touchpoints and also find new sales opportunities with existing customers. A comparison between profitability and sales value can help you understand your customer base better, helping you track the actual margins you're making and identify customers who may be less profitable than they first appear.

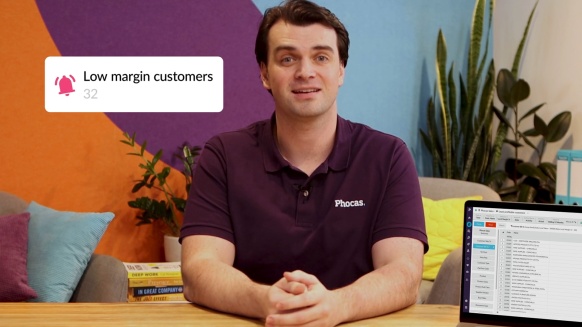

You can review total revenue value and gross margin of all of your customers for rolling twelve month period. Drill into customer who spend a certain amount but have a margin of less than x percent. Finding the combination of high revenue and low margin means the average cost of doing business with these customers is expensive.

It is also wise to set up an alert for yourself if the number of customers goes over the set threshold to minimize any knock on effects to your bottom line.

Strategies to maximize customer profitability

Now that you've categorized all your customers, developing a strategy for increasing profitability into the future is the next step. The ability to implement effective marketing strategies, evaluate the results over time, and adjust as needed, will empower you to shape customer behavior and move them from one category to another. CPA also empowers you to better prioritize your retention strategies.

- Core Customers: Do whatever you can to keep your most profitable customers happy. It’s essential you provide the extra service that separates you from your competition.

- Opportunistic customer: These high-margin customers usually place an order when your competitor is out of stock or is priced too high, your sales team should use BI to determine cross selling and up-selling opportunities or offer upgrades to convert them into loyal core customers.

- Service-drain customers: You can improve the profitability of high-volume, service-drain customers by increasing prices for specific customers, and thus your gross margin.

- Marginal customers: Low-volume marginal customers with a negative profit margin should be eliminated to improve your overall profit margin. Instead, use those resources to nurture your relationships with customers who have the potential to become core, valuable customers.

Because customer profitability analysis provides a clear picture of your group of customers, you can eliminate those that are high maintenance so your sales team can focus on customers who value and will pay for your company’s products or services. As your operations department is free from the demands of a service-drain customer, they are also available to service customers with reasonable needs. With in-depth customer profitability knowledge, business people are better equipped to make strategic decisions. Allocation of resources is also more efficient, helping to promote long-term customer relationships and customer loyalty within the core (high-profit) customer base.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

Using data to plan for the impact of tariffs and further change

Tariffs are coming. Whether you're in manufacturing, distribution or retail, it's important to understand how importing from Canada, Mexico and China or making locally, can affect your business and bottom line. We want to encourage you to analyze your data before tariffs go into effect, so you plan for the changes immediately not retrospectively.

Read more

The best financial KPIs for the distribution industry

Finance professionals in distribution businesses face a persistent challenge. That is to effectively blend operational and financial data to gain a complete picture of company performance. Traditional financial ratios often exist in isolation, making it difficult to assess the broader impact of operational decisions on financial outcomes.

Read more

Key sales KPIs for distribution companies

Managing sales in a distribution business without measuring key performance indicators (KPIs) is like maintaining your home without tools or a schedule. You don’t notice a leak until the damage is severe. Instead of making progress, you waste time searching for the right tools or calling an expert for simple fixes. Without the right KPIs, inefficiencies can go unnoticed, leading to cashflow issues and lost sales.

Read more

Essential KPIs every distribution company executive should measure

For mid-market leaders running a wholesale distribution business, data and business intelligence technology are crucial for monitoring financial and operational performance. However, the real value lies in how your team uses the data insights to influence decision-making.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today