FP&A built on BI for CA ANZ members

Get a demo to learn more.

6 ways to get accurate consolidated data, fast

Financial data consolidation quickly becomes complex when managing multiple entities, currencies, and reporting standards or incorporating operational data. Some businesses can handle it in their ERP, but many cannot - and even then, finance teams often have to manually compile data for management reporting, making the process time-consuming and error-prone.

In this exclusive webinar for CA ANZ members, we’ll share strategies to simplify data consolidation, improve reporting accuracy and provide faster, more reliable insights. Phocas in-house Chartered Accountants, Jordena Tibble and Daniel Harrison, will discuss:

- common challenges in consolidating financial data - and how to overcome them

- best practices for aligning data across entities, divisions and regions, including the importance of automation and establishing a single source of truth

- the role FP&A software can play in enabling your finance team to build and present accurate, consolidated reports

Join us for actionable insights that will help your finance team spend less time on manual data compilation and more time on analysis, communication, and driving business performance.

Registration

We respect your privacy. By submitting this form, you agree to our privacy policy.

How we help

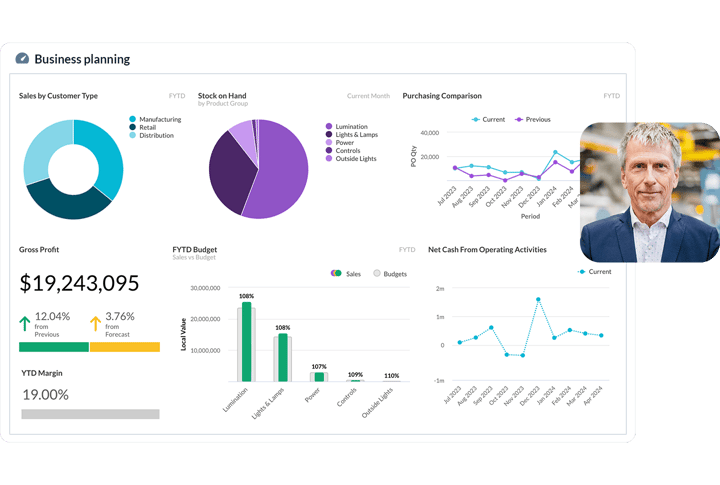

Plan with confidence across your business

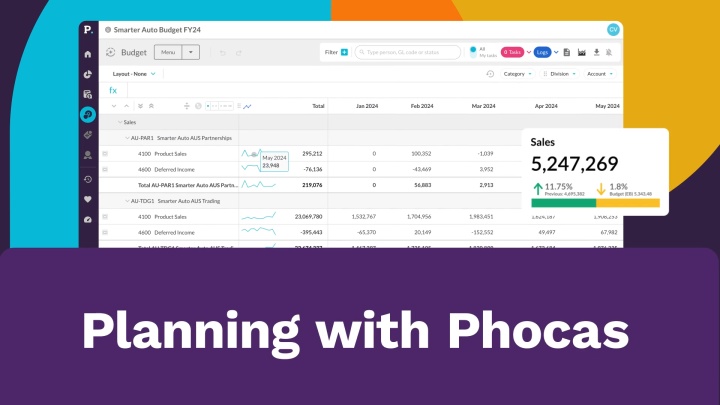

Connect everyone in your business to up-to-date data and make manual, static planning a thing of the past. Whether a financial budget, inventory plan or sales forecast, you'll find it as easy to use as a spreadsheet – just faster and custom-built.

Always know exactly what's going on

Automated tools for faster, easier financial reporting

Phocas' human-friendly FP&A software means you can automate month end, ad hoc and management reporting. No more manual processes, just agile analysis and problem solving.

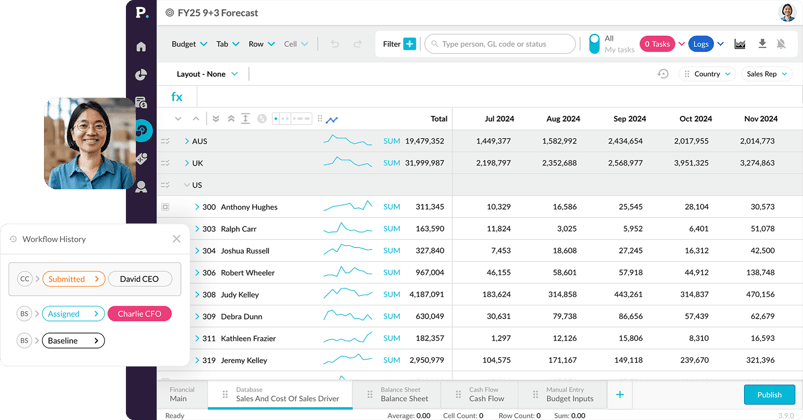

Flexible, connected budgeting and forecasting

Navigate market forces and drive sales growth

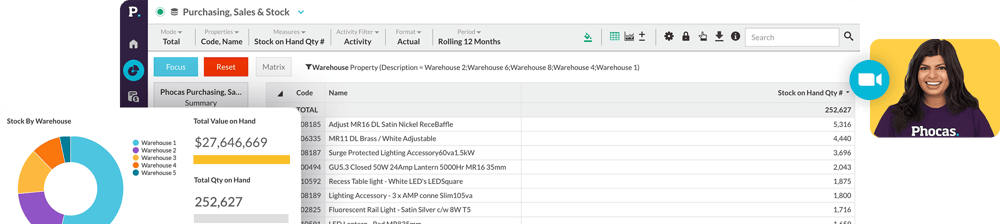

Tap into insights for a smarter supply chain

Tap into insights for a smarter supply chain

Across branches, divisions, product lines, customers and employees - your people can quickly get to the data they need and put it to work.

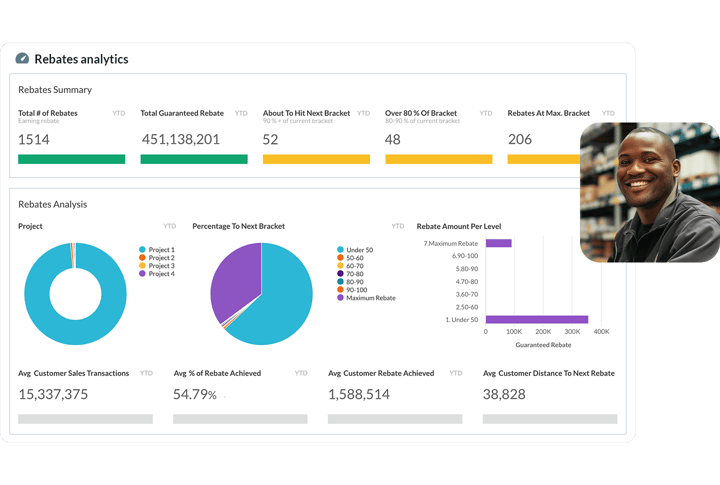

Know if your rebates programs are working

Bring your data and people together

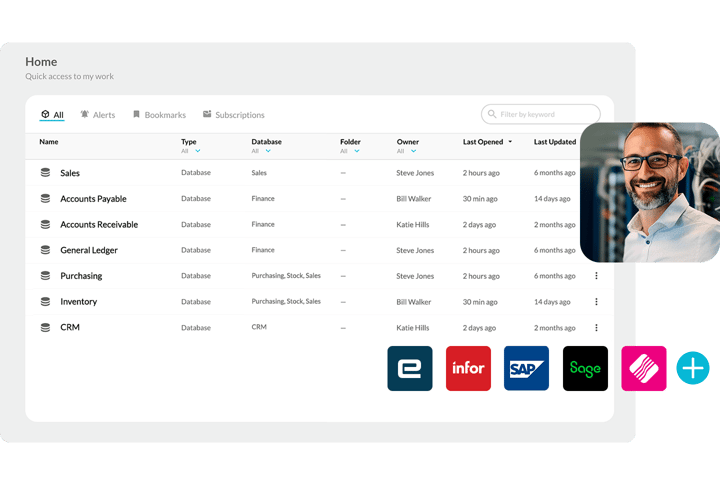

Phocas pulls financial and operational data from ERPs and multiple data sources so finance teams can plan in detail with other business partners across branches or divisions. Planning is continuous and active with built-in data management and reporting.

Whether a financial budget, headcount plan or cash forecast, a BI and FP&A platform like Phocas makes them all easy to create with built-in workflows and templates.

Hear from Phocas subject matter expert and CA, Dan Harrison

Want quick access to your data? You need Phocas

- Infor

- Oracle NetSuite

- Epicor

- Klipboard

- Microsoft

- MYOB

- Sage

- SAP

Quality winemaker adds Phocas for timely results

The Tahbilk Group turned to Phocas to consolidate data from across its business into interactive, drillable dashboards. Everyone reviews their numbers daily instead of waiting for the next month. Better reporting helps everyone make clear decisions and respond faster to customers.

Uniquely integrated platform

CA webinar sessions

6 ways to get accurate consolidated data, fast

Proactive planning to navigate market volatility

The evolving role of Finance: driving strategy, insights, and growth

Hot FP&A trends for 2025

Dynamic reforecasting: how to keep your budget relevant

5 steps to business planning success

Data-driven modelling and forecasting

From reactive to proactive: transforming your budgeting and forecasting approach

5 ways to reduce finance admin time with data analytics

The future of analytics and financial reporting

Collaborative financial planning and analysis (FP&A)

Phocas customer FP&A ratings in global planning survey by BARC

Predictive

Planning

Planning

Reporting/Analysis

Predefined

Connectors

Connectors

Performance Satisfaction

Recommendation

Satisfaction

vs 56% for Excel

vs 56% for Excel

Understand the past, operate better today, and plan well for the future