Sage financial forecasting software

Quick, obligation free

Watch Phocas turn Sage data into companywide budgets and forecasts

Real-time financial forecasts built for Sage

Phocas is a certified Sage budgeting and planning partner and with hundreds of existing Sage customers. Our software connects seamlessly with these Sage ERPs:

- Sage 50

- Sage 100 CRE

- Sage 100 Contractor

- Sage 200

- Sage 300 CRE

- Sage Intacct

- Sage X3

Sage business planning and financial insights

-

Easily customize templated financial models to bring in detail about people, products or margins

-

Built-in shortcuts to forecast sales volumes, plan for demand, model pricing and align supply chain

-

Embed workforce planning across the fiscal year to meet strategic goals of all teams

-

Scenario and what-if modelling is quickly updated by adjusting drivers and assumptions.

Customer quote

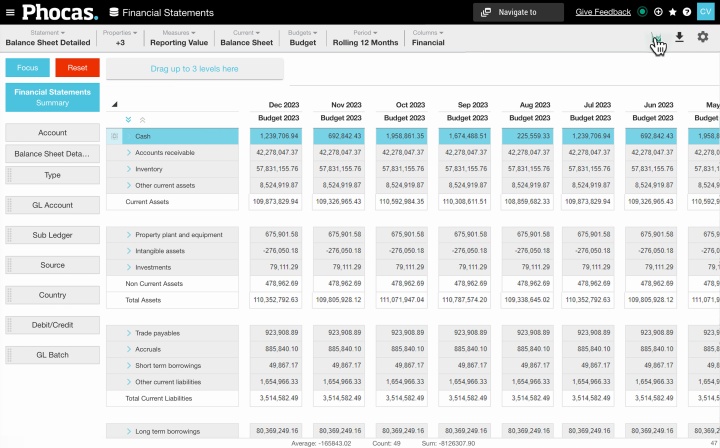

Sage cashflow forecasting keeps you in control

Use the budget model to create a three-way forecast with automatic sync from your Sage ERP for a realistic view of your cashflow

- Use your profit and loss to drive your balance sheet and cashflow forecasts

- Confidently forecast your future balance sheet position and financial health using mini-drivers for debtors, creditors and stock

- Gain full visibility of cashflow peaks and troughs throughout the year

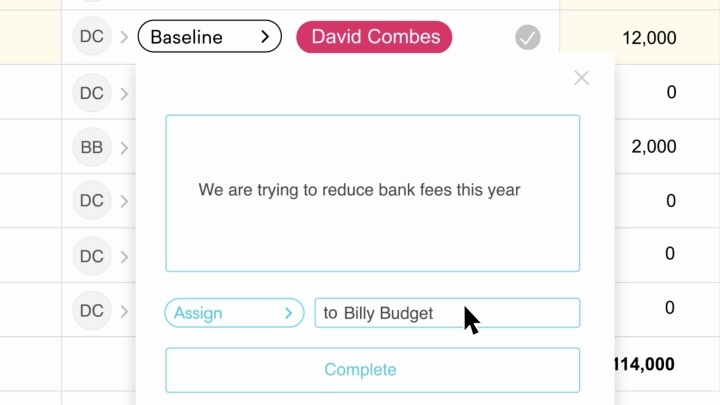

Collaborative financial management

-

Department and divisions are included by budgeting against different levels within a consolidated financial model

-

Track changes: finance and business partners can have clearer conversations with cell history tracking individual changes over time

-

Approvals: activate the assignment, submission and approval process when multiple stakeholders involved

-

Web-based workflows automatically save as a helpful guide for others to understand and step into the project.

Customer quote

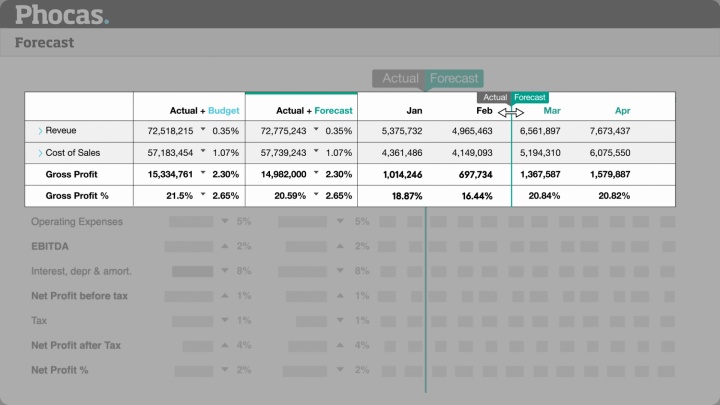

Track financial plans against targets and reforecast

Live actuals mean you can track progress, easily compare to planned performance and visualize results.

- Link budgets to financial reports and make timely adjustments after month-end

- Create rolling forecasts

- When connected to Phocas Financial Statements start a budget from your income (P&L) statement with just one click

- Bonus: After a budget model is built you have the next year's data all there for the next budget cycle

Phocas powers thousands of data-driven companies worldwide

Henry Schein

Henry Schein Bunzl Industrial Safety

Bunzl Industrial Safety Thermo Fisher Scientific Australia

Thermo Fisher Scientific Australia Husqvarna Construction Products

Husqvarna Construction Products Johnstone Supply

Johnstone Supply Stark Group

Stark Group Gazman

Gazman WD-40

WD-40 Hoyts

Hoyts- Monument Tools

- Becker Electric Supply

Steiner Electric

Steiner Electric Guest Supply Sysco

Guest Supply Sysco Seasol

Seasol Sistema

Sistema KYB

KYB Triton

Triton TJM Australia

TJM Australia Nassco

Nassco Baylis & Harding

Baylis & Harding Morelli Group

Morelli Group DMK

DMK Flournoy

Flournoy

Fast implementation, full support

See how Phocas stacks up against the competition

Anaplan vs Phocas

Vena vs Phocas

Board vs Phocas

Jedox vs Phocas

Insight software IDL vs Phocas

OneStream vs Phocas

Frequently asked questions

Yes, creating budgets is possible using Sage accounting software, either natively within the Sage ERP or using an additional product called Sage Budgeting and Forecasting.

Native budgeting in Sage can have limitations, depending on which Sage product you are using, which means it can be hard to create budgets and plans beyond the end of the current financial year. Also, comparing budgets to actuals can be tricky.

What you’re missing when building budgets within Sage’s ERPs is the ability to quickly create "what if" scenarios, compare budgets to actuals quickly and jump between budgets, cashflow forecasts and financial scenarios in one tool, something which Phocas makes easy.

Cashflow forecasts is an extension of the cashflow statement, a standard statement available in Sage accounting.

Adjustments to the predicted cashflow are made using individual entries of expenditures and income. While this is easy to get started with, it can be hard to test scenarios like “What if I increase pricing by 5% in the next financial year?” of “What happens if shipping costs increase by 12 percent in three months time?”

This is where a connected budgeting and forecasting tool like Phocas Budgets and Forecasts can really speed up the process of creating and updating forecasts.

Phocas offers a unique blend of BI and FP&A planning and reporting, filling some of the gaps that Sage ERP users find when planning, budgeting and forecasting. And we’ve been supporting companies using Sage for a long time, so we’ve likely solved the problems you’re experiencing before.

When integrated with Sage, Phocas enables companies to manage their operations more effectively in a various ways, such as:

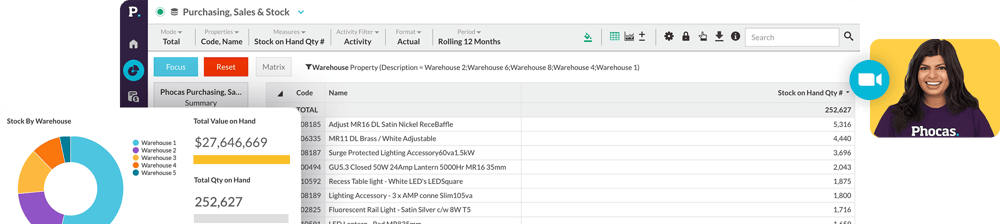

- Robust BI analytics - Phocas collects and consolidates huge amounts of data from multiple business sources, empowering Sage ERP users with fast, easy access to up-to-date data within one centralized platform.

- Self-serve reporting - Reports and dashboards are customizable to meet specific business needs and can be created by all users. Financial insights and graphs that may not be readily available in standard Sage ERP reporting tools can be extracted with ease. Design your own reports in minutes and give cross-functional teams a deeper understanding of business performance.

- In-depth analytics - a unique ad hoc analysis layer, The Grid, enables all users to perform in-depth analysis. Drill down to transactional level and pivot the data in multiple ways such as by customer, branch, product or region.

- High performance - By integrating your Sage ERP with Phocas, you'll achieve lightening fast loading times, regardless of the volume of transactional data stored. Phocas ingests and comprehends big data volumes.

- Companywide adoption - a user-friendly interface enables users across all departments to access and analyze their own data, not just IT experts or data analysts. Enhancing collaboration and speeding up important business decisions.

- All-in-one platform - Along with a BI Analytics foundation, Phocas offers comprehensive FP&A products that work together smoothly, including Financial Statements, Budgets and Forecasts, and Rebate management

Yes - Phocas specializes in combining business data, most often ERP and financial data, with other non financial data sources. Providing one trusted platform to measure, track and plan your ongoing business operations quickly and easily.

Phocas started as a BI solution, so we understand the ins and outs of data manipulation. Our customers loved the enhanced capabilities that Phocas brought to their ERP that they started asking for financial analysis and budgeting and forecasting capabilities too.

Our focus is creating software and tools that anyone in your organization can use to understand sales, operations and logistics, making sure that your team can plan and forecast based on a solid foundation of trustworthy data.

This is the process by which businesses regularly plan, review and control their finances.

The budget is a company's financial plan of intent for 12-months. This will incorporate data from finance, operations, sales, inventory and other company information to enable them to set goals and to monitor and manage their finances.

The forecast is a more detailed financial plan for a set amount of time, such as the last 6 or 3 months of the financial year.

Budget forecasting is when businesses regularly track actual performance numbers and compare them to the budget. Any insights or risks gleamed from this assessment can then be used to re-forecast the remainder of the budget period. This way, potential issues can be mitigated before they become a major risk, or swift action can be taken when responding to rapid economic or environmental change.

When you’re armed with this information in real-time, you have more control of your financial position throughout the year. It also enables you to take take action to avoid greater risks in the long term, while at the same time helping you to achieve your business goals.

For many companies, creating the budget can be an extremely time-consuming process as finance teams often work with multiple spreadsheets, consolidate input from various departments, deal with version control issues and broken formulas. Incorporating sales and operational data into your budget is often quite complex and requires a lot of collaboration, which is difficult when everyone is working on static spreadsheets.

Phocas Budgets and Forecasts software dramatically simplifies this because the process is automated. Phocas easily extracts data from your ERP and multiple other sources enabling you to quickly build your budget. Plus, gaining input from finance, operations, sales and purchasing is an easy process because everyone is working from the same data source, changes are updated in real-time, and built-in security means you can only access and action what you have been assigned.When collaborating on the budget is made easy, people contribute to the process so finance team is not constantly chasing feedback and more valuable insights are included in your budget from the get go.

With Phocas making budget building easy and collaborative, this paves the way for more accurate, frequent forecasting that's powered by real-time data. Ultimately, Phocas turns budgeting and forecasting into a well-oiled machine helping you make fast and more informed business decisions.

For more detailed insights as to how Phocas Budgeting and Forecasting can help your business, check out our blog.

There are several benefits of using financial data analysis platform over Excel or other manual reporting methods:

- Time-saving: It frees up the finance team from time-consuming reporting tasks by automating entire processes, allowing for faster reporting, consolidation, and customization.

- Accuracy: Data is pulled directly into the platform which ensures accuracy and reduces the risk of errors that can occur when maintaining and reworking static spreadsheets.

- Standardization: It enforces standardization across financial statements, budgets and reports to ensure consistency and enables comparisons across different periods.

- Collaboration: It enables teams to collaborate and work simultaneously in a secure and auditable environment. This can improve communication and reduce the risk of data discrepancies.

- Reporting: It provides advanced reporting capabilities, such as customizable templates and interactive dashboards. This makes it easier to visualize data and identify patterns and trends.

- Security: It provides better security features than Excel, including data encryption, user access controls, and audit trails. This can help protect sensitive financial data from unauthorized access or modification.

- Customizable: You can add calculations to the statements such as EBITA, margins and ratios

While Excel can be a useful financial reporting tool (and Phocas has easy exporting functionality to Excel), a complete platform of analysis, financial budgeting and forecasting, and rebates management can help businesses streamline their financial reporting processes, improve accuracy, and make better, faster decisions based on real-time data.

Understand the past, operate better today, and plan well for the future