Fast, flexible Sage reporting for busy teams

Quick & obligation free

Made for Sage

Phocas has been seamlessly integrating with Sage for many years. We assess your needs up front to ensure Phocas is the right fit, paving the way for a fast return on investment. Our dedicated implementation team takes care of all the heavy lifting, achieving in a matter of weeks what can take other providers 1 -2 years (and beyond) to complete.

- Sage 50

- Sage 100 CRE

- Sage 200

- Sage 300 CRE

- Sage Intacct

- Sage X3

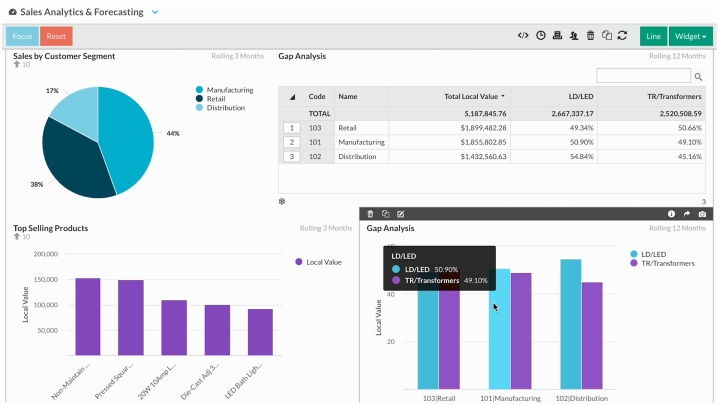

Self-serve Sage reports

- Self-serve: reports and dashboards can be built and customized in minutes; from scratch or using pre-built templates

- KPIs: report on metrics relevant to your department, save as favourites and set up ongoing alerts

- Granular visibility: drill down to transactional-level data by branch, division, sales rep, product, customer and gain instant answers

- Phocas AI: fast-track data analysis for new users

- Time & cost: self-serve reporting prevents a backlog of requests to IT and Finance, and avoids escalating consultant costs

Streamlined budgets & forecasts

- Flexible: with a familiar, spreadsheet-like interface, it's easy to make budgets more detailed – without manual errors and version control issues

- Automated: live data pulled from your Sage ERP feeds budgets and forecasts, so actuals are always reliable

- Collaboration: assign tasks, collect clear input with context and approve budgets faster – all in one place

- Consolidate: connect plans across the business in one place; financial budgets, sales forecasts, headcount and demand planning

Trusted by companies worldwide

The Phocas platform empowers over 3,000 businesses who make, move and sell products. 97% of customers stay with us year-on-year because our platform gives people confidence to run their businesses better.

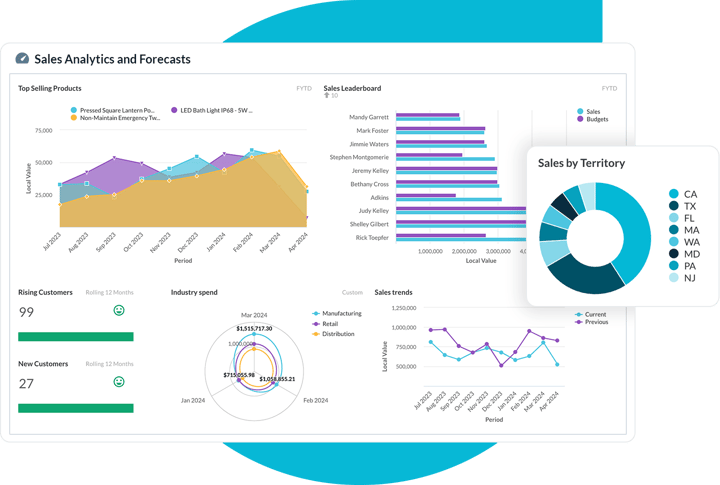

Smarter, self-serve reporting

- Fast: reports and dashboards can be built and customized with ease; from scratch or using pre-built templates

- Flexible: create, customize, automate profit & loss, balance sheet and cashflow statements for cross-functional teams in minutes

- KPIs: stay up to date on metrics relevant to your department, save as favourites and set up ongoing alerts

- Detailed visibility: drill down from dashboards, investigating by branch, division, sales rep, product, customer down to transaction detail to gain instant answers

- Customize: add visualizations; charts, graphs sparklines or calculations like revenue + gross profit per rep or days stock cover that auto update

Everyday tracking is so simple

The team at Bowens use Phocas every day. Why, because it's so simple to use and they're no longer relying on 'gut feel'. Everyone can quickly access up-to-date sales data, break it down and identify opportunities and areas for improvement.

Fast, accurate data

- Automated: data is pulled from your NetSuite ERP, multiple subsidiaries, countries, warehouses, or even multiple ERPs into one source of truth

- Reliable: Phocas handles big data volumes while maintaining fast, reliable performance

- Secure: data is accessible to everyone who needs it, while finance maintains employee-level security to protect sensitive information

- Migration: quick to implement, providing uninterrupted dataflow, reporting, dashboards even during ERP migrations

- AI-assisted: fast-track data analysis for new users by asking questions like; ‘Which customers declined last quarter?’

Smooth ERP migration, uninterrupted reporting

- BI-driven: one of Phocas’ specialties is connecting data, making it an ideal BI-based solution for ERP migrations

- Fast: can be quickly implemented to provide uninterrupted reporting, dataflow, dashboards before, during and after migrations

- Secure: Phocas provides secure data warehousing for your historical data, pulling everything together into one platform

- Effortless: Phocas does all the heavy migration lifting, so your teams can jump straight into self-serve reporting and analysis

See how Phocas stacks up against the competition

Visually presentable insights

- Unlimited: build, customize and share unlimited dashboards and workflows, creating a clear business overview

- Connect: visualize financial ratios and KPIs side-by-side, connecting different divisions, subsidiaries, branches to performance

- Drill down: quickly switch from visualizations to underlaying data where you can slice and dice the metrics

- Digestible: present live data insights to non-financial teams with graphs, pie charts, and Sparklines

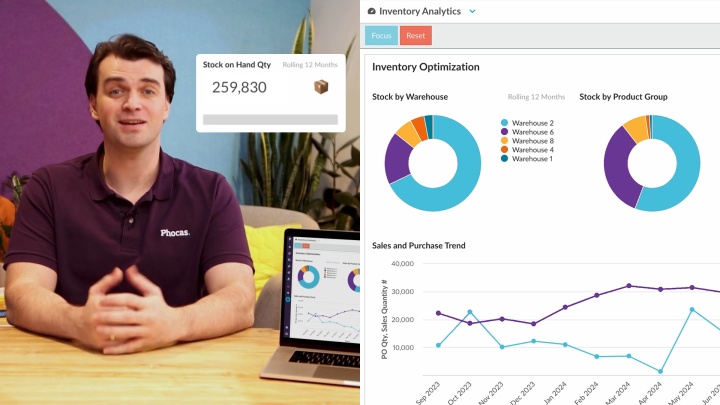

Seamless inventory analysis

- Manage stock: ensure optimal inventory levels with a clear, up-to-date view of stock movement and self-serve reporting

- Forecast: compare live actuals to historical data and budgets to accurately forecast demand; which products need to be replenished, liquidated or relocated

- Trend analysis: quickly combine purchase history, sales forecasts, seasonal and market trends to accurately predict stock requirements months ahead

- Maximize profitability: accessible, up-to-date data empowers purchasing and inventory teams to optimize pricing and improve supply chain planning

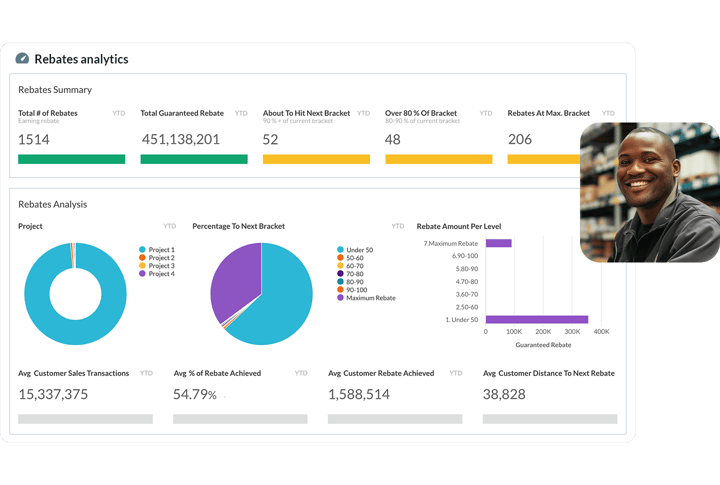

Boost rebates profitability

- Automated: stay on top of payable and receivable rebates with a self-serve tool that speeds up rebate management

- Accurate: prevent overpayments or under claiming rebates with real-time data and automated calculations

- Improved analysis: review rebate programs including structure – are they driving sales, and view impact on profit and margin in one place

- Win-win partnerships: track customer target accruals, use near-miss analysis, explore ‘what if’ scenarios and showcase potential earnings in person

Accurately forecast demand

- Detailed: analyze patterns for different market segments such as customer demand by product class, geography, sales channel, purchase history

- Reforecast: easy access to live actuals empowers teams to adjust forecasts to align with changing inventory needs

- Seasonal: tap into historical data and analyze your seasonal sales trends to create more accurate inventory forecasts

- Review: easily review your forecast accuracy by comparing it to actuals

Simplify work with a single source of truth

Frequently asked questions

Phocas offers BI and FP&A together, while Sage ERP systems are designed to manage various aspects of business operations. When integrated, Phocas enables companies to manage their operations more effectively in a various ways, such as:

- Robust BI analytics - Phocas collects and consolidates huge amounts of data from multiple business sources, empowering Sage ERP users with fast, easy access to up-to-date data within one centralized platform.

- Self-serve reporting - Reports and dashboards are customizable to meet specific business needs and can be created by all users. Insights and metrics that may not be readily available in standard Sage ERP reporting tools can be extracted with ease. Design your own reports in minutes and give cross-functional teams a deeper understanding of business performance.

- In-depth analytics - a unique ad hoc analysis layer, The Grid, enables all users to perform in-depth analysis. Drill down to transactional level and pivot the data in multiple ways such as by customer, branch, product or region.

- High performance - By integrating your Sage ERP with Phocas, you'll achieve lightening fast loading times, regardless of the volume of transactional data stored. Phocas ingests and comprehends big data volumes.

- Companywide adoption - a user-friendly interface enables users across all departments to access and analyze their own data, not just IT experts or data analysts. Enhancing collaboration and fast decision-making.

- All-in-one platform - Along with a BI Analytics foundation, Phocas offers comprehensive FP&A products that work together smoothly, including Financial Statements, Budgets and Forecasts, and Rebates.

Yes - Phocas specializes in combining business data, most often ERP and financial data, with other non financial data sources. Providing one trusted platform to measure, track and plan your ongoing business operations quickly and easily.

Phocas started as a BI solution, so we understand the ins and outs of data manipulation. Our customers loved the enhanced capabilities that Phocas brought to their ERP that they started asking for financial analysis and budgeting and forecasting capabilities too.

Our focus is creating software and tools that anyone in your organization can use to understand sales, operations and logistics, making sure that your team can plan and forecast based on a solid foundation of trustworthy data.

Data analytics, or business intelligence (BI), is the process of interpreting key business data to understand how an organization is performing, both financially and operationally.

Data analytics software is designed to retrieve, analyze, transform, and report on business data and metrics. This software provides organizations with an integrated view of their overall business by combining multiple data sets, such as enterprise resource planning (ERP) systems, CRM, HR, Payroll and e-commerce. BI can also be used to identify trends, uncover insights, and make informed business decisions.

This is the process by which businesses regularly plan, review and control their finances.

The budget is a company's financial plan of intent for 12-months. This will incorporate data from finance, operations, sales, inventory and other company information to enable them to set goals and to monitor and manage their finances.

The forecast is a more detailed financial plan for a set amount of time, such as the last 6 or 3 months of the financial year.

Budget forecasting is when businesses regularly track actual performance numbers and compare them to the budget. Any insights or risks gleamed from this assessment can then be used to re-forecast the remainder of the budget period. This way, potential issues can be mitigated before they become a major risk, or swift action can be taken when responding to rapid economic or environmental change.

When you’re armed with this information in real-time, you have more control of your financial position throughout the year. It also enables you to take take action to avoid greater risks in the long term, while at the same time helping you to achieve your business goals.

Financial statement software is a program designed to automate the process of creating reports such as profit and loss (income statement), balance sheet and cashflow statements. It achieves this through the extraction of real-time data from ERP, CRM and multiple other data sources, and helps to ensure accuracy, consistency, and compliance with accounting standards.

Statements are fully customizable to suit your business needs with an intuitive interface that enables free-form data analysis. Visualizations such as dashboards, graphs, charts and Sparklines also help to connect the wider business to performance as it's easy to provide an at-a-glance view of your finances.

There are several benefits of using financial data analysis platform over Excel or other manual reporting methods:

-

Time-saving: It frees up the finance team from time-consuming reporting tasks by automating entire processes, allowing for faster reporting, consolidation, and customization.

-

Accuracy: Data is pulled directly into the platform which ensures accuracy and reduces the risk of errors that can occur when maintaining and reworking static spreadsheets.

-

Standardization: It enforces standardization across financial statements, budgets and reports to ensure consistency and enables comparisons across different periods.

-

Collaboration: It enables teams to collaborate and work simultaneously in a secure and auditable environment. This can improve communication and reduce the risk of data discrepancies.

-

Reporting: It provides advanced reporting capabilities, such as customizable templates and interactive dashboards. This makes it easier to visualize data and identify patterns and trends.

-

Security: It provides better security features than Excel, including data encryption, user access controls, and audit trails. This can help protect sensitive financial data from unauthorized access or modification.

- Customizable: You can add calculations to the statements such as EBIT, margins and ratios

While Excel can be a useful financial reporting tool, a complete platform of analysis, financial statement budgeting and forecasting, and rebates tools can help businesses streamline their financial reporting processes, improve accuracy, and make better, faster decisions based on real-time data.

Understand the past, operate better today, and plan well for the future