Sales analytics & forecasting

Drive growth with data analytics and sales forecasting

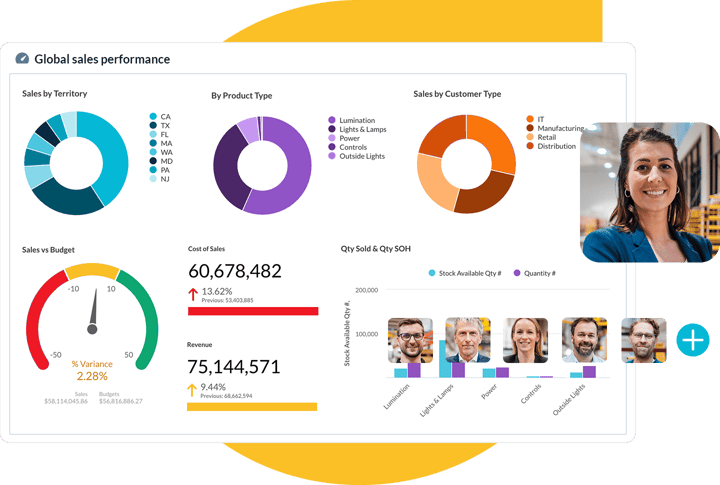

Empower your team with intuitive tools to analyze sales performance, identify trends, and forecast with confidence. With Phocas, actionable insights are at your fingertips, helping you drive revenue growth and improve sales strategies.

Sell smarter, faster

- Salespeople live and breathe numbers; empower them with faster, easier access to up-to-date sales data

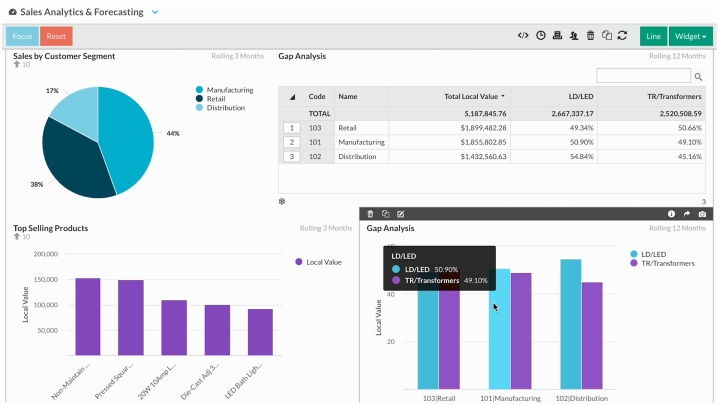

- Identify key focus areas, uncover sales trends, gap analysis and adjust your sales strategy accordingly

- Transform numbers into actionable insights with sales dashboards, charts and graphs, helping team members achieve targets and improve overall sales performance.

Drive growth

- Speed up sales cycles by quickly identifying top-selling products for new and existing customers

- Drill into customer detail to identify which sales reps, regions, products are contributing to conversion rates

- Make it easy to track sales rep performance so you're always up to speed and know where to troubleshoot underperformance.

"Our sales and marketing teams use Phocas to nail opportunities. Last month we identified the healthcare sector was producing some outstanding results. So, we were able to divert some of our sales effort away from low performing sectors into those that appeared to be more lucrative. That was really good."

— Howard Barr, General Manager at Woodberry.

Sage + Phocas customer

Analytics in action: Take a video tour

See Analytics put to work through a series of short videos. Highlighting common pain points and the specific solutions Phocas delivers.

-

Quick and easy access to dataLearn how you can get quick and easy access to the information you need to make data-driven decisions with trusted data that’s pulled fresh from your ERP.

Quick and easy access to dataLearn how you can get quick and easy access to the information you need to make data-driven decisions with trusted data that’s pulled fresh from your ERP. -

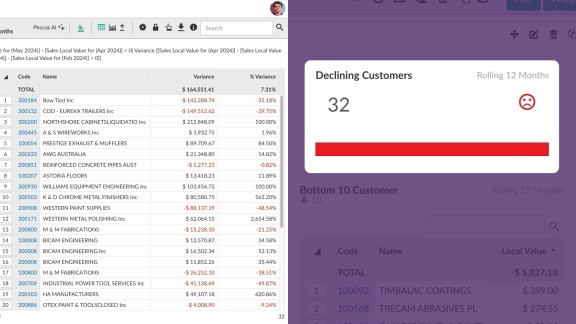

Self-serve reports and alertsBreak-free of the cycle of back-and-forth report requests and revisions with IT. Take a look at how easy it is to set up reports and alerts in Phocas.

Self-serve reports and alertsBreak-free of the cycle of back-and-forth report requests and revisions with IT. Take a look at how easy it is to set up reports and alerts in Phocas. -

Drill down and follow your train of thoughtLearn how Phocas lets you drill into your data to get super-fast answers and understand what is happening and why.

Drill down and follow your train of thoughtLearn how Phocas lets you drill into your data to get super-fast answers and understand what is happening and why. -

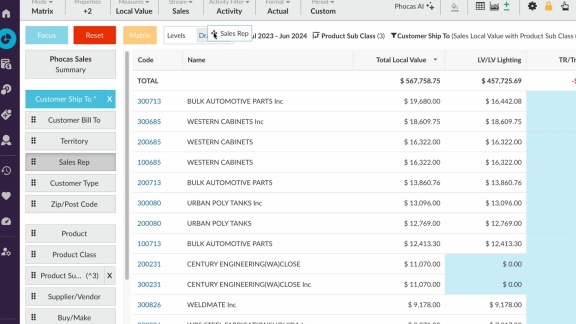

Identify opportunities to grow salesSee how Phocas can grow sales by helping your reps quickly identify easy wins, such as cross-sell opportunities in a few clicks.

Identify opportunities to grow salesSee how Phocas can grow sales by helping your reps quickly identify easy wins, such as cross-sell opportunities in a few clicks. -

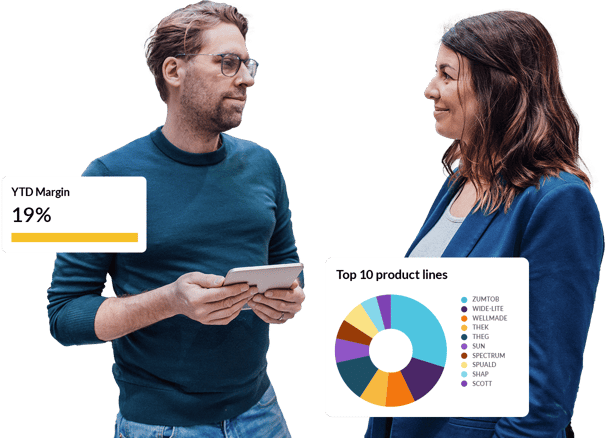

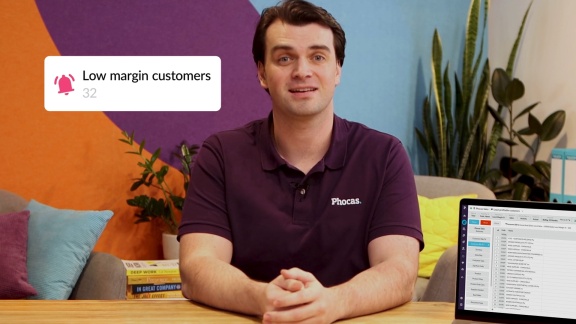

Track profitability of salesWith Phocas you can easily track the actual margins you’re making and identify customers who may be less profitable than they first appear.

Track profitability of salesWith Phocas you can easily track the actual margins you’re making and identify customers who may be less profitable than they first appear. -

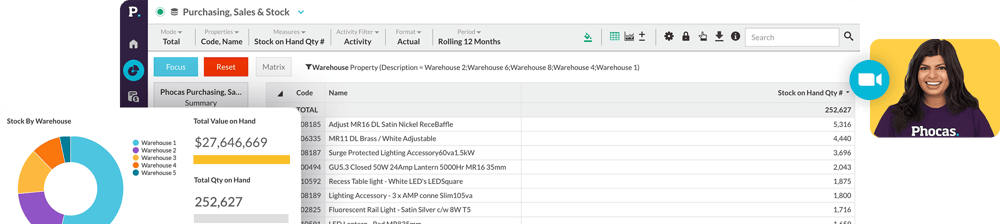

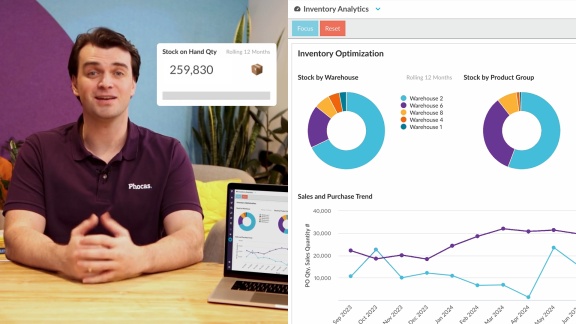

Optimize stockForget managing stock using your ERP or spreadsheets – see how Phocas makes it super easy to stay on top of your inventory.

Optimize stockForget managing stock using your ERP or spreadsheets – see how Phocas makes it super easy to stay on top of your inventory. -

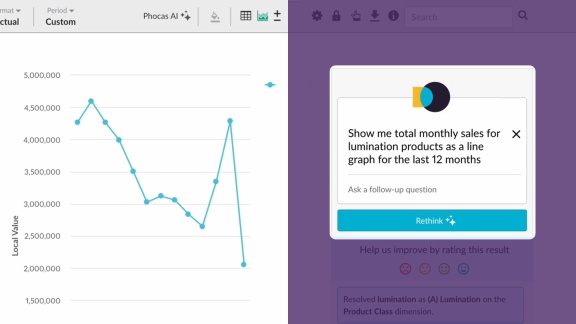

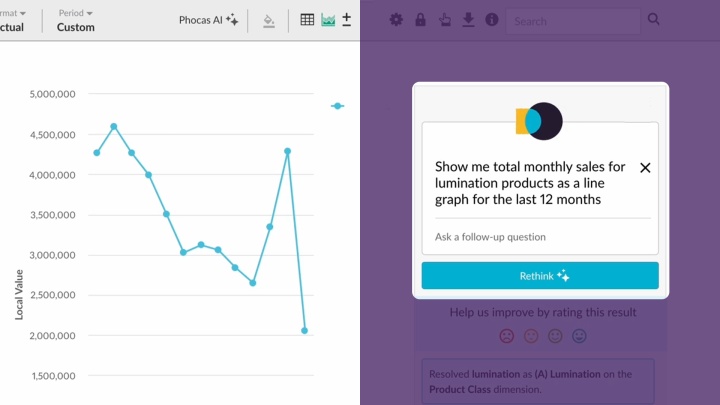

Phocas AIDiscover how Phocas AI helps you uncover insights quickly helping you drive impact across your business.

Phocas AIDiscover how Phocas AI helps you uncover insights quickly helping you drive impact across your business.

Stay on track

- Tap into historical data, seasonal data, current trends and actual sales performance to create more accurate sales forecasts

- Drive sales forecasts into financial budgets and inventory plans

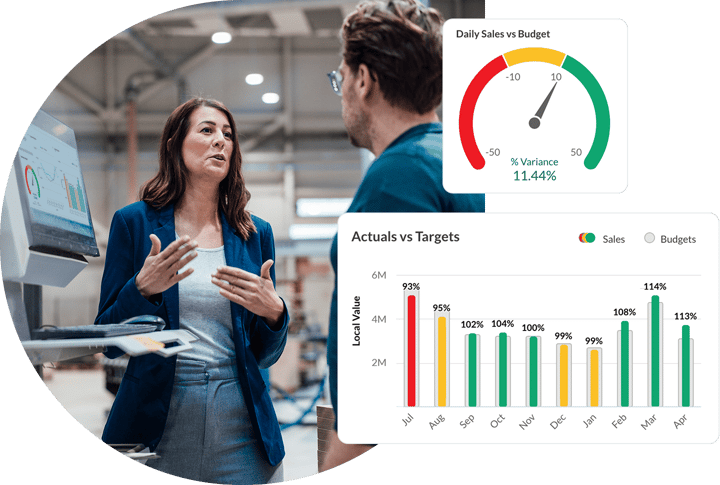

- Easy access to real-time data allows you to monitor sales performance against budget on a daily basis, enabling fast decision-making in response to changing market conditions

- Regular access to live actuals empowers sales teams to be agile in adjusting sales strategies to drive growth.

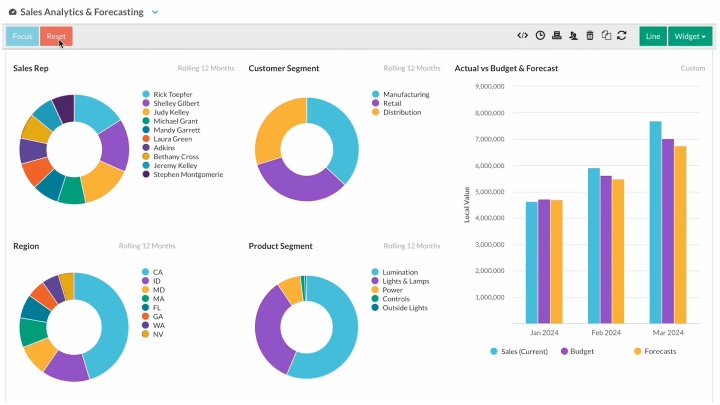

Customizable sales forecasts

- Forecast sales any way you like - by sales rep, region, product, customer segment

- Tailor sales forecasts to specific business needs and analyze performance from different perspectives

- Spot areas for improvement

- Drill into underlying sales data for a granular view of sales projections, or view overall sale performance.

Everyday tracking is so simple

The team at Bowens use Phocas every day. Why, because it's so simple to use and they're no longer relying on 'gut feel'. Everyone can quickly access up-to-date sales data, break it down and identify opportunities and areas for improvement.

Get a demo

Hear from Luke

Make sales analysis easy

- Empower your reps with easy-to-use data tools, customized scorecards and all-in-one dashboards to enhance customer conversations

- Ask Phocas AI to query your data using natural language prompts for instant results

- Human-friendly analytics empowers sales teams to prioritize product and market focus based on real-time sales data

- Leverage visual dashboards to make strategic moves, update sales priorities and figure out what is and isn't working.

"Our directors, managers, and sales team, use Phocas on a daily basis. Our sales representatives use Phocas when visiting customers. It has reached deeply into our sales process in a short space of time. It really strengthens the truth of our customer conversations, removing all of the anecdotal stuff. Phocas is self-service, intuitive, easy, quick, and does what it says on the tin.”

— Ian Brady, Systems Manager at Serfac.

Kerridge Commercial Systems + Phocas customer

Boost sales and forecast your growth with one platform

Track sales activity and success like never before

Provide critical sales data across your organization and help your executives, operations, marketing and management teams get a clear understanding of sales performance with insightful reporting tools. Streamline the process with personalized scorecards and report automation, making it easy to manage, reward and troubleshoot.

Get a demo

Featured eBook

Reach sales targets and boost your team's productivity

Improve your sales process with a data platform.

Download nowFrequently asked questions

Sales analytics is the practice of collecting, processing, and analyzing sales data to gain insights into sales performance. It involves tracking key performance indicators (KPIs) such as revenue, sales conversions, customer acquisition costs, and other metrics that can inform strategic decisions and drive sales growth. By understanding trends, patterns, and outcomes, businesses can optimize their sales processes, forecast future sales, and identify opportunities for improvement.

Sales forecasting is the process of predicting future sales performance based on the analysis of historical and current sales data to identify market patterns and trends, customer behaviour. Anticipated events and other considerations that might affect the sales forecast are factored into the analysis. This data is then used to make informed decisions about future sales volumes, revenue and other key metrics. This predictive analysis allows sales managers to improve sales forecasting accuracy. This in turn enables businesses to anticipate demand, allocate resources effectively, identify areas for improvement and make strategic decisions to drive growth.

Sales analysis and forecasting software is a specialized tool designed to help businesses automate the process of collecting, analyzing and interpreting sales data so businesses can make informed decisions and predict future sales performance.

Key features of sales analysis and forecasting software include:

- Data consolidation: The software collects and consolidates sales data from various sources, such as ERPs, CRMs, HR, Finance and other databases. This is centralized into one platform that is easy for everyone to access and analyze - not just IT and finance teams.

- Data visualization: It provides customizable dashboards, charts, and graphs to visualize sales data in an easy-to-understand format, allowing users to identify trends, patterns, and outliers at a glance.

- Forecasting capabilities: The software uses statistical models and algorithms to forecast future sales performance based on historical data, market trends, and other relevant factors. This allows businesses to anticipate demand, set realistic targets, and allocate resources effectively.

- Customization: Sales analysis and forecasting software empowers all users to create and customize reports and dashboards. Enabling businesses to tailor the software to their specific needs and objectives. This may include the ability to customize sales forecasts by sales rep, region, product, customer segment, and other criteria.

- Real-time access: Many software solutions provide real-time access to sales data, allowing businesses to monitor performance against forecasts on a daily basis and make agile decisions in response to changing market conditions.

The best way to analyze sales data is by using a systematic approach that combines historical data review, pattern recognition, and predictive analytics. Start by setting clear objectives, such as identifying top-performing products or understanding customer buying behavior. Then, use a robust analytics platform to aggregate and visualize data, allowing for easy interpretation and actionable insights. Regularly reviewing and adjusting your analysis based on real-time data will ensure that your sales strategies remain relevant and effective.

Like other specialities of business intelligence, there are several types of sales analytics, including:

- Descriptive Analytics: Looks at historical data to understand what has happened in the past.

- Diagnostic Analytics: Delves deeper into data to understand why certain outcomes occurred.

- Predictive Analytics: Uses statistical models and forecasts to predict future sales trends.

- Prescriptive Analytics: Suggests actions you can take to achieve desired outcomes based on data analysis.

Analytics is crucial in sales because it transforms raw data into valuable insights that can guide strategic decision-making. It helps sales teams understand customer preferences, market trends, and the effectiveness of sales tactics. With analytics, businesses can optimize their sales funnel, improve customer engagement, and ultimately increase revenue and profitability.

While Excel is a common tool for sales analysis, specialized sales analytics software like Phocas Analytics offers a more powerful and user-friendly alternative. Phocas provides real-time data integration, customizable dashboards, and deep-dive capabilities that Excel lacks. It's designed for ease of use, enabling sales teams to quickly find and act on the insights they need without getting bogged down in complex spreadsheets.

Yes, many CRM systems come with built-in analytics features that can track sales activities, customer interactions, and pipeline management. However, for more advanced analytics capabilities, integrating your CRM with a dedicated sales analytics platform like Phocas can provide a more comprehensive view of your sales data and richer insights.

Data analytics can help sales in numerous ways, including:

- Identifying high-value customers and market segments

- Optimizing pricing strategies

- Forecasting sales and setting realistic targets

- Enhancing sales team performance and workflows

- Improving customer relationship management

- Streamlining the sales process for efficiency and effectiveness

By leveraging data analytics, sales teams can make informed decisions that lead to better outcomes and a competitive edge in the marketplace.

Understand the past, operate better today, and plan well for the future

Whether you want to get your data organized for your team or you’re looking to combine business intelligence capabilities with financial reporting, planning and forecasting… We can help.

Get a demo