What is financial forecasting?

Financial forecasting involves analyzing past performance and financial data to anticipate future outcomes. It’s an essential tool for all businesses to evaluate their financial position, plan for different scenarios, and prepare for worst-case scenarios. Financial forecasts typically include pro forma financial statements, such as the balance sheet, income statement, and cash flow statement.

Budgeting and financial modelling

While financial forecasting projects future outcomes, budgeting focuses on setting financial targets for a specific time frame, like a fiscal year. Financial modeling complements this by creating mathematical representations of a company’s financial performance, integrating variables like cost of goods sold, growth rate, and liabilities.

Financial statements and planning

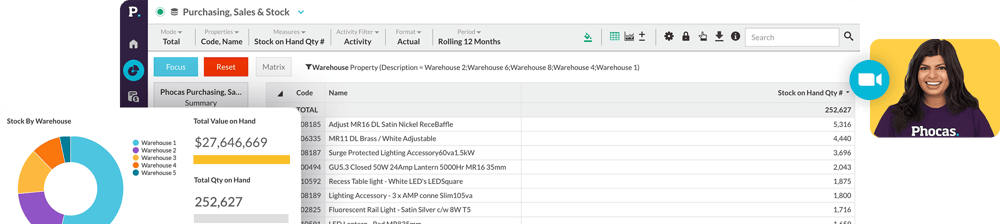

Accurate forecasting relies on a deep understanding of financial statements. The balance sheet provides a snapshot of a company’s financial position, while the cash flow statement highlights liquidity and cash movements. The income statement reveals revenue, expenses, and net income, forming the basis for financial planning and decision-making. Together, these documents offer stakeholders valuable insights for assessing business performance. Bespoke software like Phocas Financial Statements allows finance teams to automate these statements for many divisions of a business so all team leaders can understand their contribution to the overall plan and potential areas to improve in the company’s future.

Financial forecasting methods and models

Forecasting employs various methods to cater to specific needs:

- Moving Average: Smoothens data over time to identify trends, often used in sales forecasting.

- Straight Line: Projects consistent growth or decline based on a fixed rate, ideal for stable markets.

- Linear Regression: Uses independent variables to predict a dependent variable, like future revenue, based on historical patterns.

- Delphi Method: Relies on expert opinions to generate qualitative forecasting for scenarios lacking sufficient data.

These methods can be used individually or combined to create robust financial forecasting models.

The forecasting process

The process involves gathering historical data, selecting forecasting models, and creating financial projections. Templates and forecasting software, such as Phocas BI and FPA’s real-time platform streamlines the process, ensuring accurate forecasting for stakeholders. Incorporating qualitative and quantitative forecasting ensures a balanced approach, addressing both measurable metrics and expert insights.

Cash flow forecasting and beyond

Cash flow forecasting is vital for short-term planning and maintaining liquidity. By predicting inflows and outflows, businesses can manage liabilities and benchmark their financial performance against actual results. New businesses particularly benefit from this practice, as it aids in navigating financial uncertainties during the early stages.

Benefits of financial forecasting

- Informed Financial Decisions: Guides companies in choosing investments and managing expenditures.

- Improved Business Decisions: Facilitates strategic planning based on financial data.

- Enhanced Stakeholder Confidence: Demonstrates preparedness with pro forma statements and accurate forecasting.

- Adaptability to Scenarios: Helps businesses prepare for different outcomes, from growth opportunities to downturns.

Financial forecasting is indispensable for businesses aiming to thrive in dynamic markets. Whether through traditional methods like moving averages advanced forecasting software like Phocas BI and FP&A, accurate forecasting empowers business people to drive better financial outcomes.

Understand the past, operate better today, and plan well for the future