What is finance data management?

Finance data management is the practice of collecting, organizing and maintaining financial data within an organization to ensure accuracy, accessibility and compliance with regulatory standards. This process involves data capture, entry, storage and security, along with data governance to establish rules and standards for how financial data is collected, stored and used. Finance data management is critical for maintaining the integrity of financial information; enabling timely and accurate financial reporting and supporting effective decision-making.

Core components of financial data management

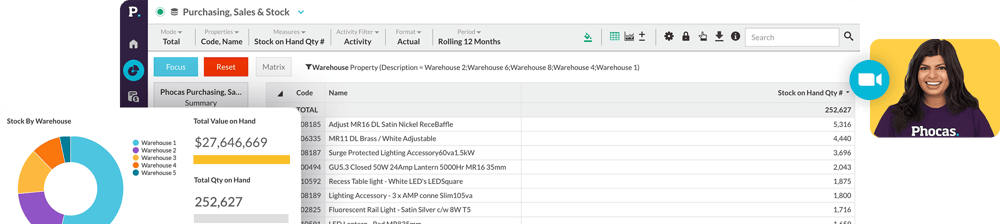

Data integration and security Financial data management relies on data integration to consolidate multiple data sources, including ERP systems, CRMs, and external sell through data and internal spreadsheets. Strong data governance and security ensures compliance and prevents data silos that hinder collaboration.

Automation and artificial intelligence Modern data management systems like Phocas use automation, machine learning, and artificial intelligence to optimize workflows, perform validation, and analyze data sets at scale.

Data models and algorithms Robust data models and advanced algorithms built into the data analytics enable financial services to handle complex datasets, ensuring a single source of truth. This minimizes errors, enhances data analysis, and supports business decisions.

Dashboards and metrics Interactive dashboards and high-quality metrics provide real-time visibility into performance indicators like profitability. These tools enable CFOs and other stakeholders to monitor sales and cashflow and make timely, informed decisions.

Benefits of financial data management

Streamlined workflows and better connectivity Efficient BI and FPA systems eliminate manual data manipulation by automating processes and ensuring seamless API-driven connectivity from the data sources like an ERP into the BI and FPA platform. This fosters collaboration and reduces manual errors.

Improved risk management Access to accurate and validated financial data enhances risk management, ensuring organizations can mitigate operational risks.

Enhanced forecasting and decision-making Using tools that have both BI and FP&A functionality helps finance teams to close month-end faster then carry out timely and accurate forecasting.

ESG and regulatory initiatives With growing emphasis on ESG and regulatory compliance, effective financial data management ensures transparency and alignment with reporting standards.

Use cases in manufacturing, distribution and retail

- Consolidating data into a centralized data warehouse for accurate reporting across many divisions, branches or stores.

- Implementing permission measures to protect sensitive information so finance can collaborate with business partners across plannning

- Enhancing customer experience through personalized insights and services.

Understand the past, operate better today, and plan well for the future