Simplify financial scenario planning

Most successful business leaders have an eye on the future and, to do so, use some form of strategic planning. One successful technique is Scenario Planning, a method that helps finance and other team members review multiple scenarios to determine how internal shifts and changing market conditions may impact the bottom line. Scenario planning is a critical aspect of the budgeting and forecasting process.

However, many finance teams struggle with the time-consuming nature of scenario planning, which means they don’t do it enough, limiting their ability to plan well or respond to change. But in recent times, with the onset of external factors like erratic weather events due to climate change, economic instability, discerning customers, and volatile supply chains, the need for easier scenario planning, which can involve the whole team and include several data sources, is an idea whose time has come.

The challenges of traditional scenario planning

In a recent poll conducted by FP&A Trends, 59% of webinar attendees cited that they could run scenarios "but it was time-consuming," and 31% said they were unable to run scenarios as part of their financial planning.

To understand why it is time-consuming, it is usually about the complexity of the data people want to include in the assumptions. Often it is challenging to extract and collate all the data finance teams need to create a meaningful scenario. If they want to predict demand for different products, they need sales, finance, and operational data to set the assumptions. When the full data set is not available, finance teams often create “a partial scenario” based, for example, on just sales data, which leads to inaccuracy in decision-making.

However, the key reason scenario planning is not always effective is because most finance teams create the budget and scenarios at the same time - once a year. As the process can be arduous, many businesses do the financial modelling, then set and forget. However, many of the assumptions about a business and market conditions don’t hold, and unexpected events can significantly affect cash flow and financial performance.

Like scenario planning, some finance teams find it time-consuming to accurately forecast and revisit their budget throughout the year, so herein lies the need to address all areas together. When finance teams can review budget, actual, and forecast data regularly, then they can identify early warning signs of challenges to the business and from scenario analysis can determine what plays out in real-time.

The solution to simplifying scenario planning

The new wave of scenario planning is to continue to combine the process with budgeting and forecasting but carry out the task using software that has built-in lookup capabilities and data integration to help determine possible future states or what-ifs from the base case.

Scenario planning involves creating multiple versions of the budget based on different assumptions such as interest rate increases, changes in consumer behavior, or supply chain disruptions. Therefore, you want to make this fiddly work as straightforward as possible without losing any nuance from your historical data.

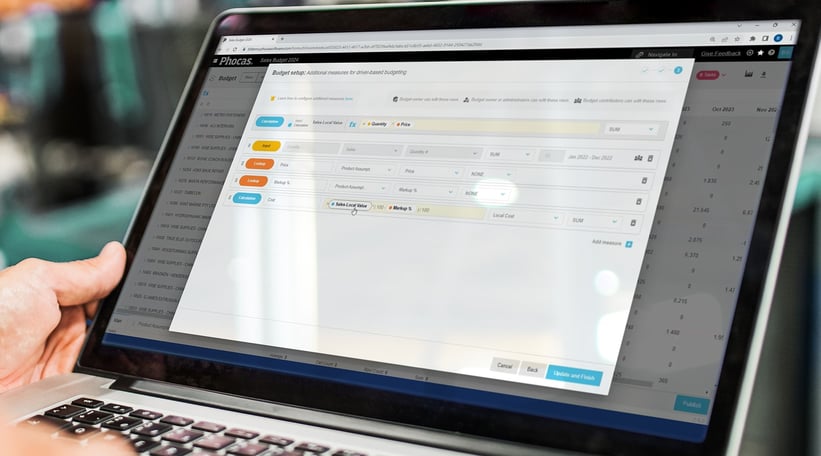

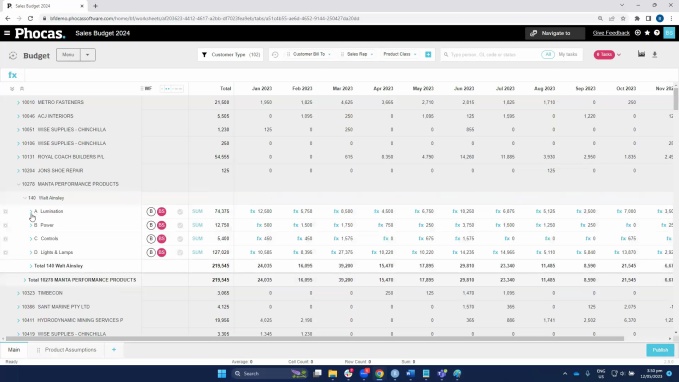

CFOs and Finance teams who use the Phocas Budgeting and Forecasting tool are building assumptions in a quarter of the time because they have access to the lookup feature, which is simplifying the process.

Rhys Miller from Key Refrigeration Supply says, "I use the new lookup feature to enter all of budgeted sales increases for the year ahead. The best thing about the new feature is that in the past I would have to arduously enter the new percentages on every single line, whereas now with Lookup I can enter them in a flash."

The lookup feature is simple and easy to use with formula-driven logic. This technique saves people time, especially when combined with the copy-down functionality.

The Lookup tab provides a place where you can record information, so it is available for quick reference purposes or to use in formulas in other tabs of templates. The Lookup tab has a structure to it and is mapped to different scenarios, so it contains rows based on that hierarchy, which is useful when you want to build potential outcomes as formulas are pre-defined.

For example, if a company's budget assumes that its customer growth will increase by 8% over the next year the lookup function can automatically set that as a default across all customers. If some customers differ from this, then you can manually change growth to 10% for one and -5% for another and all formulas update automatically in the budget information. When this is so easy to do, the finance and sales teams can then adjust the budget if demand does not meet original expectations and recreate new future scenarios to make informed decisions.

Scenario planning with companywide data

The ability to integrate financial and non-financial data (ERP data, external data, and other data sources) into scenario planning is a key benefit of budgeting and forecasting solution built on an analytics platform.

Budgeting and forecasting and scenario planning can and should run across a business. Our customers manage the scenario planning to suit their business once they have access to a full data set. Many let finance leaders govern the strategic planning but encourage different parts of the business to provide input into the types of scenarios whereas others build budgets and carry-out scenario planning and measure metrics for each division of the business. The model provides flexibility but clearly shows best-case and alternative scenarios helping people make better decisions and see the impact of key drivers on critical areas such as pricing.

Incorporating scenario planning into the budgeting and forecasting process can help organizations to be more agile and have contingency plans ready when change happens.

With a fast and easy to use a tool like Phocas Budgeting and Forecasting, scenario planning is simplified and saves a ton of time. Everyone in the business can test several assumptions and see how they influence outcomes as well as weigh up different options before making any decisions. Business is fraught with critical uncertainties so planning tools that can simplify risk management and aid strategic thinking go a long way in building a viable business.

“In the past, our VP of finance or planner would build scenarios using Excel spreadsheets,” said Paul Rotstein, President Gold Medal International. “

It might take a couple of hours to build one, and then if we wanted to change variables or criteria, we would spend another couple of hours building another spreadsheet. It was a tedious and time-consuming process. Now, with a couple of clicks in Phocas, we can run a variety of different scenarios to help us make decisions.”

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

Related blog posts

If the owner of your business wants to expand to a new State, would you have the sales forecasting figures to know whether the business can afford to do that or not? Or, if you had to produce a 3–year solvency projection for the CEO, is your sales forecasting process robust enough to support a reliable analysis?

Read more

Agility is everything in manufacturing, distribution and retail businesses. Finance teams are under constant pressure to deliver accurate forecasts, accelerate the planning cycle and to have actuals at hand so everyone knows how they’re tracking. For businesses running NetSuite ERP, this means their budgeting and forecasting tools must be up to the task.

Read more

Inventory management is a tight-rope balancing act. Ordering too much leaves you with excess stock tying up capital and warehouse space. Ordering too little puts you at risk of running out of stock, leading to stockouts, missed sales, and frustrated customers. Bad inventory forecasting means storage fees, excess inventory, waste from unsold goods, and operational inefficiencies that eat into profits.

Read more

The role of the CFO is evolving rapidly, extending beyond traditional financial stewardship to encompass business partnering, operational oversight and technological innovation. A 2024 Sage study of over 1,200 global finance leaders reinforces this transformation:

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today