Companywide financial planning and analysis

Bring all your data and people together for connected planning

Get your copyOne of the many hassles of building static budgets is consolidating the data each year.

With a business planning and analytics platform, Finance is rewarded for the time spent building a budget model in year 1 which enables easy roll forward and continual monthly reforecasting. When the budget period ends, the coming 12 months of data is already there.

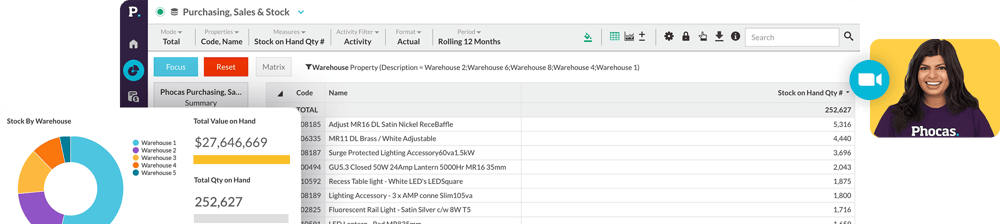

Your data, financial goals, budgets and forecasts are integrated across the organization so everyone can collaborate from the one detailed model. Budgets are also linked to financial reports to monitor results and make timely monthly adjustments after the books are closed - preventing any surprises to the bottom-line.

Grab a copy of our latest how-to guide to live budgets and forecasts and learn:

- what connected business planning is and why it's important

- common challenges of traditional planning processes

- the budgeting methods Phocas supports and how they can be used to build hybrid models

- 5 steps to financial planning success using a business planning and analytics platform with a focus on data integration, ongoing measurement, reforecasting, headcount planning and 3-way forecasting which links the 3 financial statements: balance sheet, profit and loss statement (income statement) and cashflow statement for cashflow projection

Unlock your free eBook

Understand the past, operate better today, and plan well for the future