Zeder Corporation confidently scales financial reporting with NetSuite and Phocas

Zeder Corporation manufactures and distributes suspension components for the automotive industry through retail stores and online operations and runs a NetSuite ERP.

Having used Phocas Analytics and CRM for years, Zeder’s finance and FP&A team turned to Phocas Financial Statements and Budgets and Forecasts when they needed to scale custom financial reporting and modelling across many divisions.

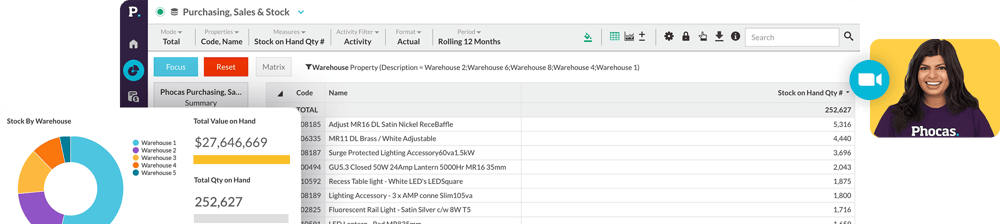

By using the one Phocas platform for BI and FP&A, the finance team can seamlessly consolidate NetSuite data and other sources, automate detailed financial reporting and carry out in-depth financial modelling. This covers everything from financial performance to operational product insights.

Dean Nicolaides, Senior Management Accountant at Zeder, works hands-on with NetSuite and Phocas. He values the ability to extract data directly from NetSuite and the data structure that Phocas has helped them set-up, calling it the backbone of the company’s financial performance system.

"We now have the granularity of reporting to pinpoint the root causes of variances and performance issues. When we spot a trend, we action it immediately. There’s a huge ROI on that,” says Dean.

Phocas integrates with NetSuite to provide self-service reporting and usability

Zeder’s finance team was under pressure to produce more reports, but NetSuite’s native reporting could not deliver the level of detail required. Dean who leads much of the FP&A work, knew they needed a solution that works well with NetSuite and would enable them to automate and be easy for others to use.

“Non-technical people don’t have the time to dig into NetSuite and learn all its nuances. They don’t want to deal with saved searches or SQL coding.”

Dean knows NetSuite well but to explain to someone else in the business how to find a saved search is difficult.

“Phocas moved us away from the reliance on a few power users. Now, instead of relying on finance, people can go into Phocas themselves and find the results they need quickly because the user interface is intuitive.”

Custom management reporting is automatic

One of Dean's responsibilities is to analyze extensive product and customer sales data and present it in a clear and comprehensible way.

“I used to spend hours in Excel making sense of it all then when I’d attempt to repeat it the next month often the spreadsheet might break,” says Dean.

Dean now provides the executive team with performance results across all customer categories. Phocas allows him to build a dashboard and automate reporting for every Monday. He’s grouped the customers and products into relevant categories and set up KPIs of interest such as volumes and pricing trends, so they are all visible in one place and people can dive into the results and view from multiple perspectives.

A reliable data structure promotes trust

Phocas makes a business consider its data structure before the software is set-up.

“When you go through the implementation process with the Phocas team, they give you good data habits and make you think about both the data inputs and outputs you need,” says Dean.

“The analysis we do now is incredibly comprehensive, allowing us to understand the root causes of variances and performance issues accurately. With this level of information, we determine why sales in a location have moved, enabling us to take action. Phocas helps us to make decisions quickly and confidently,” says Dean.

Dean also says Phocas has given the finance team confidence in the data. When pulling figures out of ERP system the parameters and settings you're using are crucial.

“If the data is not right, then it changes the results of what you’re reporting. So for example, if you want to review the profitability of a customer and include freight, rebates and discounts it's actually quite involved. Whereas in Phocas, we've set the parameters and every database has built-in checks and balances. Phocas is very clean and we know exactly what data we're getting.

“So there's also an important data validation pay off with Phocas. Being confident in the data means everything to the finance team. I think a lot of finance teams in the FP&A space, they’re constantly thinking how many working days to close month end? How long does it take us to get this reporting to the executive team? Speed matters but the numbers must be accurate,” says Dean.

ZEDER Corporation is the merged entity of Fulcrum Suspensions & Redranger.

Together Fulcrum & Redranger bring together decades of local and global leadership in the Automotive Aftermarket. Combined ZEDER is the world’s largest and leading manufacturer of automotive polyurethane bushings and related accessories with operations in Australia, US, UK and Vietnam.

Find out how our platform gives you the visibility you need to get more done.

Get your demo todayUnderstand the past, operate better today, and plan well for the future