Profitability ratios: a great benchmarking tool

There is an array of options to understand your company’s performance, so you can make confident decisions and deliver better results. Ask any seasoned finance professional and they will always advise the most useful class of financial metrics are profitability ratios.

Why? Profitability ratios are a quick reference point for how well your company is doing. The metrics also measure the ongoing ability to generate net income, one of the fundamental requirements of staying in business.

What are profitability ratios?

Profitability ratios measure how much profit you are getting from your business relative to revenue, balance sheet assets and shareholder equity. The higher the profit, the more efficiently the business is using its resources to generate output, be it through selling auto parts or managing construction projects. Similarly, a high profitability ratio indicates whether your business is maximizing its resources to produce profits efficiently.

Why do profitability ratios matter?

Profitability ratios can be easily compared to past periods in company history, or between departments to foster friendly competition or share experiences. Often cross-departmental trends can provide great insight into how different areas are managed within your business.

Profitability ratios can be customized based on the data you’re looking for. Perhaps you want to know if your costs are increasing over time? Try the operating expenses Ratio or instead your organization is focused on growth and needs to raise capital? Then the Return on Equity (roe) is the best fit ratio.

Profitability ratios fall into two buckets:

- Margin ratios can show how well your organization turns sales into profit at different levels of your income statement. Key margin ratios are:

- Gross profit margin

- Operating profit margin

- Net profit margin

- Cash flow margin

- Return ratios provide insights into your company’s ability to generate returns for it’s shareholders. Common return ratios:

- Return on equity (ROE)

- Return on assets (ROA)

- Return on capital employed

What profitability ratios uncover about your company’s financial health

When you track profitability ratios, you can quickly and easily pinpoint areas of concern that need work. For example, if your net profit margin is declining over time, that could mean you’re taking fewer orders or losing customers.

If your operating expenses ratio increases over time, that may mean your organizational operating costs are growing relative to sales or revenue. This may, in turn, mean that your company will need to think about implementing cost control practices.

Why ratios trump raw numbers

Raw numbers can be useful, but they don’t tell the full story about your company’s performance, such as how well your company turns revenue into profits (gross profit margin) and how much your company is bringing in after all direct manufacturing-related costs are removed (net profit margin).

Ratio formulas effectively look at two numbers relative to one another and provide an objective, standardized method of measuring company performance. Ratios compare different entities in your business and can be used to see how you stack up against other companies in your industry. They provide a more complete picture of a company’s profitability since they allow you to explore relationships between different areas of the business such as total revenue versus operating income across branches.

How to use profitability ratios well

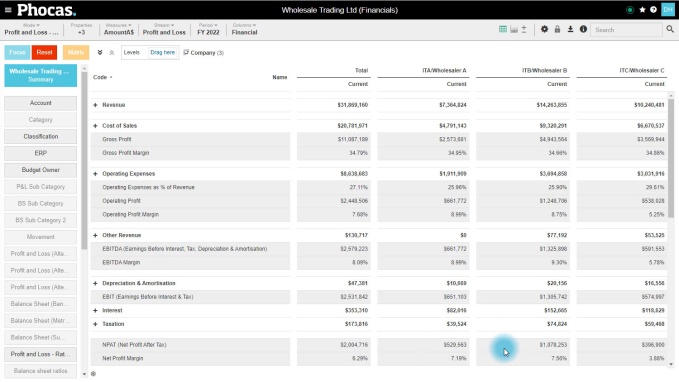

To carry out financial analysis and measure the types of profitability ratios that can provide critical insights for day-to-day decision-making you need accurate data that is preferably all in one place. Using a BI and FP&A platform like Phocas also allows you to add margin ratios or return ratios to your financial statements helping your stakeholders understand the company’s performance at a moment’s notice.

Reviewing your bottom line in Phocas BI and FP&A turns calculating ratios into a painless, automatic process. The solution pulls data from all of the company’s ERPs and consolidates them in one place. You can filter ratios by EBIT (earnings before interest and taxes) per period, profit margin ratio by region, operating margin for each company divisions, or obtain a measure of profitability per channel and drill down into each data point and look for more detailed ebitda margin.

When you use profitability ratios over time, you can begin to track trends and patterns, and quickly diagnose problems if the ratios suddenly and beofre it impacts business liquidity.

How do your profitability margins stack up?

Once you have a stable and accurate way to carry out ratio analysis it can be worthwhile to compare your company’s ratios to industry standards.

You can find ratio values for organizations in your local area by consulting your local Board of Trade, Chamber of Commerce, or industry association. Industry standards reports, typically accessible online, can also be valuable sources of information. Ensure that the ratios you compare are benchmarked against industry averages to account for differences in business models. Remember larger companies often have different cost structures compared to small business, affecting ratios like gross margin. Some industries are cyclical, so profitability ratios can vary based on where the company is in the economic cycle.

Examples of industry ratios include Risk Management Association’s Annual Statement Studies, Dun & Bradstreet’s Key Business Ratios, and Wolters Kluwers’ Almanac of Business and Industrial Financial Ratios.

Your comparisons of profitability ratios with industry can give you insights into your company’s financial performance. For example, it is useful to compare gross profit margin as it shows how efficiently your company is producing and selling its products after covering the cost of goods sold (COGS). Comparing gross margins helps assess how well your company controls production costs relative to competitors. A higher margin often indicates better cost efficiency or pricing strategies. It's a good measure of operational efficiency, allowing you to compare how well you manage daily operations.

Operating Profit Margin (EBIT Margin) looks at profitability after operating expenses (such as wages, rent, and utilities) but before interest expenses and taxes. It's a good measure of operational efficiency, allowing you to compare how well you manage daily operations. A net profit margin ratio helps understand how much profit is retained from total sales and non-operating income after taxes, depreciation and amortization.

It’s also worth comparing a return ratio such as return on assets (ROA) to know how efficiently total assets are being used to generate profit. It helps to understand how effectively companies in the industry utilize their asset base. A higher ROA indicates better asset efficiency. Another telling return ratio is Return on Equity (ROE) that measures how well a company generates profit from shareholders’ equity. It’s important to understand how a business owner uses invested capital to generate returns. Higher ROE signals more effective use of equity capital.

Read more about how Phocas’s BI and FPA can help a finance team measure and embed financial ratios in financial statements in our Automating Financial Processes ebook.

Chartered accountant and expert adviser on streamlining budgeting and reporting for the mid-market.

Related blog posts

If you’re nodding along to this headline, you’re probably interested in finding out how this process can be made reliable and repeatable. Many finance teams need spreadsheets, email trails and offline files to make critical adjustments before reports are ready for the business. It works until it doesn’t. As complexity grows, the gap between your ERP and the final ‘true’ management view widens.

Read more

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Intercompany journals are like transferring stock between two warehouses in the same distribution group. One warehouse records inventory going out at as an internal transfer price, and the other records it coming in. The group hasn’t gained or lost anything — it’s just tracking the internal movement.

Read more

Communicating financial statements effectively is one of the most important responsibilities for finance professionals. Whether you're advising the sales team or preparing updates for board members, you need to meet them where they are. Financial reporting is about ensuring your stakeholders can understand the company’s financial position, profitability and overall financial performance.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today